Real estate leaders in the ULI Greenprint community have created a sustainability pre-bid checklist for the industry to inform and adjust bid pricing in transactions.

Real estate transactions move swiftly, and to date, have been a missed opportunity to collect critical sustainability-related information that could influence bid pricing and underwriting. Particularly with the rise in building performance standards regulation and market demand for low-carbon spaces, buyers recognize that building inefficiency and inability to meet such demands put assets at future risk of devaluation or worse – financial stranding.

Going in blind has a direct impact on the asset’s assumed cash flows, ROI, and overall performance. The industry is held back by insufficient information on sustainability performance and climate risk of potential acquisitions at the pre-bid stage. For example:

- A real estate investment company acquired an asset in Denver a few months before the Energize Denver rules were published without researching pending regulations during the pre-bid and due diligence phases of the acquisition. When the regulation passed, the company realized it would owe more than $2 million in fines annually. The city granted the company a one-year reporting extension, and they are now working with an engineering firm, their property managers, and their tenants to make decarbonization investments they had not budgeted for to mitigate the fines for next year’s reporting period.

- A real estate owner acquired an asset in Washington, D.C., and, within a few weeks of managing the asset, the company received a notification from a local government agency about an upcoming deadline to comply with the local building performance standard. Given the company’s short timeframe and lack of familiarity with the asset, they hired a consultant to help them submit their data and carbon reduction plan, and they still missed the deadline. Had the company been aware of this requirement in the pre-bid phase, they could have spent less money on consultants and fines and instead trained their staff to handle it internally, supported by consultants as needed.

ULI Greenprint members came together to address the challenges of insufficient information on sustainability performance and climate risk of potential acquisitions at the pre-bid stage, creating a Sustainability Pre-bid Checklist to help the buyer, seller, and broker communities coalesce around consistent sustainability data sharing and improve communication in the pre-bid process. The checklist is relevant for all types of deal structures.

With a pre-bid checklist, acquisition teams can direct the most critical sustainability questions of the firm disposing the asset to reduce risk and make an informed decision. This could result in more appropriate bid pricing and underwriting, such as costs to electrify, meet energy performance limits or pay resulting fines, or enhance resilience against climate hazards. In specific cases, this is already successful in the market. Buyers are making more efficient, lower-risk decisions during the pre-bid phase:

- A real estate owner obtained a prior physical climate risk assessment from the seller during the pre-bid process which indicated the possibility of future groundwater intrusion at an asset. As a result, the company included remediation costs in its underwriting and discounted the revenue projections in those spaces assuming some reduced rent revenue.

- An investment firm was reviewing a multifamily asset for a possible acquisition and discovered that the asset faced more than $100,000 in Local Law 97 fines during its first compliance cycle and increasing fines for future cycles. To comply, the investment firm would have to spend $10-15 million to electrify the asset, which would increase operating expenses because of the price differential between electricity and gas. As a result, they passed on the investment opportunity.

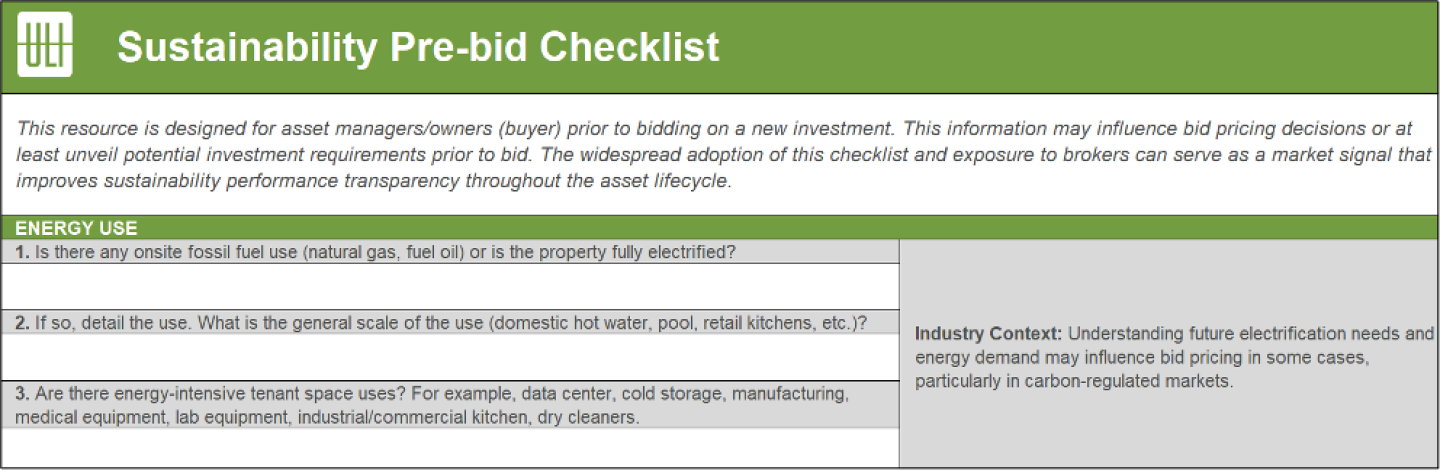

Figure 1: Screenshot of the Excel-based Sustainability Pre-Bid Checklist

It is worth noting that many leading real estate firms include sustainability questions in their due diligence processes. However, the missed opportunity is often earlier, at the pre-bid stage. As such, ULI Greenprint members were keen to address this gap.

Brittany Ryan, Head of Sustainability in the Americas for Nuveen Real Estate, appreciates the checklist’s utility for improving the precision of bid pricing, “ULI’s Sustainability Pre-bid Checklist is an opportunity for Nuveen – and the market as a whole – to increase process efficiency, transparency, and ensure the true cost of an asset is well understood upfront. We will incorporate it into our sourcing process and encourage other ULI Greenprint members to do the same.”

Blakely Jarrett, a senior director leading ULI’s Greenprint Program, notes the benefit of such leadership for the broader industry, “This checklist represents the positive industry change that ULI Greenprint members can promote when they channel their collective expertise into solving shared challenges.”

The Sustainability Pre-bid Checklist benefits aren’t limited to buyers. For sellers, consistently offering information on the items in the checklist establishes a credible baseline template across the industry. This set of datapoints could even live in Offering Memos to normalize the regular delivery of this information. For brokers, the Sustainability Pre-bid Checklist is an opportunity to increase efficiency in establishing a common language and expectations between buyers and sellers. This minor but mighty process change can reduce friction in acquisitions, unlocking capacity and resources for higher value efforts like implementing accretive decarbonization projects and initiatives.

The Sustainability Pre-bid Checklist is available for download on ULI’s Knowledge Finder, to help bring all potential risks to the forefront of real estate transactions.