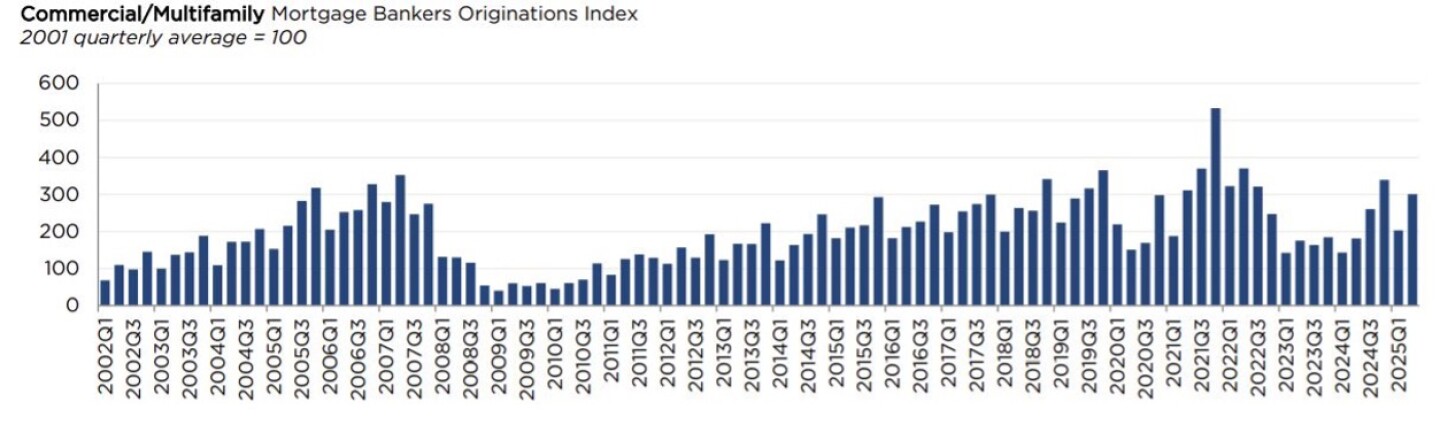

Despite a still tepid transaction market, commercial and multifamily mortgage loan originations increased in the second quarter—up 66 percent compared to a year ago, and up 48 percent from the first quarter of 2025, according to the Mortgage Bankers Association.

The Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations shows increased lending activity during the second quarter. Office had the biggest year-over-year increase in dollar volume, jumping 140 percent, followed by a 77 percent increase for health care properties, a 53 percent increase for industrial properties, and a 30 percent increase for retail properties.

Urban Land: First, what’s your outlook for access to debt and equity capital in the second half of the year and why? Second, apart from interest rates, where are the biggest pain points in the market for commercial real estate financing?

Rachel Szymanski, PhD, chief economist at Trepp Inc.

I’d expect capital markets to open up modestly in the second half of 2025, though selectively. Sentiment across commercial real estate finance greatly improved in the second quarter, signaling renewed confidence among debt providers. At the same time, nonbank lenders are stepping in where banks have pulled back, and issuance of CMBS and CRE CLOs is up—suggesting broader funding mechanisms are activating. However, I’d expect capital to continue flowing toward high-quality, low-risk deals, and continued macroeconomic volatility could intensify this trend.

Multifamily and office will likely be bifurcated, with only higher quality assets seeing strong capital interest. Retail and hospitality may face greater caution, given their sensitivity to consumer spending and macroeconomic fluctuations. Industrial could benefit from supply chain realignments and growing data center demand tied to AI infrastructure. In short, capital may return, but with sorting between those with stable demand and those seen as vulnerable to shifting economic conditions.

One of the biggest pain points is that many borrowers face friction when refinancing or resolving maturing loans. Valuation uncertainty, volatile macroconditions, and execution challenges have made it harder to reach agreement on pricing or deal structure. In many cases, loans are already past maturity—not necessarily due to distress but because decision-making has stalled amid ambiguity and shifting market assumptions. Until more clarity emerges around long-term rates and pricing norms, many assets will remain in limbo.

Aaron Jodka, director of research, Capital Markets, U.S. at Colliers

Access to capital is improving on both the debt and equity sides. Investment sales volume has been resilient in 2025, with generally increasing sales totals compared to the year before. When one-time events, such as a REIT privatization, are removed, activity looks even more favorable. Single-asset sales are performing well, as investors, [having] adjusted to the market’s higher interest rate environment . . . are transacting.

These new deals, as well as maturing loans, require capital, which is readily available. CMBS lending is on a post–global financial crisis, record-setting pace in 2025; banks are increasingly active; and private credit is soaring. While equity is harder to come by and more expensive, we’re seeing signs that those purse strings are loosening. Investors are actively exploring opportunities in ground-up development, partial interest sales, rescue capital, and common LP equity.

The most significant pain points in financing center around valuation and loan terms. While interest rates are largely accepted as a hurdle, coming to a consensus on value can be a sticking point. Values appear to have bottomed out, and a new cycle is underway. Acquisition loans are easier to pencil on the valuation side, while maturing loans are more challenging. Agreeing on current pricing can be a battle. LTVs, DSCRs, loan length, and interest-only terms are all active negotiation points. Deal structures may require more creativity, but there is ample capital in the market today [that is] looking to source transactions.

Abby Corbett, commercial real estate, senior economist, global head of investor insights at Cushman & Wakefield

Traction is building across both debt and equity markets, though it is important to distinguish their trajectories. Momentum across the debt capital markets is expected to carry into the second half of 2025, though expectations should remain tempered. Year-to-date lending activity has outpaced equity market momentum, driven by tightening credit spreads and broadening lender appetite. Refinancing activity is leading the charge, accounting for 72 percent of year-to-date loan originations, the highest share since 2000, reflecting proactive efforts to mitigate distress and preserve liquidity.

The debt markets nonetheless face headwinds as the near term is punctuated by uncertainty and stagflationary conditions. Even if credit spreads remain relatively tight, upward pressure on the long end of the yield curve is reshaping cost-of-capital dynamics and requiring more active investment strategies. And, with credit spreads near historic lows, downside risk also remains elevated, raising the potential for sharper debt-cost pressures during periods of episodic market volatility. Together, this higher-cost-of-capital dynamic erodes leveraged returns, making deals less accretive and demanding a more rigorous search for value at the asset level.

Expectations for equity market traction remain positive, though more measured and selective, as investors digest incoming data and policy developments. The higher-for-longer interest rate environment is compressing yield spreads and straining debt leverage conditions. Macroeconomic uncertainty is also prompting a shift in capital flows towards conservative core and core-plus investment strategies at the portfolio level, while requiring stricter underwriting standards at the asset level. Caution is also creating a bifurcated investment landscape where high-quality assets are favored, while lower-tier properties face increasing scrutiny and narrower liquidity.

Randall Sakamoto, president, Rosen Consulting Group

Generally, liquidity seems to be headed in a positive direction, with improving capital availability from a range of lender types. But we should be aware that the growth in originations was off of pretty low figures, so we are nowhere near a borrower’s market.

Outside of a substantial rate drop, deregulation will result in greater lending capacity. The Fed, in conjunction with the FDIC and OCC, will almost certainly relax the Basel III Endgame with a modified version targeted for release in early 2026. Lower risk-based capital requirements would be less of a burden on large bank lenders and should unlock a moderate amount of lending capacity. I think large banks will ramp up lending activity in the near future, as the strict proposal for Basel III is off the table.

Private credit should increase market share as many borrowers remain outside of the box of traditional bank lenders. Nonbank lenders have the flexibility and capacity to plug gaps in the capital stack with several hundred billion raised in the last few years. Debt funds, for example, have roughly $40 billion of dry powder. With the ability to lend to higher LTVs and underwrite to the future rather than past asset performance, nonbank lenders will be the most viable option for many borrowers.

It does seem that borrowers are anticipating lower mortgage rates and that the Fed will almost certainly cut rates in September, at least according to Wall Street expectations. The recent jobs report and employment revisions give the Fed cover to cut rates in September. To be clear, it is not merely cover, as the latest jobs data are as accurate as any prior release and reflect what we all see happening in front of our eyes: Employers are trimming workforces, and the economy is slowing. However, one or two rate cuts this year will not spur a borrowing boom. Inflation and growing federal deficits, among other issues, should keep long bond yields elevated.

We have brought [it] up for years, but loan maturities are still an issue. As more assets come back to lenders, time and capital will be spent working out these troubled situations and take away from new lending volume. So, the constraint on lending in the second half of the year will still be maturing loans and higher interest rates.

Past Snapshots: