Dallas-Fort Worth

In 2025, the country’s industrial market is experiencing a rebalancing in the wake of surging demand and record new supply that marked the early pandemic years. New opportunities in fast-growing markets are emerging, and demand drivers are shifting. New space demand will grow the most, especially for small-bay industrial assets, according to a Q3 2025 report from the business advisory and accounting firm Plante Moran.

Around the turn of the 21st century, downtown Kansas City, Missouri, faced challenges familiar to many American cities: abandoned buildings and surface parking lots filled 10 core blocks despite multiple redevelopment attempts dating to the 1960s. The downtown residential population was sparse, and some 60,000 downtown office workers made haste for the suburbs at 5 o’clock each weekday.

Drawing on insights from more than 1,700 leading real estate investors, developers, lenders and advisors across the U.S. and Canada, the report identifies key opportunities, risks and market shifts that will shape the industry in the coming year.

Since the 1980s, the Dallas suburb of Plano has attracted some of the country’s biggest corporate headquarters and established itself as a hub for major employers. But how did Plano revamp to meet the goals of a changing economy and a changing community? The city made a pivot that has been echoed in growing cities around the country: a major shift toward investing in parks and activating green space.

A team of ULI experts visited Fort Worth in September 2024 to develop anti-displacement strategies for the city’s historic, majority Hispanic Northside neighborhood, which faces mounting pressure from two nearby megadevelopments, as well as broader metropolitan growth trends that drove up the area’s property values 60 percent from 2016 to 2021.

From resilient parks to bold adaptive reuse, this year’s winners redefine urban innovation and community impact across the Americas

Released during the Institute’s 2024 Fall Meeting in Las Vegas, Emerging Trends in Real Estate® North America predicts Dallas-Fort Worth, Miami as leaders in 2025

Real estate market participants are in the midst of a “Great Reset” when it comes to adjusting views related to pricing, risk, and return expectations in an environment marked by higher interest rates and slower economic growth. The need to align thinking and strategies to fit current market dynamics is one of the key themes in the 2024 Emerging Trends in Real Estate forecast for the United States and Canada.

ULI’s new report shares promising examples of efforts to reconnect communities divided by highway infrastructure.

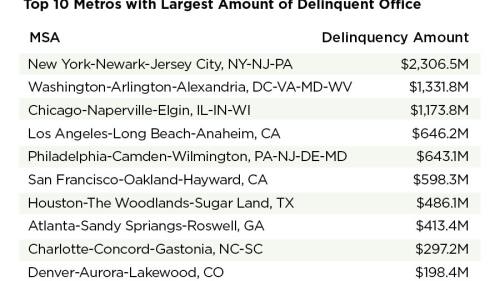

Many office property owners are heading for the exits amid weaker demand and looming debt maturities, while opportunistic private equity groups are leaning in to capture what could be once-in-a-generation buying opportunities.

“Higher and slower for longer” is one of the major trends highlighted in the newly released Emerging Trends in Real Estate® 2024 report.

An analysis of hundreds of cities indicates that trips to CBDs in large cities (say, ones above 1.5 million residents) have plateaued around 60 percent of their pre-pandemic levels; smaller towns (for example, ones with fewer than 150,000 residents), in contrast, have fully bounced back.

Turning obsolete office buildings into apartments can be complicated and tricky—but daring developers and ingenious architects are showing a way to help solve housing shortages.

Despite challenges, there is momentum in commercial real estate for capital to be raised and invested in underserved communities across the nation, according to a panel of Dallas/Fort Worth developers at the Fall Meeting in Dallas. The primary example they used to illustrate success is the National Juneteenth Museum in Fort Worth.

The Dallas/Fort Worth metro area is rising on powerful growth that will lift it past Chicago to become the third-largest metropolitan statistical area in the nation, experts said during a session at the ULI Fall Meeting in Dallas.

The COVID-19 pandemic made 2021 a historic year for the shipping and logistics industry, as rising e-commerce sent large retailers and general merchandisers scrambling for warehouse space to hold their inventory, supply-chain issues delayed shipments, real estate developers strained to keep up with demand, and local governments struggled to issue permits quickly with employees working from home.

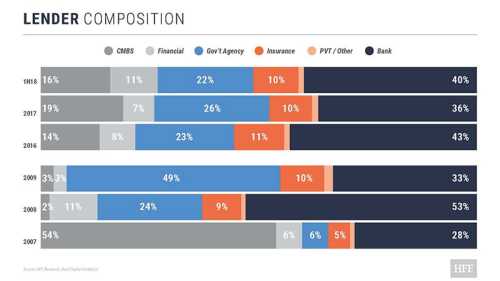

Alternative lenders increased their market share in the commercial real estate debt sector in 2018, panelists said at a ULI North Texas event in March. That trend is likely to continue this year as competition among all types of debt providers heats up capital markets.

Texas markets are meeting a healthy demand for multifamily housing from millennials who are reaching renting age and baby boomers who are downsizing, while attracting investment from around the United States. At a recent conference, speakers said that fundamentals were generally strong with higher cap rates possible in tertiary markets such as Midland-Odessa, Waco, and Lubbock.

By using 3-D printers to build lightweight but strong plastic frameworks for conventional building materials such as concrete, builders may soon be able to create complex structures with unorthodox shapes and contours that would be difficult or even impossible with today’s construction methods, said a speaker at the ULI Fall Meeting in Dallas. And better yet, they will be able to fashion intricate, customized interiors and exteriors at no additional cost.

A new ULI program that helps office tenants design and manage their spaces to reduce energy consumption could help the real estate industry reduce emissions that are driving climate change. But at the program’s rollout at ULI’s 2016 Fall Meeting in Dallas, panelists said that the new ULI Tenant Energy Optimization Program is likely to have a more far-reaching impact than that of many previous environmental initiatives because it offers a compelling, well-documented business case that energy efficiency can generate a lucrative return on investment.

Dallas/Fort Worth International Airport is the most successful American template for how a major airport can become a core for real estate development and economic growth. Now, planning is taking it to a higher altitude.