Property Types

Hotels and Resorts

While America’s South continues on a steady course with a growing population and an increasing number of jobs, officials are acting on some challenges, which include traffic, housing affordability, education needs, and the rising cost of construction.

Experts in hotel development discuss the rising popularity of social spaces in hotels, the role of technology in the hotel experience, the ways guests are shaping in-room furniture design, the competition from Airbnb, the need for “Instagrammable” spaces in hotels, and changing approaches to hotel restaurants.

Florida remains one of the healthiest worldwide hospitality centers. Hotel occupancy in Miami-Dade rose to 87.9 percent in March from 85.7 percent in the same month last year, and the average daily room rate in was also up. At a panel discussion during ULI’s 2018 Florida Summit, two hotel developers shared how their decision to lean into the evolving trends within hospitality and tourism have bred overwhelming success.

Industrial

Prime logistics rents increased globally during the 12 months ended March 31, accelerating their growth in many markets due to strengthening economies around the world and greater demand for distribution of goods bought both online and in stores, according to a report from CBRE. Prime rrents increased by 3.2 percent across the globe in this year’s first quarter from a year earlier, exceeding the previous 12-month period’s 2.2 percent global increase.

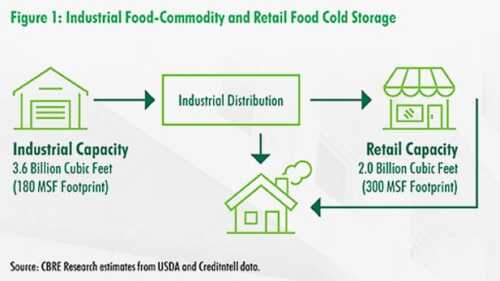

The growing popularity of online grocery shopping could result in demand for up to 35 million square feet (3.25 million sq m) of U.S. cold-storage space shifting from retail stores to warehouses and distribution centers within the next seven years, according to a report from CBRE.

With e-commerce players remaking the retail sector, industrial real estate developers are hustling to provide the infrastructure needed to get packages to doorsteps in hours instead of days.

Mixed-Use

ULI San Francisco recently hosted a panel revisiting the recommendations made by ULI Advisory Servies panelists to revive the downtown and highlighting the progress that has been made.

The winners of the second ULI Hines Student Competition for the Asia Pacific region faced a dual challenge: create a compelling urban development proposal and follow in the footsteps of classmates who won the inaugural contest.

A close look at trends shaping today’s best economic and talent hubs that offers valuable clues into how to create equitable, sustainable innovation districts that prosper.

Multifamily

ULI has launched C Change for Housing, a major new pan-European program designed to mobilize the real estate industry around two of society’s most urgent and interconnected challenges: the climate crisis and housing affordability.

At a panel at the 2025 ULI Spring Meeting in Denver, Colorado, legal experts shared their insights on how developers, planners, and housing advocates can better navigate the myriad barriers and evolving legal framework at federal, state, and local levels to advance affordable housing projects and initiatives.

As practitioners in the industry, we can all too easily reduce our thoughts about housing to the practical machinations of our work. Decisions are often made to serve regulatory agencies and capital providers, and to find the cheapest and fastest path to completion. We mustn’t lose sight of the fact that our job is to create places that serve real-life human needs.

Office

Released during the Institute’s 2024 Fall Meeting in Las Vegas, Emerging Trends in Real Estate® North America predicts Dallas-Fort Worth, Miami as leaders in 2025

According to the second annual C Change Survey, 93 percent of respondents report incorporating transition risks into their real estate investment decisions, indicating the industry’s growing awareness and commitment to integrate climate-related financial risks into decision-making processes.

Obsolete buildings will constitute up to 50 percent of all new housing in cities

Residental

The 2022 ULI Asia Pacific Home Attainability Index analyzes home attainability, both for ownership and rent, in 28 cities in five countries in the Asia Pacific region including Australia, China, Japan, Singapore, and South Korea. These countries have a combined population of approximately 1.8 billion or 21 percent of the world’s population.

To find new solutions, speakers at the 2022 ULI Europe Conference said that it is important to not only understand what’s driving housing unaffordability but also consider the mismatch between who has the power to deal with the problem and who has the mandate to deal with the problem.

Multifamily Tax Exemption Program makes housing affordable to more renters.

Retail

Bangkok mastered the art of glitzy retail palaces. Now, authenticity is the favored currency.

A retail developer and ULI longtime leader shares how his firm is approaching the current shutdown in the United States and beyond.

Singapore-based developer CapitaLand is harvesting data to boost the revenues of its retail tenants and to help it locate future malls. Speaking at the ULI Asia Pacific Convivium, Chris Chong, managing director at CapitaLand Retail, said that the company uses data to boost both footfall and spending for tenants in its malls, which will ultimately benefit the landlord.