Finance & Investment

As borrowers exhaust extension options, assets move toward refinancing, restructuring, or forced sale.

While the full impact of the pandemic has yet to be realized, commercial real estate faces new uncertainties, including questions about the AI boom’s longevity, the spending strength of the U.S. consumer, and debt sustainability. In response to increased competition for quality deals, commercial real estate firms are restructuring their operations, using diverse data sources, accessing new capital, and forming new partnerships.

With insights and research from a ULI Technical Advisory Panel and ULI’s Terwilliger Center, the Austin Housing Conservancy fund, a revolutionary approach to preserving workforce housing, was born. Now known as the Texas Housing Conservancy, the fund became the nation’s first to combine a nonprofit investment manager, Affordable Central Texas, with an open-end private equity fund.

The latest troubles at New York Community Bank have some observers wondering whether it could be a canary in the coal mine for the broader regional banking sector. Regional banks are definitely in a tough spot due to deposit flight, higher funding costs, and concerns about problematic commercial real estate loans. But, at least for now, troubles seem to be limited to a few isolated cases, rather than systemic.

As office values have declined, it’s created a pivotal moment for astute investors and developers as they evaluate the underlying land value and look for the best property uses over the long term. Indeed, there is latent potential in the evolving office landscapes, but a keen and studied eye will be required to discern the true opportunities from the potential money pits.

Ten projects take advantage of financial tools that promote environmentally positive development

According to the latest Emerging Trends in Real Estate® Europe report from PwC and ULI, 75 percent of real estate leaders agree current valuations “do not accurately reflect” all the challenges and opportunities in real estate, as a wedge continues to be driven between market price expectations and book valuations.

The second half of 2020 through to the following year was probably the busiest investment period in the two decades at Brookfield in the Asia Pacific region, according to the investment management firm managing partner and chief investment officer Lowell Baron. Baron spoke at a fireside chat session at the 2023 ULI Asia Pacific Summit opposite moderator Radha Dhir, JLL’s CEO and country head for India.

The 2023 ULI Asia Pacific Summit in Singapore brought together a panel of prominent investors to discuss how a fast-changing global macro environment is impacting Asia Pacific’s commercial real estate markets. Panelists noted that current conditions are uncharted territory for an industry conditioned by 40 years of falling interest rates and inflation.

The development of Zibi, a master-planned development under construction in Ottawa on 34 acres (14 ha) of waterfront property is relying heavily on feedback from the community, including consulting with Indigenous people, panelists said at the 2023 ULI Spring Meeting.

In an era when the costs for infrastructure are skyrocketing, the need for innovative financing structures is more critical than ever. The panel discussion “Accelerating Development with Early-Stage Financing” at the 2023 ULI Spring Meeting provided a fresh perspective on how early-stage capital can expedite development timelines and transform the industry.

ULI is pulling together industry leaders from across the United States and Canada to advance the analysis of transition risk, which refers to the business risks associated with climate change and the transition to a low-carbon economy. The Carbon Risk Real Estate Monitor (CRREM), ULI, and the Lawrence Berkeley National Lab are partnering to create more granular curves for the U.S. and Canada.

Asia Pacific asset owners are just beginning to grapple with decarbonization and how to factor transition and climate risks into their valuations; even so, some markets and investors are already ahead of the pack. This topic was discussed as part of a recent ULI Asia Pacific webinar, part of a series looking at decarbonization.

Office property owners who were able to weather the worst of the COVID-19 pandemic are crashing into a hard reality wrought by sharply lower demand and higher interest rates. Undercurrents of stress are now emerging in the form of defaults.

For grizzled veterans of commercial real estate, the return to a “negative leverage” environment may have been unforeseen but surely was not unique.

The boom in private-equity real estate fundraising that has delivered a slew of billion-dollar megafunds in recent years has slammed into some formidable headwinds. Yet, near-term challenges are not diminishing the appetite for capital among a still-crowded field of fund managers and sponsors.

When Urban Landlast spoke to New York City landlord Leslie Himmel of Himmel + Meringoff Properties in March, vacancy within the nation’s largest office market was hovering just below 10 percent. While that still registers below the market’s peak of 11.7 percent in 2010, according to Moody’s, that rate has continued to drift upwards since March. Urban Landrecently sat down with Himmel for a lively discussion about doing business in a recessionary market amid rising interest rates, and her ongoing search for what she calls “brave money.”

Haven Realty Capital and institutional investors advised by J.P. Morgan Global Alternatives have formed a programmatic joint venture to acquire and develop more than $1 billion in new build-to-rent communities throughout the United States. The joint venture comes at a time when new for-sale housing starts have fallen to a two-year low.

Developers and investors seeking capital to finance commercial real estate are facing a new reality in which capital is both more expensive and less available. Borrowers still have options, but those options depend on the credit quality and type of deal, as well as what that borrower is looking for in that loan.

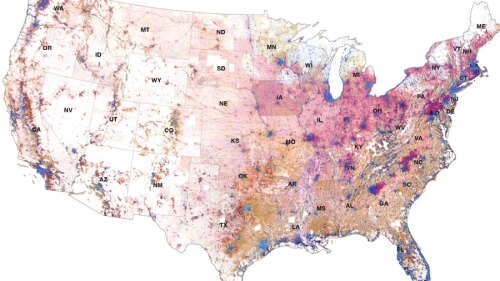

ULI has been establishing dialogue between real estate professionals and climate risk data analytics firms that can help advance the interests of both parties. Enhanced collaboration and understanding between these two sides should continue to improve this evolving space, potentially improving both financial and climate-risk outcomes. As part of these efforts, ULI collaborated with First Street Foundation, a research and technology nonprofit with expertise in assessing physical climate risk at the property level in the United States.

Two of Asia’s leading entrepreneurs gave real estate investors a glimpse into the worlds of Web 3.0 and deep tech at the ULI Asia Pacific Summit.

The Dodge Momentum Index, a leading indicator for U.S. commercial real estate activity, increased 4 percent in February to 158.2, from the revised January reading of 151.9. In February, institutional planning rose 9 percent, and commercial planning moved 1 percent higher.

The next decade will be a critical period of change, with ongoing uncertainty amid the big evolution in technology, data, and laws. Commercial real estate market players may shift their strategies, affecting capital flows into and out of the asset class.

A new report by ULI and Heitman, a global real estate investment management firm, indicates that environmental change is prompting the migration of people and businesses, movements that may trigger significant shifts in demand for real estate. Just as investors are being forced to recognize and price the physical risks associated with climate change—wildfires, hurricanes, excessive heat—they need to integrate climate migration risk into their underwriting models.

Peter Ballon, global head of real estate for CPPIB Investments, kicked off the 2021 ULI Virtual Spring Meeting with a keynote panel of industry leaders from Europe, the Asia Pacific region, and the Americas discussing global capital flows.

As part of the 2021 ULI Virtual Europe Conference in February, high-level ULI members from across the global finance and investment sector gathered virtually to discuss capital flows, real estate market dynamics, and debt and equity markets. Among the trends discussed were an acceleration of deglobalization, shifting from “just in time” to “just in case” deliveries, and more interest in the hyperlocal, also characterized as “love thy neighborhood.”

A study by the U.S. Federal Reserve Bank of Philadelphia showed that tenants who lost jobs during the COVID-19 pandemic may have already amassed $11 billion in rental arrears. Procedures for evictions and foreclosures may be failing the most vulnerable tenants and landlords.

The climate plan outlined by U.S. President-elect Joe Biden’s administration is significant in that it reaffirms a commitment to addressing climate challenges, said panelists participating in a recent webinar hosted by the ULI Center for Sustainability and Economic Performance. The plan would also provide considerable resources to support and propel innovation throughout the real estate industry in key areas such as energy efficiency, carbon emission mitigation, and climate change resilience.

In a new survey conducted by ULI and EY, real estate professionals said that they overwhelmingly expect increased remote working, including more working from home (96 percent), more remote working away from the home (72 percent), and more use of satellite offices at the edge of cities (67 percent).

SPONSORED POST:See the latest trends in CRE and learn how slow payments in the construction industry generated domino effects costing an estimated $100 billion in 2020. Rabbet, a provider of cloud-based software for managing construction finances, surveyed real estate developers, lenders, subcontractors, and general contractors and packaged the results in its two latest reports.

![GENSLER - CHASE PARK - FINAL RENDERING[1].jpg](https://cdn-ul.uli.org/dims4/default/4d0af69/2147483647/strip/true/crop/6000x3372+0+397/resize/500x281!/quality/90/?url=https%3A%2F%2Fk2-prod-uli.s3.us-east-1.amazonaws.com%2Fbrightspot%2Fc6%2Fbd%2F50e442924bf6b2a530572e6c2c9b%2Fgensler-chase-park-final-rendering1.jpg)