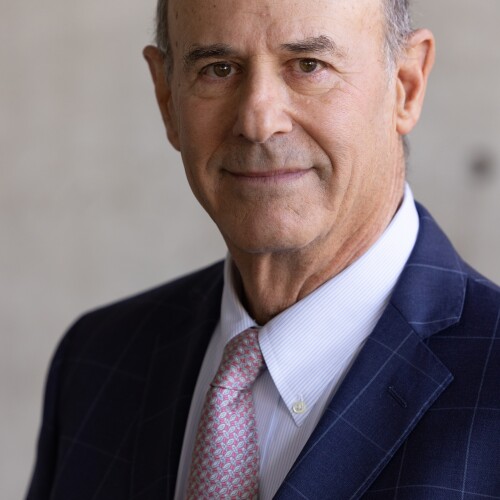

Richard Peiser is the Michael D. Spear Professor of Real Estate Development at the Harvard University Graduate School of Design. He is a ULI Foundation governor and a member of the Institute’s Urban Development/Mixed Use Council.

Richard Peiser is the Michael D. Spear Professor of Real Estate Development at the Harvard University Graduate School of Design. He is a ULI Foundation governor and a member of the Institute’s Urban Development/Mixed Use Council.