Property Types

Hotels and Resorts

The hotel industry in the United States faces complex challenges in 2025, according to Jan Freitag, national director of hospitality analytics for the CoStar Group. During the “State of the U.S. Hotel Industry” presentation at the ULI 2025 Spring Meeting in Denver, Colorado, Freitag highlighted the challenges facing the hotel business amid macroeconomic uncertainty.

Once a sprawling expanse of uncharted land, Las Vegas, Nevada, has evolved into the entertainment capital of the world, a gaming super-hub, and a premier destination for sports. This remarkable transformation didn’t happen overnight; it stemmed from decades of strategic planning, investment, and visionary zoning recommendations.

Las Vegas is unlike any other place in America. Each year it draws more than 40 million visitors to the dazzling casinos and hotels that “turn night into daytime”—and transform the city into a glittering jewel in the desert. With 164,000 hotel rooms, Las Vegas is the largest hospitality market in the U.S.—outpacing Orlando, Florida, the next biggest market, by approximately 15 percent, according to JLL.

Industrial

Standing in the shadow of Regions Field and within earshot of Railroad Park, Birmingham’s Urban Supply hints at what the next chapter of downtown life could look like. Once-quiet brick warehouses are being steadily reimagined into patios, storefronts, and gathering spaces along a new pedestrian alley. Early tenants have begun to open their doors, and programming is slowly bringing people into the district. While the project is still in its early stages, the framework is in place for a vibrant hub that will grow block by block in the years ahead.

What trends are shaping the future of the industrial sector? Four experts from ULI’s Industrial and Office Park Development Council talk about the industrial submarkets and property types that offer the greatest opportunities, challenges developers face in bringing new projects to market, ways artificial intelligence and emerging technologies are reshaping the sector, tenant priorities, and other key trends.

After a quiet first half of 2024, CMBS originations increased 59 percent in Q3 on a year-over-year basis, according to the Mortgage Bankers Association’s Quarterly Survey.

Mixed-Use

As the number of U.S. factory jobs continues to shrink, cities increasingly find themselves with underused or abandoned industrial land. Where these sites border residential areas, the result is blight and increased crime. Read how the Oakland, California, housing authority took aging public housing on a blighted site and remade it to strengthen connections to nearby residences and community amenities.

Digital technology revolutionized the way entertainment professionals work, bringing about a convergence of media, entertainment, and technology that allows creative companies to downsize their workspace and locate wherever they please. Read about districts that are attracting entertainment firms with their interesting, edgy architecture and attractive lifestyle amenities and services.

In the age of creativity and innovation, developing “creative clusters” is vital to meeting the challenges of a new, global, knowledge-based economy. Read what visionaries in places like Chicago and Miami are doing to develop jobs-producing creative hubs targeting designers, graphic designers, and others representing one of fastest growth sectors of the new economy, the creative industries.

Multifamily

With mortgage foreclosures increasing and the number of renters on the rise, “it is critically important” that a financing tool be developed to help expedite private acquisition of foreclosed single-family properties so they can be placed back into the market as rentals, according to lending industry representatives speaking on a multifamily finance panel at ULI’s 2011 Fall Meeting.

The Avenue, located at one of the most coveted corners in Hollywood’s current renaissance, was developed as a condominium by an affiliate of John Laing Homes, now submerged in Chapter 11 bankruptcy. The seven-story condominium development was 70 percent complete when Laing halted construction. Read how the property is being repositioned and what the developer considers a key to its approach.

With multifamily yields on both coasts stagnant, some of the smart money is going inland—and more investors are expected to follow. For example, says one insider, a lot of institutional capital is looking at Texas and the middle of the country because it is getting priced out of coastal markets. Read more to learn what insiders have to say about the dramatic difference in cap rates they’re seeing.

Office

Balancing the need for open spaces, collaboration, and privacy in the workplace of the future.

Sullivan Center is a complex of nine historic structures in downtown Chicago that have been renovated and repositioned for modern uses.

The new Exxon Mobil Corp. headquarters, rising north of downtown Houston, is one of the largest construction projects in the United States. About 80 percent of the campus will remain in its natural state or be planted with native species. Water use will also be reduced compared with a conventional development of similar size through recycling of rainwater and smart irrigation systems.

Residental

With arts, office, and recreational offerings, Philadelphia’s Center City is drawing new residents—of various ages—to downtown living.

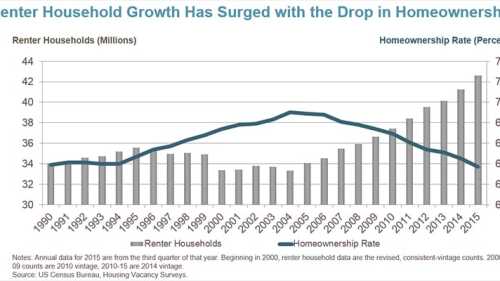

According to a report by Harvard’s Joint Center for Housing Studies, the United States has seen an unprecedented increase in those living in rental housing, with nearly 9 million rental households added since 2005. While private lending has increased in the sector, new construction is largely focused on the higher end of the market.

This book by Barbara Miller Lane, an emeritus professor of history at Bryn Mawr College in Pennsylvania, describes a unique era in American homebuilding that gave both working-class and more upwardly mobile middle-class Americans a shot at what many consider the American dream—a house and a yard in the suburbs.

Retail

For decades, civic leaders have tried to revitalize Market Street, San Francisco’s central thoroughfare, only to see their efforts founder. “I sometimes call it the great white whale of San Francisco,” says Eric Tao, managing partner at L37 Development in San Francisco and co-chair of ULI San Francisco. “Every new mayor, every new planning director, every new economic development director has chased that white whale.” This year, however, an international competition of ideas hosted and run by ULI San Francisco, with support from the ULI Foundation, generated fresh momentum for reimagining the boulevard. The competition drew 173 submissions from nine countries and sparked new conversations about the future of downtown San Francisco.

The OAK project began in 2009, when a development firm set their sights on the corner of Northwest Expressway and North Pennsylvania Avenue, the state’s most important and busiest retail intersection. As the region’s only parcel capable of supporting a vertically integrated project of this scale and density, that land represented an opportunity to create something truly special.

As aging retail continue to evolve, one increasingly popular trend has been to redesign malls as town centers—recalling a time when such commercial districts were the heart and soul of a community. Mall–to–town center retrofits are emerging throughout the nation, especially in suburban communities, where pedestrian-friendly, mixed-use environments are highly attractive to millennials now raising families.