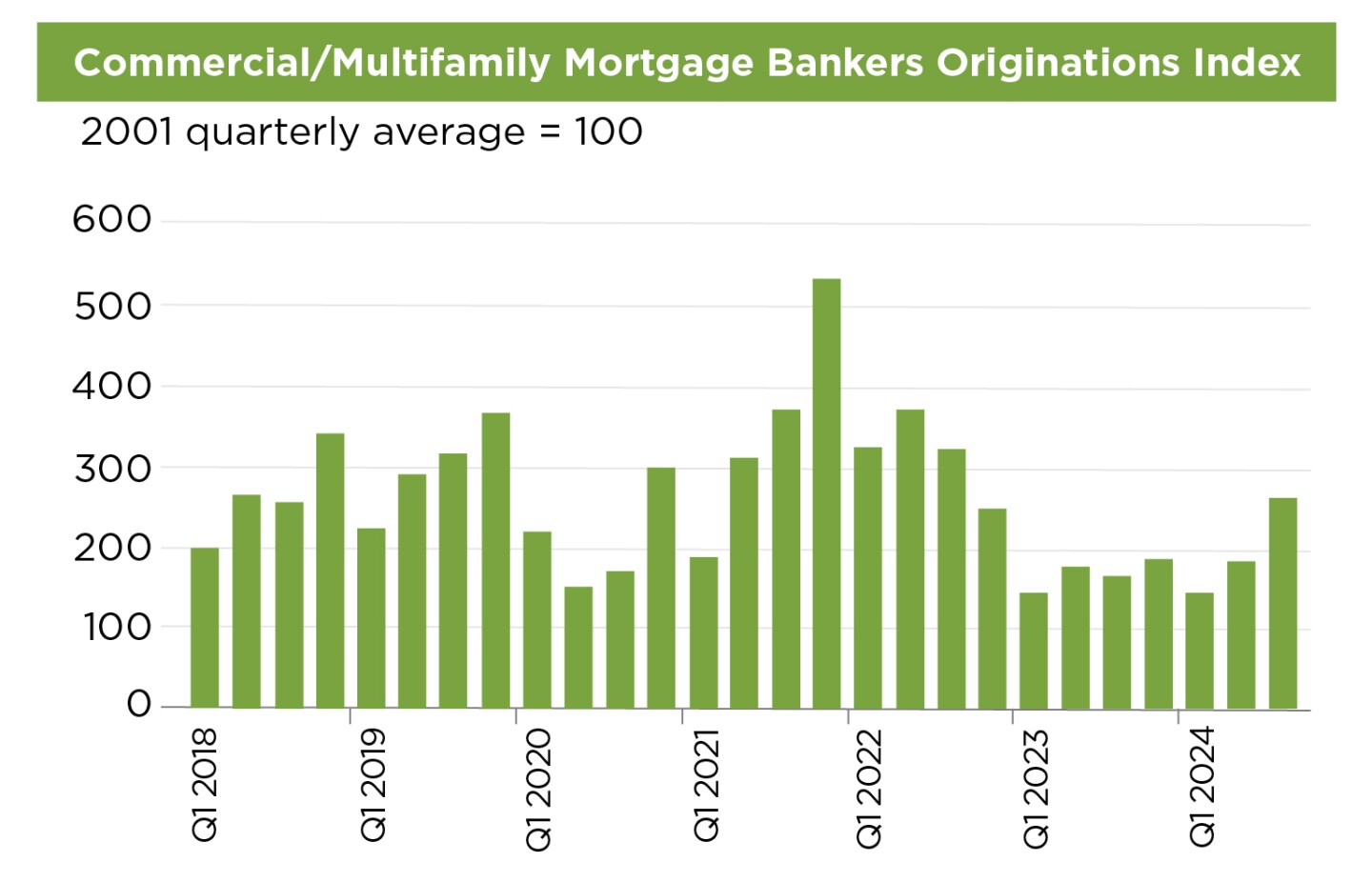

Recently released data on commercial/multifamily mortgage loan originations show welcome improvement. After a quiet first half, loan originations increased 59 percent in Q3 on a year-over-year basis, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

But taking a closer look under the hood at who’s lending and where capital is flowing reveals a choppy market. On one end, loans to healthcare properties for the first three quarters surged 165 percent compared to the same period in 2023, while office lending fell 17 percent. And while CMBS/conduit loans were up 160 percent on a year-to-date basis, lending from depositories—banks and credit unions—declined 5 percent.

ULI: Borrowers are anticipating lower interest rates ahead even as lenders continue to deal with loan maturities and delinquencies. In this market of “haves and have-nots”? What’s your outlook for liquidity for commercial real estate in the coming year?

Jaimie Woodwell, vice president and head of commercial real estate research at the Mortgage Bankers Association (MBA)

The most important thing to understand about borrowing and lending in today’s commercial real estate market is that every property is in a unique position—driven by its own property type and subtype, market and submarket, owner, lender, vintage, and more. And while uncertainty around some of those factors might crimp the availability of mortgage financing for some properties, low volumes over the last year and a half have been driven much more by a lack of demand for loans than by any lack of mortgage availability.

Expectations are that the Federal Reserve will cut the Fed Funds rate once more this year and an additional three to four times next year. That drives the short-end of the interest rate curve, but longer-term interest rates have already priced those cuts in—meaning that from here, longer-term rates are much more likely to be driven by changing expectations around economic growth, inflation, federal budget deficits and more, and not necessarily in the downward direction.

In 2023 and the first half of 2024, borrowers and lenders saw time as a net positive for maturing loans, bringing lower interest rates and potentially greater certainty around space market fundamentals. After rates fell in the Q3 of 2024, and have risen in Q4, it’s not clear how many wounds time will continue to heal. Lenders are in the market, offering loans that are very competitive given today’s broader context. Loan maturities will be one key driver of volumes in the coming year. Aside from that, how and when borrowers choose to pull the trigger is likely to be driven just as much by psychology as by anything else.

Rebecca Rockey, deputy chief economist, global head of forecasting at Cushman & Wakefield

Liquidity will improve further, which is a continuation of the momentum we’ve seen form over the recent quarter. In addition to the traction on the capital markets, most markets and asset classes are slated to record improving fundamental market conditions, including declining vacancies and accelerating rents, both of which bode well for operating fundamentals and cash flows at a time when income is of greater import to owners and investors. And though we don’t expect interest rate volatility to dissipate, the reality is that the Fed is easing and that will continue—of course, with the path being data dependent.

Debt costs, credit spreads, and asset pricing are more attractive than they were a year ago and we’re tracking several noteworthy inflections throughout parts of the capital markets. For example, we’re seeing notable momentum from non-agency CMBS [commercial mortgage-backed securities] issuance all as a broader spectrum of lenders across the life co. and debt fund side are eager to deploy debt capital. On the capital-flows side, we’ve started to see a gradual return of core capital, which is really the tip of the spear that helps to loosen fund flows and liquidity constraints while also providing conviction of an eventual exit to value-add investors.

Meanwhile, on the transaction side, we’ve seen an uptick in portfolio trades, which are typically a sign of an early inflection in institutional sentiment as these “splashy” portfolio buys tend to demonstrate to the wider market that this window of opportunity is starting to close. I expect to see private credit, equity (public and private) and other institutional capital more active with banks being more selective as they navigate regulatory scrutiny.

Lonnie Hendry, Chief Product Officer at Trepp

It appears the “higher for longer” narrative is turning into the “higher for longer” reality for borrowers heading into 2025. The Fed’s 50 bps [basis point] pivot in September and subsequent 25 bps interest rate reduction in November have been countered by increasing treasury rates that continue to put upward pressure on mortgage interest rates. The overall delinquency rate also continues to increase on a month-over-month basis with no end in sight during 2025 based on properties that are shown as current on the mortgage but have DSCR [debt service coverage ratio] a 1.0x or less.

I think the bifurcated market of “haves and have nots” will continue into 2025, and I don’t see any significant changes in store outside of some externality. President-elect Trump has a track record of decreasing regulation, which could potentially bolster bank lender appetites, but it remains to be seen how quickly those changes could be implemented and what other factors may change during that time period. In spite of these challenges, I think investors are hungry to transact and we will continue to see good transaction velocity for well-located, quality assets in 2025.

Erin Patterson, managing director, real estate, global co-head of research & strategy, Manulife Investment Management

We believe that originations will continue to increase, and mark 2023 as a cyclical low. The MBA forecasts originations to be up 26 percent in 2024, so we’ll see if that comes to pass. And, even if the overall tide rises, some boats may be left in the lurch even as others have smoother sailing. We know that office distress has been most prevalent, with $5.3 billion and $7.3 billion in CMBS loan maturities in 2024 and 2025, respectively. Multifamily garnered attention with $2.6 billion in maturities looming in 2024. However, this level drops off significantly next year to $200 million.

Volume for both office and multifamily is anticipated to pick up in 2026. Office will likely continue to face headwinds, and until there is more significant reconciliation on the supply side, financing is likely to remain limited in this sector. The retail sector is slowly moving back in favor for investors and lenders, with fairly stable maturity levels over the next few years. Overall, 2025 seems poised to be a more active year given the support pillars in place across much of the commercial real estate market.

Lauro Ferroni, head of capital markets research, Americas at JLL

The real estate transactions market in the U.S. has already shown notable improvement since the beginning of 2024. This has been driven by several factors, including the widespread market consensus that interest rates have plateaued and would start to decline, and the continued healthy leasing demand across most property sectors driven by GDP and job growth, etc.

Bidding activity on investment sales transactions has risen materially. In a further sign of conviction, institutional investors are returning to the market across all property types, especially for transactions above $100 million. The year has also ushered in more pricing data points across the board along with cap rate compression in in-favor sectors.

From a debt market standpoint, as the figures from the Mortgage Bankers Association indicate, loan originations marked a meaningful y-o-y [year-over-year] rise in the third quarter of 2024. As an additional sign of liquidity in the market, the number of lenders quoting on loans during the third quarter rose by 30 percent or more across each of the major property sectors vs. Q4 2023.

The new liquidity cycle is expected to strengthen further into 2025. While the 10-year U.S. Treasury continues to be variable, and uncertainty persists around the Fed’s path with regard to the timing and pace of interest rate cuts, commercial real estate market activity is expected to mark further growth during 2025.

William Maher, director, strategy & research, RCLCO Fund Advisors

Commercial real estate liquidity will continue to slowly improve over the next year as interest rates decline, lenders resolve problematic loans, and transaction volumes increase. It’s definitely a chicken-and-egg situation, but one reason for recent low loan origination has been low transaction volumes. Overall commercial real estate transactions have been flat at about $90 billion per quarter for the past seven quarters as owners have been reluctant to sell at current prices. That should change as values stabilize and start to rise.

In the meantime, loan availability—and terms—have generally improved, particularly among CMBS originators, but surveys show that banks are also loosening commercial real estate credit availability. Over the next year, depository institutions, life companies, and CMBS/conduits will continue to ramp lending up as values increase with declining interest rates. Office, however, will remain problematic as current values and future cash flow remain tough to decipher.

Past Economist Snapshots: