Office - Buildings

ULI has received the 2020 Excellence in Energy Star Promotion Award for its efforts in promoting energy-efficient and sustainable buildings, and its thought leadership on energy conservation throughout the real estate sector.

Panelists at the 2020 ULI Arizona Trends Day discussed how they are reducing the focus on abundant parking to provide more walkable open space which can be activated. One transit-oriented development in Tempe is billing itself as “car free” as it emphasizes bike lanes, walking, and access to light rail.

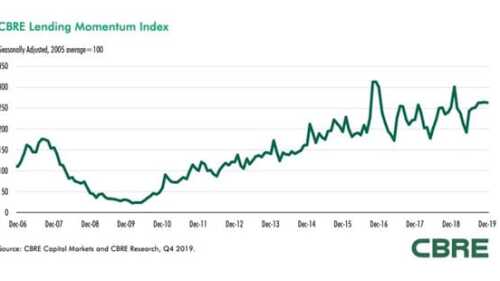

The U.S. Federal Reserve’s interest rate reductions, combined with continued economic growth, supported strong commercial real estate lending activity in the fourth quarter of 2019, according to the latest research from CBRE. The CBRE Lending Momentum Index, which tracks the pace of commercial loan closings in the United States, reached a value of 263 in December 2019—virtually unchanged from its third-quarter 2019 close and up 4.2 percent from a year earlier.

The Dodge Momentum Index, a monthly measure of the initial report for U.S. nonresidential building projects in planning, rose 6.9 percent month over month in October. The increase was due to a recovery in institutional planning projects, which had stepped back over the previous few months. Institutional planning moved 22.8 percent higher in the month while commercial planning lost 0.5 percent.

Hotels and office buildings are taking on many of each other’s characteristics in terms of design and use. This confluence has several drivers, among them the evolution of technology, shifts in guest and tenant expectations, and the increasing mobility of the American workforce.

The Dodge Momentum Index moved 4.1 percent higher in September to 143.6 from the revised August reading of 137.9. The gain in September was due entirely to an 8.9 percent increase in the commercial component, while the institutional component fell 4.8 percent.

The plan to develop a robust pipeline of tech talent—and to retain that talent—was one of the deciding factors driving Amazon’s choice of Crystal City in Arlington, Virginia, said speakers at the ULI’s 2019 Fall Meeting in Washington, D.C.

Whether making or adapting a building, district, campus, city, workspace, portfolio of properties, brand, or lifestyle, the human experience is central. Three examples from the United States and Canada illuminate how our cities are everyday places—small and forgotten places—waiting to be discovered and transformed into human-oriented social places.

According to a new report from Cushman & Wakefield, flexibile office space could triple in size in the coming years, representing 5 to 10 percent of office inventory in many markets. Investors also believe coworking is well positioned to weather an economic downturn.

While investment volumes in commercial real estate in Hong Kong were up strongly last year, flagship office buildings and prime development sites are beyond the reach of all but a handful of players. For most investors, more interesting opportunities lie in other, less-visible parts of the market. Rather than waiting for (and possibly missing) the next correction, investors who are willing to roll up their sleeves may find opportunities away from the spotlight.