The U.S. Federal Reserve’s interest rate reductions, combined with continued economic growth, supported strong commercial real estate lending activity in the fourth quarter of 2019, according to the latest research from CBRE.

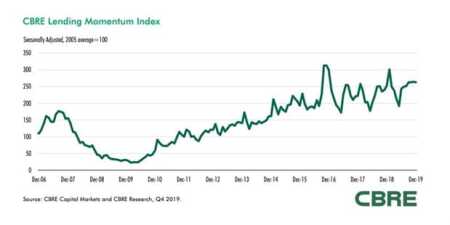

The CBRE Lending Momentum Index, which tracks the pace of commercial loan closings in the United States, reached a value of 263 in December 2019—virtually unchanged from its third-quarter 2019 close and up 4.2 percent from a year earlier.

“A favorable capital markets environment for real estate continued to support strong commercial lending activity into year-end,” said Brian Stoffers, global president of debt and structured finance for capital markets at CBRE. “Alternative lenders should remain a plentiful source of lending capital in 2020, particularly for bridge and construction loans.”

The multifamily agency market also posted a record year in 2019 with volume totaling $148.5 billion, he said. “The agencies will have almost $80 billion each to deploy in 2020, which should provide strong liquidity to multifamily investment,” he added.

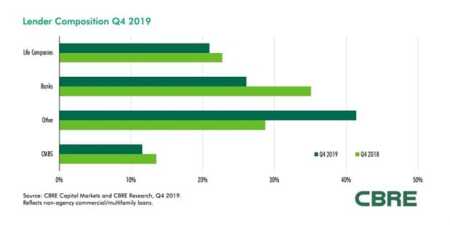

CBRE’s lender survey indicates that alternative lenders—which includes real estate investment trusts (REITs), finance companies, and debt funds—had another strong quarter to lead origination activity in the fourth quarter. Alternative lenders accounted for 41 percent of total nonagency volume, up from 29 percent for the third quarter of 2019 and 29 percent a year earlier.

Among traditional lenders, life companies accounted for 21 percent of nonagency lending volume in the fourth quarter, down from a 29 percent share in the third quarter and 23 percent a year earlier. Competition for high-quality life company product increased in the fourth quarter, leading to the relative decline.

Banks’ share of volume rose to 26 percent in the fourth quarter from 24 percent in the third quarter, but was down from 35 percent a year earlier.

Among the originations tracked by CBRE, commercial mortgage–backed securities (CMBS) lenders accounted for 12 percent of total volume, down from 17 percent in the third quarter and 14 percent a year earlier.

Corporate bond and CMBS pricing remained tight. Between October 2019 and late January 2020, BBB-rated corporate bond spreads tightened by close to 30 basis points (bps); spreads on benchmark 10-year AAA-rated CMBS bonds narrowed by close to 20 bps over the same period. With tight spreads, CMBS is positioned to build on the strong issuance volume, which contributed to a post-recession high of $97.8 billion in 2019.

Underwriting on loans tracked became more conservative in the fourth quarter, marked by higher debt service coverage and lower loan-to-value ratios. The percentage of loans carrying either partial or full interest-only terms fell to 64.1 percent from a high of 67.9 percent in the third quarter of 2019.