Finance – Capital Markets

ULI MEMBER–ONLY CONTENT: As other segments of the real estate business adjust to challenges presented by the COVID-19 pandemic and economic recession, the industrial sector is looking to capitalize on greater demand for its facilities resulting from the explosion of e-commerce, panelists said at a Trends and Outlooks session during the 2020 ULI Virtual Fall Meeting.

ULI MEMBER–ONLY CONTENT: The pandemic has triggered a bigger decline in hotel and resort revenues (measured by revenue per available room) than the previous five economic crises combined, said panelists speaking on the hotel and resort sector outlook during the 2020 ULI Virtual Fall Meeting.

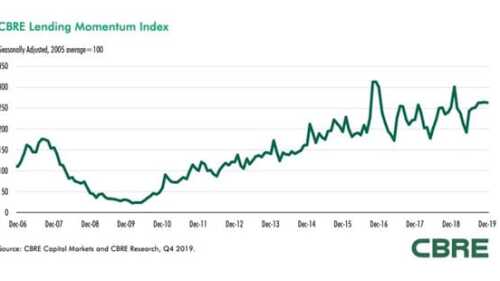

The U.S. Federal Reserve’s interest rate reductions, combined with continued economic growth, supported strong commercial real estate lending activity in the fourth quarter of 2019, according to the latest research from CBRE. The CBRE Lending Momentum Index, which tracks the pace of commercial loan closings in the United States, reached a value of 263 in December 2019—virtually unchanged from its third-quarter 2019 close and up 4.2 percent from a year earlier.

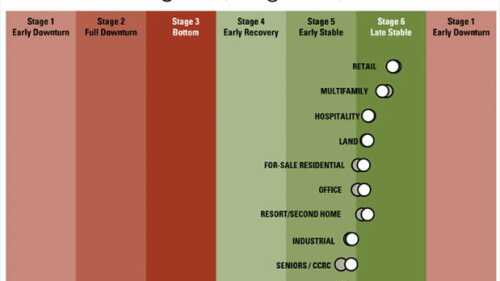

The persistent theme over the current economic cycle of “lower for longer” growth has contributed to a record expansion cycle that has surpassed 10 years. Results from ULI’s latest “Real Estate Economic Forecast” show that trend is likely to continue into 2021, said panelists speaking on a webinar discussing the survey results.

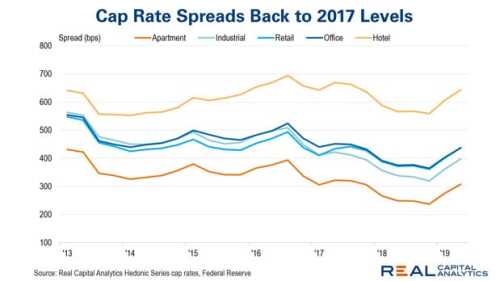

Interest rates have been on a roller-coaster ride over the last year, but cap rates are largely unchanged. The result of these moves is that cap rate spreads relative to the safe investments in the 10-year U.S. Treasury bonds have moved back to the levels seen in 2017. Given everything that has changed over the last year—as well as everything that has not—there may be room for cap rate spreads to move lower.

At the 2019 ULI U.K. National Conference, a panel on the practicalities of real estate investment reflected on the opportunities and challenges, not least in terms of the impact that Brexit is having on investor sentiment, as well as where we are in the market cycle. Multifamily continues to do well, while retail is struggling as in overbuilt markets.

Jes Staley, CEO of multinational investment bank Barclays, spoke at the ULI Europe Conference in London, sharing his recent experiences addressing shifting financial regulations and the evolving opportunity presented by new technologies.

According to a survey by RCLCO, sentiments about the real estate conditions in the U.S. remain at a relatively high level, but slightly below where they were six months ago. Just over one-half (51 percent) of RCLCO’s Mid-Year 2018 Sentiment Survey respondents say U.S. real estate market conditions are moderately or significantly better today than they were 12 months ago, five percentage points lower than in the year-end 2017 survey.

A glut of liquidity in local capital markets is making life difficult for domestic and foreign investors alike.

The new ULI Real Estate Economic Forecast is taking a more bullish view on the U.S. economy—at least for the remainder of this year. As compared with the fall survey, key indicators such as gross domestic product (GDP) growth, jobs, and the Consumer Property Price Index (CPPI) all trended higher. But that boost may be short lived with growth tapering in 2019 and 2020.