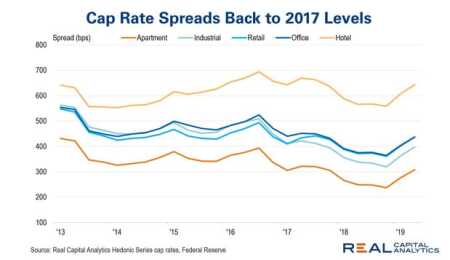

Interest rates have been on a roller-coaster ride over the last year, but cap rates are largely unchanged. The result of these moves is that cap rate spreads relative to the safe investments in the 10-year U.S. Treasury bonds have moved back to the levels seen in 2017. Given everything that has changed over the last year—as well as everything that has not—there may be room for cap rate spreads to move lower.

Interpreting moves in cap rates can sometimes be more of an art than a science. Sometimes, a high-quality transaction can move into the mix and make market averages look lower. Thus, interpreting moves in market averages can require a lot of hand waving, with some uncertainty around the results.

To help reduce the uncertainty in such analysis, the team at Real Capital Analytics applied advanced data science techniques to build a cap rate series (the RCA Hedonic Series [RCA HS]) that controls for quality differences between transactions. Using this tool to look at the true signal in cap rate trends, spreads relative to the 10-year U.S. Treasuries have gone up between 70 basis points to 80 basis points since the end of 2018.

Essentially, the 10-year U.S. Treasuries plunged and cap rates held largely steady. The hotel sector did see a bit of a cap rate expansion since the end of 2018—roughly 20 basis points—but otherwise cap rates were essentially unchanged. Factors that go into setting cap rate levels did change, however.

The Wall Street Journal Economic Forecasting Survey is a useful tool to gauge sentiment on the direction of factors that should drive cap rate levels. Every month, they ask more than 60 professional economists for their forecasts on the direction of various indicators. Between the July 2018 and July 2019 editions, there has been a downward shift in expectations for the level of 10-year U.S. Treasury bonds, but not so much for gross domestic product (GDP) growth.

All other things being equal, if interest rates decrease, then cap rates should as well, given the way that investors price real estate assets off of the rates of return in the bond markets. It was not just the 10-year Treasury rate that dropped; other instruments like corporate bonds have dropped as well.

Furthermore, in July 2018, the WSJ survey showed an expectation that the 10-year rate would end 2020 at the 3.5 percent level. In July 2019 however, this expectation slipped to 2.4 percent.

Still, if interest rates are falling because you expect less growth in the economy, then the expectations that investors have for income growth will be lower. Lower income growth expectations can mean higher cap rates and higher cap rate spreads. There has been a slight downshift in GDP expectations for 2019 from the Wall Street Journal survey between this year and last—2.3 percent versus 1.9 percent—but the longer-term expectations are the same. So there is no big expectation that the forces driving property income will tank.

These two survey items alone do not explain cap rate levels, but they are useful indicators for the factors of income growth and relative rates of return in other sectors that do determine cap rate levels. The wider spreads to the 10-year U.S. Treasury rates in the face of forces that would indicate lower cap rates are a sign of a general sense of unease on the part of investors given some of the uncertainty in the economy. If that unease begins to stabilize with interest rates and growth expectations where they are now, then not only may cap rate spreads narrow again, but cap rates may compress further, bringing the United States closer to global levels.