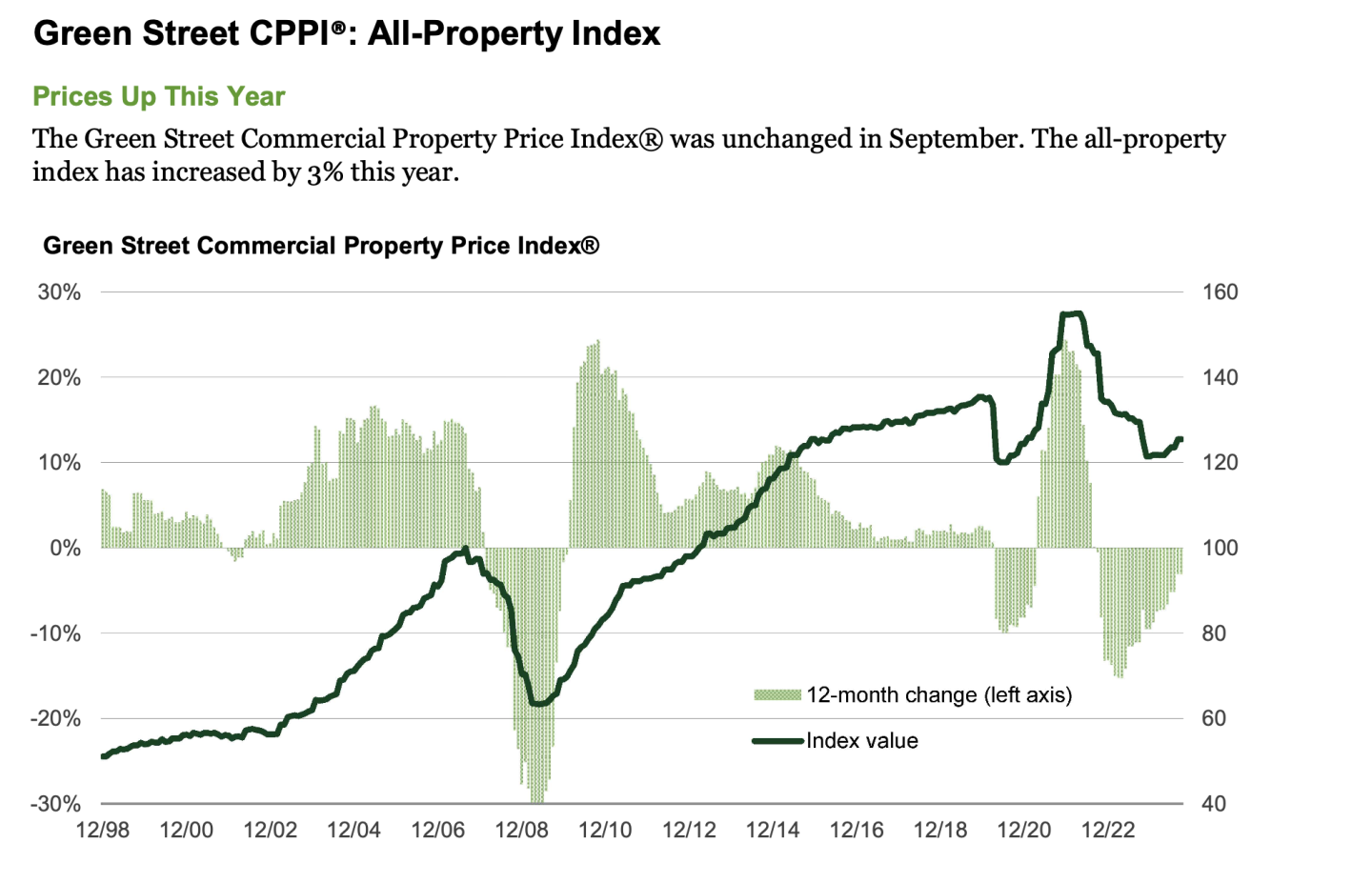

Industry CPPI data suggests that property prices may be at—or near—bottom. The three major indexes from MSCI Real Assets, CoStar, and Green Street all showed an increase in CPPI in August. After rising 1.6 percent in August, Green Street’s recently released Commercial Property Price Index remained unchanged in September. Green Street’s all-property index—a measure of pricing for institutional-quality properties—is up 3.3 percent year-to-date through September.

Urban Land: Commercial real estate prices across most properties appear to be stabilizing. What’s your outlook on the trajectory of commercial real estate values over the next six months? What sectors do you think are poised to rebound faster, and, aside from office, what sectors do you think are showing more weakness in pricing?

Victor Calanog, PhD, Global Co-head of Research and Strategy, Manulife Investment Management

Transaction-based cap rates from RCA [Real Capital Analytics] actually began flattening and showing slight declines as early as May or June of this year. So, there was already some evidence that [commercial real estate] prices were stabilizing even before the Fed’s rate cut on Sept. 18. At this point in the cycle, however, we’ve found that averages tend to mask variation, which may remain relatively wide. Transaction volume also has shown some signs of increasing from 2023 lows. But if you exclude large portfolio sales from the second quarter, for example, the overall figure for even multifamily is still flat or even down year-over-year.

We’re cautiously optimistic that residential and logistics have long-term tailwinds that will get [them] past short-term volatility, but we’re keeping an eye on not just CPPI numbers—which [tend] to reflect averages—but [also] on the underlying data points that drive [them]. Averages are indicative: opportunities and risks lie in points that vary to the left and right of the mean.

Daniel Ismail, Managing Director and Co-Head of Strategic Research at Green Street

There’s much to be optimistic about [in] the outlook for commercial real estate prices over the next six months. Green Street’s Commercial Property Price Index bottomed in late [2023] and is marginally positive thus far in [2024], but the REIT [real estate investment trust] and fixed-income markets are suggesting further price increases. U.S. commercial real estate unlevered returns look favorable versus investment-grade and high-yield bonds, while the majority of U.S. REIT sectors are now trading at premiums to gross asset value. Both are historically powerful indicators about the direction of property prices and they’re both flashing green.

Regarding sectors, the majority of REIT property sectors are trading at premiums to private prices and equity issuances have been more common in recent months. Health care, data centers, and even parts of retail are trading at notable premiums, suggesting future price increases are likely. Conversely, lodging, life science, and single-family rentals are trading at discounts to private values, suggesting the likelihood of future price increases is less likely. Further transactional evidence will likely take longer to appear, but when the dust settles, these signals are usually prescient.

Darin Mellott, Head of U.S. Capital Markets Research for CBRE

We expect the 10-year Treasury to remain at levels supportive of investment activity and values, averaging 3.8 percent in Q4 and gradually drifting down to the mid-3 percent range in 2025. While we do not anticipate rapid asset price appreciation over the next six months, we expect positive movement, which will vary significantly between property types.

The pace of recovery will differ based on markets, property types, and specific assets. By the end of 2025, we believe the industrial sector will experience the most value appreciation, followed by retail and multifamily. These sectors are underpinned by solid fundamentals, supported by an economic soft landing (CBRE’s base case).

Meanwhile, office values remain relatively flat but are expected to increase slightly, benefiting from ongoing economic growth and reduced uncertainty for businesses. It’s important to note that we are at a turning point in the market; general statements may not fully capture the dynamics at play, but the recovery has indeed begun.

Lea Overby, Head of CMBS Research at Barclays Capital

We think [commercial real estate] prices and transaction volumes might have found a bottom and may start to show modest improvement within the next few months. Improved lending conditions and sentiment should help the sector to [stabilize further], and increased risk appetite may lead to higher valuations. However, significant distress still remains across [commercial real estate], which will likely prevent more immediate improvements, especially across transaction-based pricing indices.

Across the major property types, we are most optimistic about the multifamily sector, as it has [undergone] significant price deterioration and could be more sensitive to the move in rates. [Yet] pricing within the lodging sector could remain under pressure as cash-flow growth slows further. Looking at lodging trends in 2024, it appears that while expense growth has likewise moderated, it remains a headwind, outpacing revenue growth.

Rich Hill, Head of Real Estate Strategy & Research at Cohen & Steers

We believe that private commercial real estate values are in the process of bottoming if they haven’t already and project that they will trough around [minus 20] percent to [minus 25] percent. We think this cycle is playing out in textbook fashion, with listed REITs as a leading indicator for private. REITs troughed in October 2023, and total returns have risen 43 percent since then, as of the end of [third quarter 2024]. Private valuations typically trough 12 to 18 months after REITs, and distress in the debt markets peaks 12 to 24 months later.

We do not expect a V-shaped recovery, like what occurred post-GFC [Global Financial Crisis], and believe the recovery will be uneven across property types, with potential for inconsistencies across indices, given different methodologies. We think open-air shopping centers have already bottomed, following the “retail apocalypse.” This property type is seeing low levels of supply and its strongest occupancy rates since [before] the GFC, contributing to a strong investment opportunity, in our view. Indeed, open-air shopping centers are the best-performing property type year-to-date, according to NCREIF.

[We] expect private CRE darlings like industrial and multifamily to face more challenges than perhaps many other investors expect, given the oversupply in the market, [plus] the fact that many funds bought these properties at peak valuations and some apartments were financed with short-term floating-rate debt that is starting to come due. Additionally, industrial REITs are down [1.3] percent as of [third quarter 2024], and industrial REITs are the third-worst of the 18 REIT sectors this year. It may take time to see the impact in multifamily and industrial, and the decline may not be as severe as some other property types, but what worked last cycle may not work as well in the next cycle.

Past Economist Snapshots:

![Calanog,Victor_09.2023[1].jpg](https://cdn-ul.uli.org/dims4/default/92daf5c/2147483647/strip/true/crop/4000x6000+0+0/resize/450x675!/quality/90/?url=https%3A%2F%2Fk2-prod-uli.s3.us-east-1.amazonaws.com%2Fbrightspot%2Fc6%2F0e%2F6471c58846478c4ceae49284ba7f%2Fcalanog-victor-09-20231.jpg)

![Daniel Ismail[1].jpg](https://cdn-ul.uli.org/dims4/default/f0cf237/2147483647/strip/true/crop/3600x2700+0+42/resize/500x375!/quality/90/?url=https%3A%2F%2Fk2-prod-uli.s3.us-east-1.amazonaws.com%2Fbrightspot%2F54%2F88%2Fdb1c5c054c5e9203fe2ff1decc55%2Fdaniel-ismail1.jpg)

![DMellott_Crop[1].jpg](https://cdn-ul.uli.org/dims4/default/f0fa6e5/2147483647/strip/true/crop/3300x4340+0+0/resize/450x592!/quality/90/?url=https%3A%2F%2Fk2-prod-uli.s3.us-east-1.amazonaws.com%2Fbrightspot%2F67%2Fce%2Fe2bb5eea4a4aaa500ce0da7238fa%2Fdmellott-crop1.jpg)

![Lea Overby Headshot[1].jpg](https://cdn-ul.uli.org/dims4/default/cafdd94/2147483647/strip/true/crop/228x304+0+0/resize/228x304!/quality/90/?url=https%3A%2F%2Fk2-prod-uli.s3.us-east-1.amazonaws.com%2Fbrightspot%2Fc8%2Fc8%2Feb10eb6f4169802c031a085fae36%2Flea-overby-headshot1.jpg)