Environmental, social, and governance (ESG) policies continue to evolve around the world as governments seek to accelerate decarbonization without overburdening businesses with red tape. There has been uncertainty, for example, around major regulations related to corporate-level ESG reporting and due diligence.

The introduction in 2023 of the International Financial Reporting Standards (IFRS) S1 and S2 Sustainability Disclosure Standards sparked hopes for a consistent, comparable, global baseline for sustainability reporting; however, it hasn’t yet been translated into policies internationally, as various groups and trade organizations continue debating the U.S. SEC’s climate-related disclosures requirements and proposals for the European Eunion Omnibus Simplification Package.

Despite such geopolitical headwinds, green building regulations continue to gain momentum among local authorities. Many cities have moved beyond reporting requirements to demand practical, asset-level action. Numerous jurisdictions have introduced requirements on net-zero carbon and energy efficiency in buildings, fossil fuel-free heating, embodied carbon, electric vehicle (EV) charging facilities, and climate adaptation measures.

To track these myriad regulations, ULI Greenprint partnered with global consultancy firm Arup to publish the third and latest version of its Global Green Building Policy Dashboard. “ULI is pleased to publish this updated dashboard,” said ULI Greenprint Vice President Blakely Jarrett. “As sustainability practitioners spend more and more time navigating an evolving regulatory landscape, the dashboard is one way that ULI Greenprint members are supporting the industry, by freeing up practitioners’ time to implement sustainability projects and initiatives.”

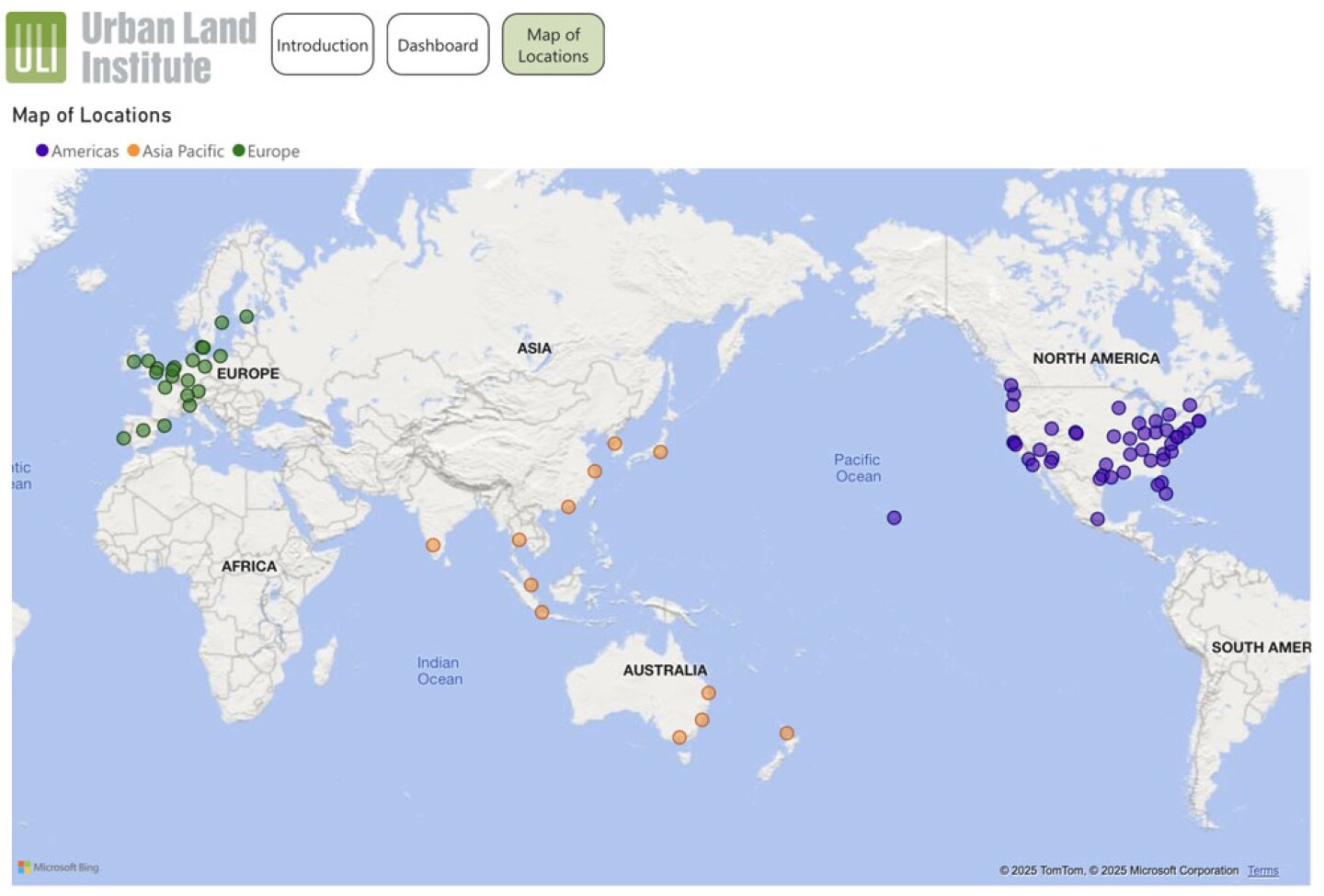

The tool now summarizes regulations across 81 jurisdictions, offering a visual map with helpful filters by region, location, and regulation category. Here are a few notable changes since last year’s update:

- In the U.S., the city of Boston approved an amendment in the zoning code to include Net Zero Carbon (NZC) Zoning, which introduces a net-zero emissions standard for new large project filings. The neighboring city of Cambridge adopted the Fossil Free Ordinance for all new construction and major renovation projects (residential and commercial).

- In Europe, the German government is planning to phase out fossil fuels from heating by January 2045, and—in addition to banning fossil fuels in new buildings—is asking all municipalities to submit fossil fuel-free heat plans for existing buildings. The EU also approved an amendment to its Energy Performance of Buildings Directive, setting renovation targets for the bloc’s worst-performing buildings.

- In Asia Pacific, the Shanghai Green Building Regulations, which went into effect on January 1, 2025, include certification requirements for new buildings and upgrades for existing ones. In Singapore, a new Mandatory Energy Improvement regime will require existing buildings that are consistently energy-intensive to undergo audits and undertake efficiency improvements.

These are a few examples of asset-level regulations that have come into force over the past 18 months. The landscape is complex, especially for companies that own geographically diverse portfolios.

“Following our years-long partnership to develop this resource, this third update to the dashboard provides critical information to better navigate local-level building requirements,” said Arup associate Linda Toth. “This year we are seeing continued growth in energy and carbon building performance standards nationally—as well as increased climate resiliency planning from locations across the globe—to influence high-performance buildings.”

Mapping out existing green building policies is just the first step. The real estate industry is increasingly calling for more harmonization and consistency across sustainability legislation, with the goal of easing the regulatory burden and increasing investor confidence. There have been some industry-led initiatives to address this issue. For example, Aligning Real Estate Sustainability Indicators (ARESI) addresses existing ambiguities in building-related KPIs (key performance indicators) within the European legislative framework.

“The ARESI working group is pivotal for the real estate investment management sector, directly tackling the fragmentation and ambiguity in key sustainability indicators across the EU and UK,” said Robbie Epsom, EMEA head of sustainability at CBRE Investment Management. “By providing interim solutions to harmonise key performance indicators and leveraging existing European legislation, ARESI streamlines regulatory burdens. This clarity is essential to unlock the significant private finance needed for the climate transition, enabling efficient capital allocation and informed decision-making across the entire value chain, from financial products to property transactions and valuations.”

Keeping up with the pace of regulatory changes is a challenge—but this uncertainty also brings opportunity. If the real estate industry proactively engages with policymakers to shape the regulatory landscape, perhaps lawmakers will be better informed and deliver practical regulatory frameworks.

ULI will continue to expand and update the dashboard. If you have any questions or feedback, please email [email protected].