Real estate economists continue to expect a slowdown in the U.S. economy and real estate markets over the next year, consistent with their outlook six months ago. The economy will slow meaningfully in 2024 before improving in 2025. Real estate markets are expected to follow suit with flat or negative results in 2024, followed by a partial recovery in 2025.

The Fall Real Estate Economic Forecast, produced by the ULI Center for Real Estate Economics and Capital Markets, is based on a survey conducted October 6 to 23, 2023, including 39 economists and analysts at 35 leading real estate organizations. The forecast results are based on the median responses gathered in the survey, which reflect a wide range of views both better and worse.

While the Fall 2023 forecast’s overall outlook remained consistent with the prior Spring survey, the timeline of the expected economic slowdown was pushed out. The 2023 gross domestic product (GDP) growth expectation increased from 0.9 percent to 2.1 percent while the 2024 forecast fell from 1.5 percent to 0.9 percent. This same trend was evident six months ago as economic data continues to surprise on the upside. Forecasts also reflected a more moderate downturn relative to Spring expectations. For example, 2024 employment growth was revised from 0.8 million to 1.0 million. Overall, economists expect the coming slowdown to be later and shallower than previously predicted.

After a slowdown in 2024, survey participants continue to expect a modest recovery in 2025. Several 2025 forecasts are at or above long-term averages, including employment growth, single-family housing starts, and rent growth in apartments, industrial, and retail. However, key metrics such as GDP, real estate returns (public and private), and transaction volumes will be at or below their long-term averages.

One of the most significant changes from the Spring survey was economists’ views on capital markets. The 10-year U.S. Treasury yield touched 5 percent during the period of the survey, and the Fed has continued its “higher for longer” messaging. Respondents projected the 10-year yield to end 2023 at 4.6 percent, considerably higher than the Spring’s 3.5 percent forecast. Forecasts for 2024 and 2025 were also elevated at 4.0 percent (up from 3.3 percent) and 3.9 percent (up from 3.15 percent), respectively. Elevated rate expectations will impact real estate markets. Transaction volume and commercial mortgage–backed securities (CMBS) issuance projections declined considerably across the forecast horizon. High rates also dragged down 2024 valuation forecasts, with economists expecting higher cap rates and prolonged declines in commercial real estate pricing.

Key Findings for Commercial Real Estate

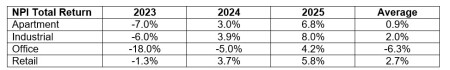

Forecasts for total returns of the NCREIF Property Index (NPI) of unleveraged core real estate fell moderately relative to six months ago. Much of the deterioration in return projections is likely due to expectations that capital markets will remain constrained in the near term, putting downward pressure on real estate valuations. Relative to the Spring, NPI total return forecasts fell by 2.2 percentage points in 2023 and 0.1 percentage point in 2024. However, return expectations are up in 2025 by 1.0 percentage point.

Return forecasts by property type continue to show wide variation through 2025. Retail and industrial are forecast to record the highest returns with average annual returns of 2.7 percent and 2.0 percent, respectively. Retail performance expectations benefit from earlier value write-downs which have left the sector with the highest income yields. Apartment forecasts are not far behind at 0.9 percent. The outlook for office returns remains challenged, and survey respondents forecast an average annual return of -6.3 percent through 2025.

Public real estate return forecasts also declined relative to the prior survey. Economists expect the NAREIT All Equity REITs index to improve from its -24.4 percent return in 2022 but remain negative at -4.5 percent in 2023 before increasing to 0.0 percent in 2024 and 5.0 percent in 2025. This represents a notable decrease from Spring expectations of 4.0 percent, 10.0 percent, and 10.0 percent over the next three years.

Against the backdrop of challenged capital markets and low real estate returns, capitalization rates or income yields are projected to increase from their recent all-time lows. Economists forecast that the overall NPI cap rate will rise from 4.0 percent in 2022 to 4.8 percent by 2024, remaining at that level in 2025. With the 10-year UST forecast to yield 3.9 percent in 2025, the resulting spread of 90 basis points will be below the long-term average of 260 basis points. Higher-income yields will drive declines in commercial real estate pricing. The RCA Commercial Property Price Index (CPPI) is projected to fall by 7.0 percent in 2023 and by another 1.1 percent in 2024 before returning to growth of 4.1 percent in 2025.

Real estate economists expect U.S. transaction volumes to fall significantly, potentially due to the steep rise in borrowing costs over the last year. Transactions are forecast to total $312 billion in 2023 and rise modestly to $414 billion in 2024 and $510 billion in 2025. Forecasts declined notably from six months ago and are below the long-term average of $520 billion. CMBS debt issuance is similarly predicted to decline and remain below average through the forecast period. Issuance forecasts are all down from the Spring and total $40 billion in 2023, $60 billion in 2024, and $77 billion in 2025.

Despite current challenges in capital markets, rent growth is generally projected to hold up in most property types. From 2023 to 2025, annual rent growth is projected to average 5.0 percent, 2.0 percent, and 2.4 percent for industrial, apartments, and retail, respectively. These growth rates outpace long-term averages of 2.7 percent and 1.3 percent for industrial and retail, respectively. Apartment rent growth forecasts trail their long-term average of 2.8 percent. Office will continue to underperform with rents contracting an average of 0.8 percent annually through 2025.

Availability rate forecasts rose from the prior survey for industrial, apartments, and office while retail forecasts were mostly flat. The industrial availability rate is projected to increase from 4.8 percent in 2022 to 5.8 percent in 2024 and 2025, still well below its long-term average of 9.7 percent. Relative to Spring forecasts, expectations rose a modest 20 basis points for each year. Apartment vacancy forecasts rose by larger margins with peak vacancy of 6.0 percent forecast in 2024, up from a 5.3 percent forecast six months ago. Vacancies are expected to trend above the long-term average of 5.1 percent throughout the forecast timeframe. Economists expect the retail availability rate to remain at 6.9 percent through 2025, notably below its long-term average of 9.8 percent and little changed from six months ago. Office continues to suffer from reduced usage, and participants increased vacancy forecasts to reflect that sentiment. Vacancies are projected to rise to 19.2 percent in 2024 and 2025, up from the Spring forecast of 19.0 percent and much higher than long-term average office vacancy of 14.6 percent.

Hotel fundamentals have returned to their pre-pandemic seasonality trends as travel has remained strong. Survey respondents’ projections have moderated slightly over the last six months. The national occupancy rate is expected to average 63.2 percent in 2023, rising to 64.1 percent in 2024 before falling to 61.0 percent in 2025, consistent with the long-term average of 61.1 percent and notably down from the Spring forecast of 64.8 percent. Revenue per Available Room (RevPAR), which combines rental rates and occupancy, is expected to increase 8.5 percent in 2023 before moderating to 4.1 percent in 2024 and 3.5 percent in 2025, trailing its long-term average of 5.2 percent.

Real estate economists expect single-family starts to drop considerably in 2023 and remain low in 2024 before recovering somewhat in 2025. After 1.0 million new single-family starts in 2022, starts are projected to fall to 880,000 in 2023, tick up to 900,000 in 2024, and recover to 1.0 million in 2025, outpacing their long-term average of 935,000. Average home prices are expected to increase 2.0 percent in 2023 and 2024, up from forecasts six months ago of -4.6 percent and 1.6 percent, respectively. In 2025, prices are projected to rise 3.0 percent, below both the 3.5 percent Spring forecast and the 4.6 percent long-term average.

Key Findings for Major Economic Indicators

The ULI Real Estate Economic Forecast continues to signal an economic slowdown and possible recession over the next six to 18 months. Annual GDP is projected to grow at a slightly above-average pace of 2.1 percent in 2023 before slowing to 0.9 percent in 2024 and rebounding to 2.0 percent in 2025. This represents an upgrade from the Spring’s 2023 growth outlook of 0.9 percent and a downgrade from its 2024 and 2025 forecasts of 1.5 percent and 2.5 percent, respectively.

Economists’ labor market forecasts point to an improved outlook in both 2023 and 2024, suggesting that a coming economic downturn may be less severe than initially expected. The economy is projected to add 3.75 million net new jobs in 2023, notably higher than the 1.5 million expected six months ago. Job growth is forecast to slow to 1.0 million in 2024, higher than the Spring forecast of 0.8 million, and recover to 1.8 million in 2025. Unemployment projections for 2023 and 2024 correspondingly declined by 20 basis points to 3.8 percent and 4.4 percent, respectively. Survey respondents expect unemployment to settle at 4.3 percent in 2025, well below its long-term average of 5.8 percent. As of October 2023, job growth had totaled 2.4 million year-to-date, and the unemployment rate stood at 3.9 percent.

Inflation expectations also improved moderately over the last six months. The 2023 forecast fell from 4.1 percent to 3.5 percent in response to several positive reports from the Consumer Price Index (CPI). Inflation is projected to fall further to 2.7 percent in 2024 and 2.3 percent in 2025, both near the long-term average of 2.5 percent.

Long-term interest rates have recently risen to their highest levels since 2007 as the Federal Reserve completes its most aggressive rate-tightening cycle since the 1980s. Economists’ expectations for the yield on the 10-year U.S. Treasury note increased markedly from the prior survey. Participants expect the 10-year UST to end 2023 at 4.6 percent and decline to 4.0 percent in 2024 and 3.9 percent in 2025. These represent large increases from Spring forecasts of 3.5 percent, 3.3 percent, and 3.15 percent in 2023, 2024, and 2025, respectively.

Summary

Respondents to the Fall 2023 ULI Real Estate Economic Forecast adjusted projections to reflect a later start to the expected economic slowdown and decreased severity of the downturn. Compared to the Spring 2023 forecast, economic forecasts were slightly less optimistic, potentially due to expected higher interest rates during the forecast period. Real estate economists also expect a more subdued real estate recovery in 2025 compared to earlier this year.

WILLIAM MAHER is director, of strategy & research, and SCOT BOMMARITO is senior research associate with RCLCO Fund Advisors.

![Western Plaza Improvements [1].jpg](https://cdn-ul.uli.org/dims4/default/15205ec/2147483647/strip/true/crop/1919x1078+0+0/resize/500x281!/quality/90/?url=https%3A%2F%2Fk2-prod-uli.s3.us-east-1.amazonaws.com%2Fbrightspot%2Fb4%2Ffa%2F5da7da1e442091ea01b5d8724354%2Fwestern-plaza-improvements-1.jpg)