Members Only

Urban Land content is sometimes created only for current ULI members.

The Summer 2025 issue of Urban Land is now available for ULI members. This special issue is dedicated to Project Recovery in Los Angeles, with contributions from member leaders including Lew C. Horne and Claire De Briere. Also covered is the ULI Advisory Services team’s work on Panther Island in Fort Worth, Texas.

RXR CEO and Chairman Scott Rechler, in a recent ULI members-only webinar with ULI Foundation Chair Faron A. Hill, described the challenges and opportunities ahead as an epic, unavoidable storm. “That hurricane … eventually, it’s going to hit land,” Rechler warned. “The question is when it hits, how hard it hits, and where it hits the hardest.”

It’s tough to view a strong economy as bad news. Yet a firmly positive economic projection in ULI’s Real Estate Economic Forecast does not bode well for commercial real estate participants who are hoping for relief in rate cuts from the U.S. Federal Reserve.

In a general session at the 2024 ULI Spring Meeting, former U.S. Secretary of State Hillary Rodham Clinton spoke with Ralph Rosenberg, a partner and global head of real estate with KKR. Clinton, who now teaches at Columbia University, focused her remarks on what she said are the three major conflicts affecting the global economy.

The Manhattan office market is beginning to make a comeback, but much has changed since the start of the COVID-19 pandemic. The persistence of hybrid and remote work have changed the equation for commercial rentals, both in terms of landlord-tenant relationships and the quality of office product on offer.

Since the retirement of Urban Land Institute’s Global CEO Ron Pressman in October 2023, the search for a visionary global leader has taken center stage. As the Institute charts its course in shaping the built environment for transformative impact within communities worldwide, finding the right leader is paramount.

As the recent cultural and real estate realignment called “The Great Mall Sorting” continues, A-plus malls are thriving, while the B and C properties are gradually being repurposed, reused, and completely rethought, according to architect Sean Slater, senior principal at the architectural firm RDC in San Diego.

Potential trouble brewing in a sector that has been viewed as relatively bulletproof multifamily sector is concerning. But while stress is very much real, industry participants are quick to point out that the overall foundation for multifamily remains strong. “The cracks that we’re seeing are not structural; they’re superficial,” says Vincent DiSalvo, chief investment officer at Kingbird Investment Management, a family office investment firm specializing in multifamily.

ULI MEMBER-ONLY CONTENT: According to the latest ULI Real Estate Economic Forecast, investors are expected to buy just $312 billion in commercial real estate in 2023. That’s a fraction of the volume of sales in 2021 and $100 billion less than expected in the spring forecast just six months ago.

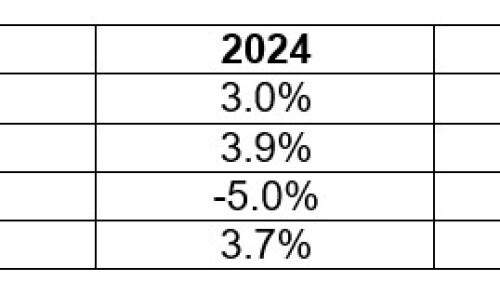

Real estate economists continue to expect a slowdown in the U.S. economy and real estate markets over the next year, consistent with their outlook six months ago, according to a ULI survey. The economy will slow meaningfully in 2024 before improving in 2025. The Real Estate Economic Forecast, produced by the ULI Center for Real Estate Economics and Capital Markets Estate, is based on a survey including 39 economists and analysts at 35 leading real estate organizations.