Multifamily

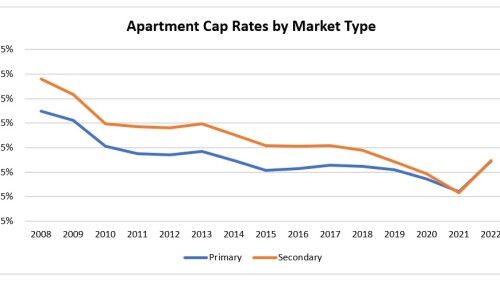

The next era of multifamily real estate will be led by managers that have the ability to produce alpha. The 2010s were defined by a seemingly never-ending bull market. The next cycle will remind investors of the importance of partnering with managers that apply an appropriate risk-reward analysis and have the skill and experience to add value at the real estate level to generate alpha.

ULI Asia Pacific Young Leaders hosted a forum on housing attainability in May with a focus on Australia, China, and Singapore. The event started with a short presentation by Ken Rhee, Senior Director of ULI China and the primary author of the newly released 2023 ULI Asia Pacific Home Attainability Index.

Innovative technology platforms already are helping many owners operate apartment buildings more efficiently and improve services for tenants. But experts say that is just the start of a revolution that could transform the multifamily segment.

A member of ULI Los Angeles shares how his company is harnessing creativity and a lot of hard work to build attainable housing that is within reach of most renters.

Repurposing commercial properties into multifamily housing is growing more common across a variety of real estate markets and can provide a critical source of housing where shortages persist, according to a new report from ULI and the National Multifamily Housing Council Research Foundation.

Ten projects leverage public and private resources to realize complex new developments.

A new ULI report explores the social, environmental, and economic benefits of creative placemaking, along with successful case studies in the United States.

Investors who specialize in “deconverting” condo properties back into rentals are finding opportunities. But the deals take patience and fortitude.

Successful development of 20-minute communities in Black and brown neighborhoods requires community involvement and ownership, according to panelists who explored the topic at ULI’s 2021 Fall Meeting.

Khoo Teng Chye, the new chair of ULI Asia Pacific, began his three-year term in July, succeeding Nicholas Brooke, chairman of Professional Property Services in Hong Kong. An urban planner based in Singapore, Khoo teaches at the Faculty of Engineering and the School of Design and Environment at the National University of Singapore. Previously, he was executive director of Singapore’s Centre for Liveable Cities and chief executive officer of PUB, Singapore’s National Water Agency.