Accompanying the well-documented renaissance of cities in the past decade is a revolution in technology that can change the way developers, owners, and designers work together to develop new neighborhoods, construct new towers, and recast existing building stock for relevant uses.

Construction is often the easiest part of bringing building plans to fruition, and the decision making along the way to groundbreaking can be the part most riddled with uncertainty and miscommunication. This can result in missed opportunities to execute on a vision in a way that is better, faster, and more lucrative. Such messiness is where opportunity lies.

Data and technology are only as powerful as the ability to put them to use. With a growing cohort of experts in data visualization, virtual reality (VR), and augmented reality (AR), immense untapped potential exists to use these tools more creatively and intelligently. People trained both in high-tech programming and in planning/design are creating a whole new spectrum of custom-developed tools and approaches.

Today, questions involving the site of a building—taking into account nuances in retail activity, the implications of incrementally adjusting ceiling heights, or the effect on natural light and viewsheds of moving a central core, as well as the impact on the bottom line—can be analyzed with more meaningful inputs. Gut feelings and industry expertise have their place in decision making, but being more certain about decisions and able to tell an immediately understandable story about why a decision makes the most sense is a welcome addition to conversations between stakeholders in a development project.

Throughout the life of a project, technology and data help clients and teams understand which design strategies may be the most effective, from initial site selection to how a design will work on site. Dashboard tools are also speeding up our iterative approach to design, enabling us to test ideas and demonstrate the impacts nearly instantaneously. And technologies like data visualization and VR/AR are becoming powerful means to build shared understanding of key considerations and potential solutions among highly diverse stakeholders.

We are seeing the returns on tech investment play out across the entire development process, from site selection to building design, interior programming, and interior design.

Understanding Urban Context and Selected Sites

In urban projects, site is incredibly important. Pedestrian counts, transit access, and perception can all be strikingly different from one block to the next. This sensitivity raises the need for finely tuned site selection tools that can quickly assess a site’s viability.

One criterion that has been difficult to understand is how well a proposed development would fit into a constellation of existing businesses. Traditional data sets can be outdated or lack geographic detail, only capturing how many businesses are in a zip code rather than on a given block. But better data abound: the amount of data about how people shop and do business is exploding through companies like Google and Yelp.

For Sasaki, these sorts of data sets have become an important source of insight into how neighborhoods function. The baseline provided by the data then becomes our starting point for finding gaps in business coverage (where is the nearest grocery store? who are the anchor tenants in this neighborhood?) and allows us to right-size the development proposal or building design with those types of tenants in mind.

Data on business locations also prove valuable in the very early stages of a project in allowing comparison of potential districts for new development. By aggregating the retail mix of each district, we see how they differ, both in overall mix and retail strategy.

This allows us to quantify our understanding of Boston’s Back Bay, for example, which succeeds because of a potent mix of smaller shops on Newbury Street, medium-size tenants on Boylston, and traditional mall tenants at the Prudential Center. We can then compare that mix to that of emerging districts like the Seaport or Kendall Square, looking for ways to either replicate that model or develop complementary—yet differentiated—development approaches.

Inventorying entire districts in this way is only possible because of emerging data sets and the teams that turn numbers into accessible visualizations that anyone can grasp and use.

Weighing Trade-offs within the Building

The real estate business is looking for ways to be agile, but the opportunities are different for new construction versus the repositioning of existing properties. Though new construction solutions are nearly endless, cities are full of aging assets that still hold high value. How does one determine the best mix of uses and construction types for a property—and do so quickly?

Funding of mixed-use projects is typically tied to project use types and the potential income to be generated over specific periods of time. This income level depends on many factors, including market conditions, construction type, construction costs, and competing properties. While market conditions will vary, the ability to quickly investigate development scenarios and understand their cost tradeoffs allows project teams to determine the best path forward.

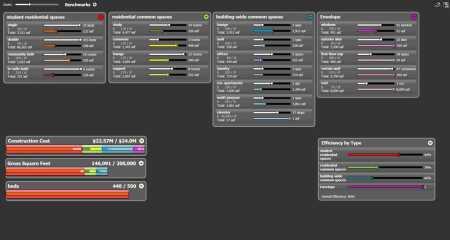

At Sasaki, the approach is a dashboard tool that allows us to adjust the mix of uses within any project—affecting everything from building use to interior design—in order to play out different scenarios and their effect on construction costs and rental income. This allows real-time tracking and insight into how building gross square footage and rentable square footage change as uses of office space change throughout the project. With input from a construction manager, we can assign costs to various construction types to illustrate how project costs vary with the design.

The numbers are important, but no more important than user experience. The tool also helps office clients develop a workplace strategy specifically reflective of their culture. We can rapidly understand the amount of space needed, whether it is to be open space versus closed space, “me” space versus “we” space, and the associated cost to achieve the right ratios among the choices.

Workplace strategy is too often associated with cost cutting and densifying space, but the goal actually is to create a vibrant workplace that reflects the company mission. This approach allows design teams to tailor ideas to fit the way a company wants to work in the future and to model the outcomes to arrive at solutions that suit the company’s strategy and budget.

Across the country, cities face a common challenge: many existing buildings do not suit the purposes they need to fill, and converting them can be difficult.

The growing popularity of coworking companies, which give tenants lease flexibility and robust amenities and services, is driving competition among building owners and managers. Building owners find it challenging to offer potential tenants their desired mix of amenities, retail options, and space uses in a fiscally responsible way, in part because the tradeoffs are complex.

In addition, existing buildings present the challenge of how to maintain existing value while changing the use to drive higher value or increase the structure’s relevance in the market over the long term. This is particularly true for office towers with minimal street-level retail, many of which were built before the mixed-use development trend hit in the 1990s. Owners grapple with how to increase the value of these older assets while making them relevant for today and in the future.

In Boston, Sasaki faces an added challenge. It is the hottest area of the country for biotech and lab space. With Kendall Square’s saturation, many companies are now turning to convert offices to labs in order to remain in this recognized science and tech center. These conversions are highly complex, requiring a deep understanding of infrastructure in order to make them successful both from a use and cost perspective.

With these pressures—of having to build out amenities to compete for tenants, convert use types, or build out labs—colliding in many real estate markets, a tradeoff dashboard laying out the cost of infrastructure upgrades can facilitate smarter investments throughout the development process.

For example, with labs typically requiring floor-to-floor heights of 13 to 15 feet (4 to 4.6 m) to accommodate required infrastructure, our dashboard can set these parameters to inform design decisions. When a building is being considered for lab buildout, the ability to adjust variables like grid size, ceiling height, floor plate size, number of backup generators, or additional ductwork leads to productive dialogue about what to prioritize and what to let go.

Visualizing Potential: Virtual and Augmented Realities

The maxim “seeing is believing” seems particularly apt in today’s highly visual culture. For decades, two-dimensional drawings and three-dimensional physical models were the primary tools to convey what a project would look like to design teams, clients, construction teams, and the public.

Today, VR and AR are emerging as a new paradigm for design. We can create truly immersive environments that provide the viewer with a realistic experience and real-time, in-situ exploration of a design. This shift from “looking in” to “looking around” to even “designing from within” is rippling through our practice in several ways.

Designers are always trying to connect the dimensions of a building to their experiential memory of what it feels like to be in a space of similar proportions. This approach generally works well, but it means even designers are sometimes surprised by what a building feels like when they enter it for the first time.

Bringing VR into the design process gives designers the ability to “preview” that immersive experience far earlier in the process, allowing them to make critical adjustments along the way to deliver on design intent and make important new discoveries that can transform a project. For example, on a recent chapel project, Sasaki designers were able to manipulate their designs to allow light to shine directly on the altar at specific times of day, a solution borne out of their many virtual “visits” into the space.

This immersive experience is becoming even more accessible with the emergence of lighter-weight, portable headsets. Sasaki can now do virtual “site tours” with clients and stakeholders at meetings.

This ability to share progress and ideas with clients without requiring the mental leap of interpreting a diagram or a drawing has been incredibly powerful for building confidence in a design strategy and excitement about projects. Moving beyond fully finished visualizations, it is now even possible to bring clients into a VR environment, allowing them to move elements around to show exactly what they envision.

Finally, as a project nears completion, we can use AR that superimposes elements onto the physical world through a phone or headset (think Pokemon GO). Bringing project designs onto a site, we can do walk-throughs with stakeholders to see how the space is coming together and do space planning on unfinished floors. This immersive experience removes confusion about design intent and builds shared understanding across the design team, clients, and other stakeholders.

Putting It into Practice

New technology and big data are becoming fixtures in design and real estate, and these tools will continue to evolve. Along the way, three lessons have come into focus for ways to integrate technology within current processes:

- Map tools to the process. At the very beginning of a project, map out the big questions and key decision points, looking for areas where big data or technology would be helpful. Before doing any data mining, we often start by asking ourselves, “What kind of information would help us understand this issue?”

- Think iteratively. Design, like many things, is not a linear process. Technology can do things very quickly that take humans a long time. Try to identify the opportunities to use technology on a project, particularly iterative tasks like test fits or tradeoff comparisons. These constitute opportunities to take back significant time by automating the activity, thus freeing up time for more design, strategic thinking, or other critical thinking work.

- Grow in phases. It is not necessary to go from an Excel spreadsheet to machine learning all at once. Technology can be introduced in stages, and often just getting familiar with good data sets or some simple tradeoff calculators is a valuable first step.

Good design and innovative real estate development will always be based on the same fundamentals. No amount of technology will change that. But technology and data can be powerful tools for amplifying the impact and value of good design and making decisions with a fuller picture of all the variables in play. This can only set the stage for better decisions that have real impact on the way we lead our lives on city streets and high above them shopping, dining, working, and living.

BRAD BARNETT, senior associate at Sasaki, is codirector of Sasaki Strategies, the company’s in-house team of designers, analysts, and software developers. ELIZABETH VON GOELER, director of workplace strategy at Sasaki, has more than 25 years of experience designing retail space, restaurants, multifamily housing, and workplaces as an interior designer.