Economy

The new ULI Real Estate Economic Forecast is taking a more bullish view on the U.S. economy—at least for the remainder of this year. As compared with the fall survey, key indicators such as gross domestic product (GDP) growth, jobs, and the Consumer Property Price Index (CPPI) all trended higher. But that boost may be short lived with growth tapering in 2019 and 2020.

At a recent event hosted by ULI Washington, panelists discussed how U.S. and Chinese companies are continuing to work together. After record levels of U.S. investment from China in 2016, new controls on capital outflow and investors’ changing attitudes have slowed inflows, while domestic development in China has also shifted.

Hines, which recently opened operations in Athens, offers its view of prospects for an economic recovery following nearly a decade of austerity.

Commercial real estate investors are keeping calm and carrying on, even though they are uncertain about what is coming next for fundamental elements affecting their business, such as the federal tax code and interest rate policy. “It makes it difficult to plan. . . . You don’t know what the federal budget is going to be. You don’t know what the Federal Reserve is going to be,” said Bowen H. “Buzz” McCoy, who participated in the 24th annual ULI/McCoy Symposium on Real Estate Finance, held in December in New York City.

Commercial real estate lending markets remained on the upswing in Q3 2017 with rising equity prices, limited volatility, and tightening spreads, according to the latest research from CBRE.

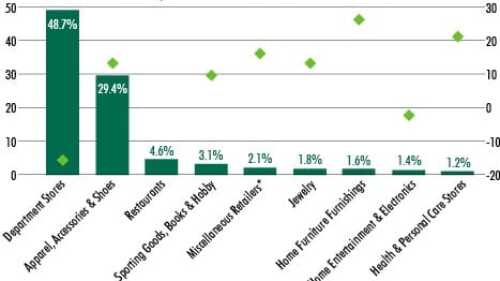

A new report from CBRE highlights that the two categories occupying the most space in U.S. malls—department stores at 48.7 percent of gross leasable area, and apparel, accessories, and shoes at 29.4 percent—also posted relatively tepid retail-sales growth from 2011 to 2016. In contrast, categories with stronger retail-sales growth, such as health care, still account for relatively little occupancy of U.S. malls

Brexit and the recent U.S. and French elections came up in many conversations at ULI Germany’s recent Urban Leader Summit in Frankfurt. Although panelists said they are concerned about the geopolitical changes afoot, the domestic German economy remains strong.

The latest survey of U.S. real estate economists showed a marked increase in expected economic measures, most likely due to federal proposals to reform the tax code, reduce regulatory burdens, and invest in infrastructure. Compared with the same survey from six months ago, real estate economists have higher expectations about gross domestic product (GDP) growth, employment growth, and housing starts.

Officials in West Palm Beach, Florida—located in a region that boasts some of the wealthiest residents in the world—have made strides in attracting leading financial firms, while also making significant investments in enhancing residents’ quality of life. At a ULI Southeast Florida event in March, local officials and real estate development experts outlined the city’s plan for attracting new companies to the region.

According to the latest forecast from the Joint Center for Housing Studies at Harvard University, spending on home improvements is projected to strengthen in the majority of America’s largest metro areas in 2017, with many markets in the East and Midwest expected to post double-digit annual growth. The residential remodeling market reached a record high of $340 billion in 2015—surpassing its previous peak in 2007—and is projected to increase 2 percent per year on average through 2025 after adjusting for inflation.