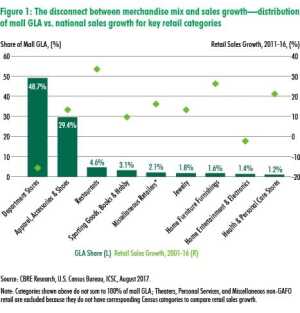

A new report from CBRE highlights that the two categories occupying the most space in U.S. malls—department stores at 48.7 percent of gross leasable area, and apparel, accessories, and shoes at 29.4 percent—also posted relatively tepid retail sales growth from 2011 to 2016.

In contrast, categories with stronger retail sales growth still account for relatively little occupancy of U.S. malls. That includes restaurants at only 4.6 percent of gross leasable area, sporting goods at 3.1 percent, home furnishings at 1.6 percent, and health and personal care stores at 1.2 percent.

“The American mall itself isn’t anywhere close to dead; it’s the old mall model that is dying,” says , CBRE Americas head of retail research. “Converting malls’ tenant bases to include more of the categories that in-person shoppers now favor won’t be an easy or quick fix. But it is a necessary evolution for the mall industry to maintain its place as a cornerstone of American retail.”

One challenge for mall owners is that most retailer leases in malls span ten or more years, and those pacts are challenging to revise or terminate early without the retailer’s consent. Another is that department-store chains often hold veto power over any significant changes proposed for their space or, in some cases, the mall in general. However, in both cases, struggling retailers are becoming more amenable to efforts to reposition the malls that house them.

“Going forward, we’ll see mall owners invest capital into placemaking and creating experiences for shoppers, which can include introducing more trendy, startup retailers in their malls,” says Todd Caruso, senior managing director leading CBRE’s retail investor business. “Studying the data underpinning a mall’s trade area, including consumer preferences, will help owners determine whether their strategies should include re-tenanting, redevelopment, or demolition.”