Economy

Zanny Minton Beddoes, editor in chief of the Economist, outlined several trends accelerated by the global COVID-19 pandemic in a presentation at the 2020 ULI Virtual Fall Meeting.

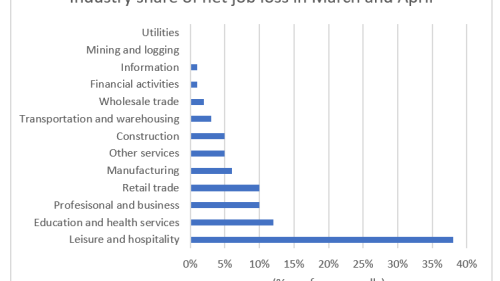

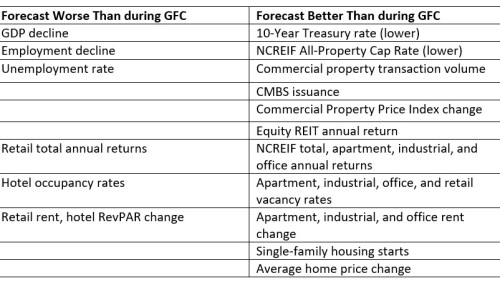

The ULI Center for Capital Markets and Real Estate’s latest semiannual consensus forecast of real estate and economic indicators anticipates a 5 percent decline in real gross domestic product (GDP) for this year, with increases of 3.6 percent and 3.2 percent in 2021 and 2022, respectively. The semiannual survey based on the median of the forecasts from 43 economists and analysts at 37 leading real estate organizations completed in late September through early October, also anticipates this year’s unemployment rate to be 8 percent, declining to 6.6 percent in 2021 and 5.5 percent the following year.

A recent webinar organized by ULI Japan helped envision this “new normal,” looking at the current state of the global economy to make predictions about the “post-pandemic world.” The online forum was moderated by Jon Tanaka, managing director and cohead of Japan Real Estate, Angelo Gordon, who was joined by Izumi Devalier, chief Japan economist, Bank of America Merrill Lynch.

The latest “Real Estate Economic Forecast,” produced by the ULI Center for Capital Markets and Real Estate, points to a U.S. economy that has likely already hit bottom, with growth resuming in the second half of the year that will soften some of the blow. Panelists on a ULI webinar said that this outlook comes with crossed fingers due to uncertainty related to the path of COVID-19 and the time it takes to develop an effective vaccine.

In a follow-up to Promoting Housing Affordability, a report released earlier this year, ULI Europe held a webinar to look further into the report’s recommendations and how the COVID-19 crisis will affect the delivery of affordable and intermediate housing.

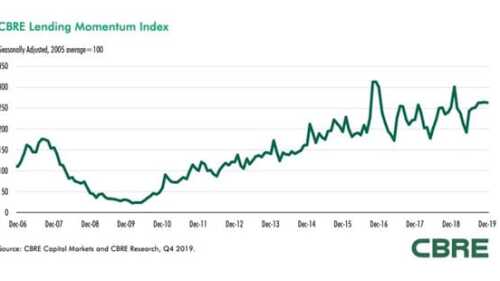

The U.S. Federal Reserve’s interest rate reductions, combined with continued economic growth, supported strong commercial real estate lending activity in the fourth quarter of 2019, according to the latest research from CBRE. The CBRE Lending Momentum Index, which tracks the pace of commercial loan closings in the United States, reached a value of 263 in December 2019—virtually unchanged from its third-quarter 2019 close and up 4.2 percent from a year earlier.

Nearly every speaker at the ULI Europe 2020 Conference in Amsterdam had something to say about one issue: climate change. The property industry is directly at risk from increasingly frequent extreme weather events, and stricter regulations are shaping the development and maintenance of properties.

Talk of a true urban “transformation” tends to carry more weight when it comes from a former police chief-turned-mayor speaking at a reinvented former trolley warehouse. The mayor of Tampa, Florida, Jane Castor, greeted attendees at a recent ULI Tampa Bay conference at the brick-walled Armature Works project.

How can public/private partnerships succeed in a politically fractious era?

Panelists talked about how the San Antonio region is faring versus other cities in Texas in attracting talented workers and corporate office tenants and where it can improve compared with cities of a similar size.