Summary

Buyer appetite for commercial property softened a bit, with prices just off their nearly four-year high. Cap rates fluctuated above recent lows and transaction volumes were down, although they remain above their long-term monthly average. The upward trajectory of permits and starts of all types of housing continues unabated, and prices for new single-family homes have returned to their peak. Economic indicators continue to reflect sustained moderate growth.

The top ten trends in this month’s Barometer:

- Employment growth continued at a relatively steady pace above the long-term monthly average. The unemployment rate remained at its lowest level in close to four years.

- GDP growth was revised upward and is now above the long-term quarterly average, retail sales were strong after adjusting for a drop in gasoline prices, the manufacturing sector expanded, and the value of private residential construction edged up.

- CMBS issuance remained above the long-term monthly average, and spreads tightened. The delinquency rate has paused in its retreat from July’s historic high.

- Commercial property prices softened slightly due to declines in non-major markets, according to one source, but remain close to four-year highs. Total REIT returns were positive, reversing three straight months of negative returns, and were positive in all sectors.

- Monthly cap rates continue to fluctuate but remain low at just 35 basis points above the low of mid-2007.

- Commercial property transaction volume was off from the previous month but has now exceeded the long-term monthly average for the seventh-straight month.

- Single-family and multifamily housing permits and starts continue to climb, reaching four-year highs. The inventory of new single-family homes, which had declined to a 50-year low during the summer, is now on the upswing, and sales increased.

- Sales of existing single-family homes increased, and inventory fell to an 11-year low.

- Prices of new homes have essentially returned to their pre-recession peak. Prices of existing homes remain significantly down from their peak but are in recovery mode—up 4 to 10 percent from one year ago, depending on the data source.

- Due primarily to an almost six-year low in foreclosure starts, total new foreclosure proceedings are down.

Overall, 72 percent of the key indicators in the Barometer have improved from the previous month’s Barometer; compared with a year ago, 86 percent have improved.

For details, click on the Economy, Capital Markets, Housing and Commercial/Multifamily tabs, above.

(For annual projections of key Barometer indicators, see the ULI Real Estate Consensus Forecast).

Economy

Monthly employment growth has now fluctuated between 132,000 and 192,000 jobs for a half year, remaining consistently above the 40-year monthly average. For December, unemployment remained at its lowest level in close to four years. Third-quarter GDP growth was revised upward, topping the long-term quarterly average. Consumer confidence fell sharply in early December, but retail sales were strong in November. The manufacturing sector expanded for the third time in four months. Private residential construction edged up, while private nonresidential construction slipped; private construction overall declined. S&P 500 returns were solid.

Net job growth in December of 155,000 jobs was made up of 168,000 new private sector jobs and the loss of 13,000 public sector jobs. Upward revision of November’s net job growth to 161,000 is also welcome news. However, the country has 4.0 million fewer jobs than it did almost five years ago. At December’s growth rate, it would take more than two years to regain just those jobs. The greatest private sector job gains in December were in health care, food services, construction, and manufacturing. The overallunemployment rate in December remained unchanged at 7.8 percent, below 8.0 percent for the fourth-straight month and for the fourth time since the beginning of 2009.

Third-quarter GDP growth was revised upward to 3.1 percent (from the previous third-quarter estimate of 2.7 percent) and is up substantially from 1.3 percent for the second quarter. According to the Bureau of Economic Analysis, this latest estimate has not greatly changed the general picture for the economy for the third quarter, except that personal consumption expenditures are now showing a modest pickup and imports are now showing a downturn. The increase in the third quarter primarily reflects contributions from personal consumption expenditures, federal government spending, residential fixed investment, and exports that were partly offset by declines in nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased.

The Consumer Confidence Index fell sharply from 71.5 in November to 65.1 in early December. Total retail sales in November were up 0.3 percent, driven by solid increases in electronics/appliances and building materials and motor vehicles offset by a substantial decrease in gasoline sales. Excluding gasoline sales, retail sales rose by 0.8 percent in November. Total retail sales of $412.4 billion are 3.7 percent higher than those of a year earlier, and 4.1 percent higher excluding gasoline. According to the U.S. Census Bureau, the effect of Hurricane Sandy on these numbers cannot be isolated, but indications are that the storm had both positive and negative effects on the retail sales data; this additional variation was not large enough to substantially affect the reliability of the published sales estimates.

The value of private construction slipped 0.3 percent in November, though it remains 13 percent higher than a year ago. Public construction put in place slipped 0.4 percent and is down almost 3 percent from a year earlier. November’s total construction value of $866.0 billion is down 29 percent from the prerecession high in March 2006, with private construction down 39 percent.

Inflation, as measured by the Consumer Price Index, was –0.3 percent in November. This decrease was due primarily to a 7.4 percent decline in the gasoline price index, which offset increases in most other categories. Besides gasoline, the only declines were in the indexes for apparel and used vehicles. Over the past 12 months, inflation was 1.8 percent, with increases in all categories except natural gas, used vehicles, and electricity.

Monthly returns for the S&P 500 were 0.9 percent in December, the historical monthly average, but year-over-year returns, at 16.0 percent, were above the historical yearly average.

The Purchasing Managers’ Index registered 50.7 in December, indicating expansion in the manufacturing sector for the third time in the past four months. November’s level of 49.5 in November had indicated contraction in this sector.

Real Estate Capital Markets

Commercial real estate prices softened slightly but remain close to four-year highs. Cap rates fluctuated but remain low at just 35 basis points above the bottom reached in mid-2007. Total transaction volume was off from the previous month but exceeded the long-term monthly average for the seventh-straight month. Total REIT returns were positive, reversing three straight months of negative returns. CMBS issuance remained above the long-term average and delinquencies were unchanged.

Capitalization rates, as reported by Real Capital Analytics (RCA), were 6.88 percent in November—up 5 basis points from October, continuing the slight fluctuations of the past three months. As reported in last month’s Barometer, NCREIF capitalization rates continued to compress in the third quarter, slipping from 5.96 percent in the second quarter of 2012 to 5.88 percent in the third quarter.

Commercial property sales volumes (excluding land and hotels) declined by 4.5 percent to $17.3 billion in November, according to RCA. Still, November is the seventh-straight month of sales volumes above the historic monthly average (since 2001). Transactions declined in the retail and industrial sectors and increased in the apartment and office sectors. Compared with a year earlier, transactions are up 42 percent, primarily because office transactions dipped in November 2011.

According to Real Capital Analytics, the ten most active sales markets in the past 12 months are, in descending order: Manhattan, Los Angeles, Chicago, Seattle, San Francisco, Houston, Dallas, Boston, Atlanta, and Denver. Over $6.28 billion in transactions have been recorded in each of these cities since December 1, 2011.

Moody’s/RCA Commercial Property Price Index was down 0.5 percent in October, as the 1.5 percent decline in the index for non-major markets more than offset the 0.6 percent increase in major markets. In September, the index was at its highest level since January 2009. (This is a same-property index based on all U.S. transactions exceeding $2.5 million.) Values are now down 22 percent from the December 2007 peak and are about 5 percent higher than a year ago.

The new value-weighted composite CoStar Commercial Repeat-Sale Index in October was down 0.8 percent from September, when it was at its highest level in almost four years. (The index is based on a repeat-sales methodology that tracks transactions exceeding $100,000 and includes land sales.) Values are down about 18 percent from the peak value in September 2007 but are 6 percent higher than a year ago.

As reported in last month’s Barometer, the NCREIF Property Index turned in a positive third quarter with total returns of 2.3 percent, sustaining the consistently positive returns for almost three years, but at a somewhat slowing growth rate over the past year. The capital appreciation component was 0.9 percent for the quarter, the lowest it has been since appreciation turned positive in mid-2010. Total 12-month returns are now 11.0 percent. Returns for the quarter by property sector were all between 2.1 and 2.4 percent.

Total equity REIT returns were 3.7 percent in December, reversing three straight months of negative returns. For individual core sectors, returns ranged from 7.1 and 6.7 percent for the industrial and lodging/resorts sectors, respectively, to 3.3 and 2.5 percent for the office and retail sectors, respectively. One-year total returns as of December stood at 18.1 percent, with one-year returns reaching 31 percent for the industrial sector and 26.7 percent for the retail sector. Lodging/resorts at 12.5 percent and apartments at 6.9 percent had the lowest one-year returns.

CMBS issuance during December, as of December 20, was $5.04 billion, according to Commercial Mortgage Alert. November’s issuance of $7.95 billion was the highest monthly volume since the end of 2007; December’s issuance remains above the long-term monthly average (since 1991). According to Trepp LLC, CMBS delinquency remained at 9.71 percent in December.

Bank real estate loan delinquency rates continued to fall in the third quarter. Commercial and multifamily mortgage delinquency rates are now 3.16 percent and 1.84 percent, respectively. The multifamily delinquency rate is now below the long-term historical average (since 1991). Construction and development loans have the highest delinquency rate at 9.54 percent, substantially above the quarterly historical average (since 1991) of 5.3 percent.

Housing

Prices of existing homes just barely shifted down in October after a series of monthly increases, according to a leading source of repeat sales data in 20 large cities. Another source of repeat sales data, tracking the entire country, reported that prices increased in October, recovering from a dip after months of increases. And according to a source of data on nationwide unpaired transactions, price increases in November were strong following a series of declines. Prices tracked by these three sources are now up 4.3 percent, 5.6 percent, and 10 percent, respectively, from one year ago. The inventory of existing homes for sale fell to an 11-year low, and despite concerns that low inventory discourages potential buyers, sales rose to a three-year high. For new single-family homes, prices were up and close to their pre-recession peak, sales rose, and inventory, which had reached the lowest level in 50 years during the summer, continued to grow. Permits and starts continue to climb, reaching four-year highs for both single-family and multifamily housing. Total new foreclosure proceedings were down, primarily due to an almost six-year low in foreclosure starts.

Existing single-family home prices declined, albeit just barely, according to the S&P/Case-Shiller Index (which tracks repeat sales in 20 cities), with a –0.06 percent shift. This follows six consecutive months of price increases, including two months with the highest growth rates since mid-2004; prices are now 4.3 percent above those of one year ago. But prices remain significantly lower—29 percent—than their peak in July 2006. The Federal Housing Finance Agency House Price Index (HPI) for existing single-family home prices (tracking repeat sales in the entire country) rose 0.27 percent, a rate just slightly higher than the long-term monthly average (since 1991). This increase follows declines in August and September and little growth in July. In contrast, growth rates in March, April, and May were the highest in 21 years. With these earlier increases and October’s growth, prices are now up 5.6 percent from a year ago. Still, the index is 15 percent lower than its peak in June 2007.

Existing single-family home prices (based on individual, unpaired transactions for the entire country), as tracked by the National Association of Realtors (NAR), increased a healthy 2 percent after four straight months of decline. Still, the pattern of the past five months is in marked contrast with the substantial increases for March through June, which accounted for the longest sustained period of strong price growth in more than 40 years—totaling a whopping 21 percent. The median price for existing single-family homes stood at $180,600 in November. With the earlier months of high growth and November’s growth, prices are now 10 percent higher than one year ago, but still 19 percent below the peak in 2006.

New single-family home prices were up a strong 3.7 percent in November, after a dip in October. November’s median price of $246,200 is up almost 15 percent from November 2011 and off less than 1 percent from the 2007 peak.

Single-family building permits were up 3 percent in November (an annual rate based on a three-month moving average) to 560,000. The number of permits has steadily increased each of the past 19 months and is at its highest level in more than four years (since September 2008). Still, November’s permit numbers are almost 70 percent below the prerecession high witnessed in November 2005 and 41 percent below the long-term monthly average (since 1970). Single-family housing starts increased almost 2 percent in November (on a three-month moving average) to 581,000 and are now at their highest level in four years (since October 2008); starts are 67 percent below the prerecession high in November 2005.

Sales of new single-family homes (seasonally adjusted) rose 4.4 percent to 377,000 in November after a dip in October. Sales have remained between 360,000 and 377,000 over the last seven months, the longest sustained period of sales of 360,000 or more in three years (May to November 2009). Sales are now up 15 percent over October 2011. Still, monthly sales volumes are 73 percent below the prerecession high in July 2005. Inventory increased for the third-straight month, reversing five years of monthly declines. The multiyear decline had brought inventory in July and August to the lowest monthly level since record keeping began in 1963.

Sales of existing single-family homes (seasonally adjusted) rose by almost 5.5 percent in November to 4.4 million, 12 percent higher than those of a year earlier and the highest monthly level since November 2009. November’s monthly sales were 30 percent below the prerecession high in September 2005. Inventory declined by 3 percent to 1.80 million, a low not seen since 2001. The forward-looking NAR Index of Pending Sales (of existing single-family homes, condominiums, and co-ops) moved up 2 percent to 106.4, the highest point since April 2010, when the first-time homebuyer credit expired.

Multifamily building permits rose 5 percent to 299,000 in November (based on a three-month moving average), the highest level since August 2008. Multifamily housing starts were up a substantial 11 percent in November to 270,000, the fourth-straight month of strong growth. Monthly starts have increased a whopping 34 percent over the past four months and are now at their highest monthly level since September 2008.

The rent index for apartments, calculated quarterly by CBRE and reported in last month’s Barometer, was up 1.0 percent in the third quarter of 2012 to $1,310, which is 4.8 percent higher than a year earlier. Apartment vacancy rates, reported quarterly by CBRE, dropped to 4.5 percent in the third quarter of 2012, continuing an almost three-year slide.

Existing condo sales reached 600,000 in November, a 9 percent jump from October. This is up 33 percent over November 2011 and 22 percent above the long-term monthly average (since 1989). Inventory declined by 10 percent in November and remains substantially lower than one year ago—23 percent—and off 37 percent from the long-term monthly average; supply declined from 5.5 months to 4.5 months.

New foreclosure filings—default notices, scheduled auctions, and bank repossessions—decreased 3 percent in November to a total of 180,817, according to RealtyTrac, almost returning to September’s five-year low. RealtyTrac noted: “The drop in overall foreclosure activity in November was caused largely by [an almost six-year] low in foreclosure starts for the month. [But] we’re likely not completely out of the woods when it comes to foreclosure starts as lenders are still adjusting to new foreclosure ground rules set forth in the National Mortgage Settlement along with various state laws and court rulings.”

Home mortgage rates (30-year fixed) remained unchanged in December at 3.35 percent, the lowest monthly rate since record keeping began in 1971.

Commercial/Multifamily

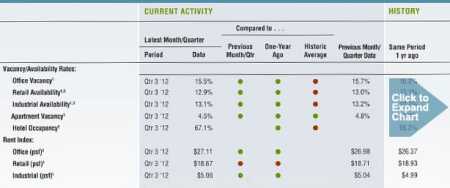

The apartment sector continues on a vigorous track, with already low vacancy rates dropping further and rents climbing to new all-time highs; with completions at a three-year high, the pace of these improvements may soon be tempered. Office and industrial fundamentals continue to improve in the third quarter, albeit very slowly, as vacancy rates creep down, rents creep up, and both are assisted by extremely low completion levels. Retail fundamentals show one small sign of relative improvement as availability rates dipped below 13 percent, but rents continue their 4.5-year decline; completions are at a fraction of the historical monthly average for this sector. Both hotel occupancy rates and RevPAR showed healthy improvement from a year earlier.

Office vacancy rates are down to 15.5 percent in the third quarter of 2012 from 15.7 percent in the second quarter, according to CBRE. The last two years have been marked by slow declines in vacancy rates interspersed by plateaus. Rents crept up 0.5 percent in the third quarter, the seventh-straight quarter of rent growth, and are up 2.8 percent from a year earlier. Net absorption was 8.5 million square feet (789,676 sq m), about 75 percent of the long-term average (since 1988), while completions remain low at 12 percent of the long-term average (since 1980).

Retail availability rates barely changed, down from 13.0 percent in the second quarter to 12.9 percent in the third quarter, according to CBRE; still, this is the third-straight month of decline (albeit slow) and the first time in almost three years below 13.0 percent. Rents continued their 4.5-year slide in the third quarter and are off 1.4 percent from a year earlier. Net absorption was 2.8 million square feet (260,178 sq m), about one-third of the long-term average (since 1989); completions stood at less than 10 percent of the long-term average (since 1980).

Industrial availability rates barely changed, notching down from 13.2 percent in the second quarter to 13.1 in the third quarter, but continued their slow eight-quarter decline; rates are now down 60 basis points from the same quarter a year earlier. Rents edged up for the third-straight quarter but are still barely above the 14-year low reached in the last quarter of 2011. Net absorption was strong at 21.65 million square feet (2.01 million sq m), close to 70 percent of the long-term average (since 1980); completions stood at about 20 percent of the long-term average (since 1980).

Apartment vacancy rates dropped to 4.5 percent in the third quarter of 2012, continuing an almost three-year slide. Rents were up 1.0 percent in the third quarter and are 4.8 percent higher than a year earlier. Absorption remained high at 170 percent of the long-term average (since 1994). Completions in the third quarter were fairly steady at 35,095 units, after a sharp jump to a three-year high in the second quarter. Completions are at 83 percent of the long-term average (since 1994).

Hotel occupancy rates stood at 67.1 percent in the third quarter of 2012, up from 66.3 percent in the same quarter a year earlier, according to Smith Travel Research, while the RevPAR Index was up 5.2 percent from a year earlier.

(This section draws from third-quarter data which was first presented in last month’s Barometer).