If a community articulated what it stood for, what it believed in, what it aspired to be—as a city, as a neighborhood—would it have a better chance of creating and sustaining more healthy, vibrant place with positive, economic, health, civic, cultural and environmental conditions? Imagine that the issues of race, income, education and unemployment inequality, and the resulting segregation, isolation and fear, could be addressed by planning and designing for greater access, agency, ownership, beauty, diversity or empowerment. — Design for the Just City

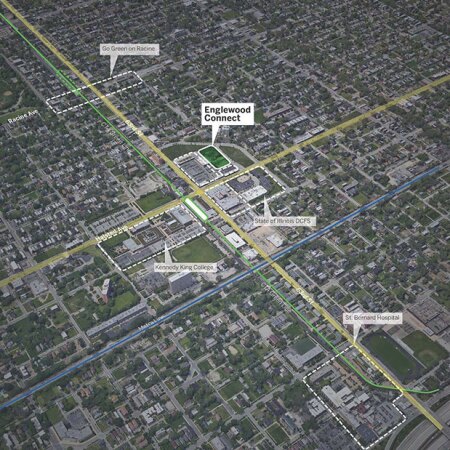

Englewood Connect is a three-phase plan, comprised of just under 40,000 square feet (3,716 sq m) of commercial and business incubator programming. The scope includes a restored firehouse repositioned as a culinary center, hoop houses for year-round community gardens, the Englewood Livingroom community space, a flexible open-air market, and small business incubators. (SOM)

At the 2021 ULI Fall Meeting, the Redevelopment and Reuse Product Council hosted a panel discussion of Englewood Connect on Chicago’s South Side. Chicago’s Invest South/West initiative is focused on ten underrepresented neighborhoods Mayor Lori Lightfoot has targeted for public/private investment in once thriving pedestrian and commercial city cores. One of those neighborhoods, Englewood is a 95 percent Black community with a median per capita annual income is just under $15,000 compared to the citywide average of just over $37,000. Panelists included Zeb McLaurin, president of McLaurin Development Partners, chef and local entrepreneur David Blackmon, and project designer Dawveed Scully, associate principal and senior urban designer at SOM Chicago.

The Invest South/West corridor improvement Initiative focuses public and private resources on ten communities, including Englewood. Launched in 2019, the initiative includes $750 million in public funding, of which $524 million has been released to date. That $524 million has garnered an additional $575 million in private and philanthropic partnership. Public investment has included enhancements to 50 park district properties, improvements to streetscape, expansion of transportation options and public art installations. Priorities for Invest South/West included creating places with high quality design, promoting the arts and a community driven development process.

Englewood Connect is a three-phase plan, comprised of just under 40,000 square feet (3,716 sq m) of commercial and business incubator programming. The scope includes a restored firehouse repositioned as a culinary center, hoop houses for year-round community gardens, the Englewood Livingroom community space, a flexible open-air market, and small business incubators. The project creates an ecosystem for upward economic mobility, focused on food, in a historically Black neighborhood on Chicago’s South Side.

The program was developed in partnership with neighborhood leaders such as Blackmon, with the intent of providing an entrepreneurial response to a community established need for fresh food. Proposed uses include a commercial kitchen, food hub and retail consumption space, education and training for small businesses and restaurants, urban agriculture hoops and a community commons. Early estimates by the development team show the creation of more than one hundred construction jobs, as well as between 38-47 full time onsite employees for the businesses established.

As part of Lightwood’s Invest South/West initiative, the project addresses an economic and social reality of the last thirty plus years in Chicago: a decline in the city’s black population. Between 1980 and 2016, Black residents have decreased by 350,000. Englewood specifically experienced a drop of 34,326 residents, a 59 percent decrease and blow to the local tax base. A study by the University of Illiniois, Chicago’s Institute for Research on Race and Public Policy examined these trends in a report, Between the Great Migration and Growing Exodus: The Future of Black Chicagoans. Social inequities, including unemployment, lack of services, high cost of living and violence, were all cited as potential factors. Englewood ranked fifthth of the 77 ranked Chicago neighborhoods in a hardship index at 68.9 out of 100, compared to 11.1 and 8.6 at Lincoln Yards or the Loop respectively.

Invest South/West funds were awarded by a competitive request for proposal (RFP) process. Priorities in the RFP intrinsic to the Englewood Connect proposal include a contribution to neighborhood wealth building and diversity, space for community input in the programming and evaluation process, and partnership with local Chicago development and design firms. First phases of the project with the adaptive reuse of a historic firehouse are estimated at $10.3 million in public and private investment. Goals identified in the Englewood Quality of Life Plan are central to Englewood Connect’s vision, including collaboration with local community, economic development and business growth, and revitalization of existing assets.

More broadly, a focus on entrepreneurial small business growth in Englewood is a development model that speaks to sustainable community wealth building. A report by the Kellogg Foundation estimates an $8 trillion gain by 2050 through closing the racial equity gap. By that time, more than half of U.S. consumers and workers will be people of color. With the stability wealth building provides in a community comes opportunity for post-secondary and advanced education. The Center for American Progress estimates a $2.3 trillion boost to the 2050 economy if Black and Latino children achieved educational parity with white children. The role that small business creation plays in Englewood Connect has long term benefits that far exceed the immediate return on investment and was sustainably developed in partnership with the local community.

However, focus on near term gains and limited sources of funding remain one of the largest barriers to community focused development projects like Englewood Connect. According to a McKinsey report on the state of Black businesses, “black entrepreneurs are three times as likely as white entrepreneurs to say that a lack of access to capital negatively affects their business’ profitability and almost twice as likely to cite the cost of capital.” The same study reports that Black entrepreneurs are less likely to have access to information or a network that can help support their businesses.

Englewood Connect provides such opportunities through training, retail and business networking spaces offered through a local neighborhood-based incubator. A partnership between the city, private development, and local community leaders made way for a sustainable project in line with the city’s revitalization efforts and the community’s 2016 Quality of Life Plan. For all of the reasons outlined in this article,revitalization through partnership and sustainable entrepreneurial opportunities is just good business sense. Additionally, the same entrepreneurial challenges facing community residents are facing community developers of color like McLaurin. Part of the success of such projects is ensuring that developers like McLaurin are supported in their work.

Last year, ULI Building Healthy Places Initiative published The Case for Social Equity in Real Estate. In that report, one of the roadblocks identified to projects like Englewood Connect was a lack of market-based funding mechanisms for social equity work. The fact that social equity is tied to economic growth has yet to be clearly quantified. There is a need for new metrics by which to assess risk and financial modelling, inclusive of more long term social and financial benefits.

The beginning of these metrics exists in evaluation systems such as LEED ND, LEED Cities and Communities, BREEAM, WELL Building, Just City Index, and the U.N. Sustainable Development Goals- amongst others. Social metrics, spearheaded in part by green building metrics, could lead to federal revenue streams similar to the U.S. EPA’s Green Infrastructure Funding. The private sector can take a lead in developing new equity based financial models. However, the understanding of equity as a philanthropic pursuit as opposed to an investment opportunity offering real returns needs to be challenged.

According to a McKinsey study on Inclusion and Diversity, companies in the top quartile of ethnic and cultural diversity outperformed their counterparts by 36 percent in 2019, up 3 percent from 2017. While a relatively small change, it is statistically significant. Interestingly, while sentiment on diversity of race and ethnicity was positive amongst survey respondents at 52 percent, sentiment on inclusion was the opposite at 29 percent. This suggests a gap between an intention for diversity and the action of inclusion, with an associated cost of underperformance through untapped markets. Similarly, an article in Harvard Business Review showed firms with both acquired and inherent diversity were forecasted as 45 percent likelier to report a growth in market share over the previous year, and 70 percent likelier to report that the firm captured a new market.

Increasingly, studies are indicating that diversity in executive and board leadership role are tied to financial growth. Diversity of thought, experience, and familiarity with different markets expand opportunities in private sector ventures. The same principle can be applied to our own agendas at Council meetings and beyond. The story of Englewood Connect brings the value of diverse project types, and teams, to the ULI discourse. As a case study, the project brings to light that social equity and economic growth are directly related and both relevant in our dialogue around development.

Englewood Connect illustrates the success of municipal initiatives like Invest South/West in catalyzing private development rooted in community collaboration. Municipal incentives spark local private development, programmed in partnership with community residents. The issue of social equity in real estate seems enormous in the broad view. The goal of community inclusion in Englewood Connect can be scaled up to our larger real estate community within ULI’s membership. Perhaps part of the path forward is recognizing that equity is synonymous with growth, and that growth is achieved one project at a time. Let’s make room at the table for these new opportunities and together come to solutions on how to close the equity gap.