This new feature from the ULI Center for Capital Markets and Real Estate showcases how developers bring together financing for small but high-impact developments.

Sun Crest Heights is a 44-unit complex of two three-story structures built in 1972 in Capitol Heights, Maryland, just east of Washington, D.C. The area became suburbanized in the 1960s but saw substantial disinvestment and blight starting in the 1980s.

Developer Chris VanArsdale of VNV Development had heard about a local loan fund to stabilize class B apartments in Maryland. A broker suggested the Sun Crest property, pointing to its high occupancy and close-in location.

The former Crest Apartments turned out to have a lot hidden under the hood. “There was a drug and gun operation being run out of the building that was concealed from us during due diligence,”

VanArsdale says. It took police and what VanArsdale termed a “heroic” property manager months to clear that operation, which involved emptying half the apartments. That required “a value-add strategy,” he says. “By just shifting interior walls, we could increase the number of bedrooms per unit,” as well as the project’s net income potential. That work exceeded the initial project scope, requiring a second round of funding.

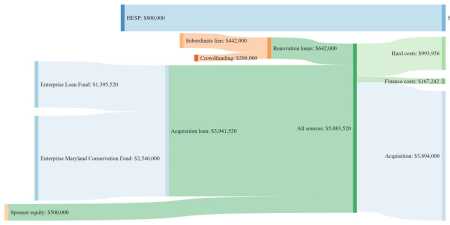

Development Finance

The initial acquisition was financed by Enterprise Community Partners, a national nonprofit community development group launched in 1982 by the late developer and longtime ULI supporter James Rouse.

Enterprise launched a new loan product in 2015, capitalized by the state of Maryland, to preserve rental housing in low-income census tracts. By aggregating its zero-interest loans with existing products, Enterprise could use competitively priced acquisition loans to put affordability covenants on properties.

Monica Warren-Jones, director of capital solutions for Enterprise’s Mid-Atlantic market, said her firm found promise in “a partner who was vested in the deal and in giving residents better living circumstances. . . . We had really excellent communication with the borrower, who was very forthright about the tenancy issues,” which helped Enterprise understand the need to extend the loan’s term.

Solar Power

The solar array was installed by Oakland, California–based GRID Alternatives but is owned by a third-party solar investor. That investor receives tax credits, renewable energy certificates (RECs, proof of renewable energy generation), and a contract to sell electricity to the apartments. Investors prefer larger deals with higher incomes, so GRID expanded the array onto a new carport and secured a determination that the RECs could be sold into the valuable Washington, D.C., market. The larger array helps the development achieve near net-zero energy use.

Renovation

When the project turned out to be substantially more complicated than expected, VanArsdale turned to two mission-driven for-profit lenders. The first was City First Enterprises, an affiliate of a Washington commercial bank incorporated as a benefit corporation, or “B Corp,” which he knew from a previous deal.

For a junior renovation loan, VanArsdale compared crowdfunding platforms and decided on Small Change, which differentiates itself by appealing to social impact investors. Founder Eve Picker says Sun Crest attracted Small Change’s attention because it is “in an appreciating market while allowing people of modest means to take advantage of solid, updated housing.”

Observations

“The best outcome was [the project’s] transformative impact on the community,” says VanArsdale. Lenders like Enterprise understand the unpredictability of community development and are willing to work with sponsors who clearly communicate what is going on and how they intend to address it.

Debt was a useful tool to get affordability covenants onto the property, but affordable properties have limited capacity to service debt. Warren-Jones notes that more- patient, “equity-style capital would allow us to have some involvement and stay in the project.” For instance, both Enterprise and Maryland have been very active in outreach around Opportunity Zones.

PAYTON CHUNG is a director in ULI’s Center for Capital Markets and Real Estate. To share your own story, visit Navigator.