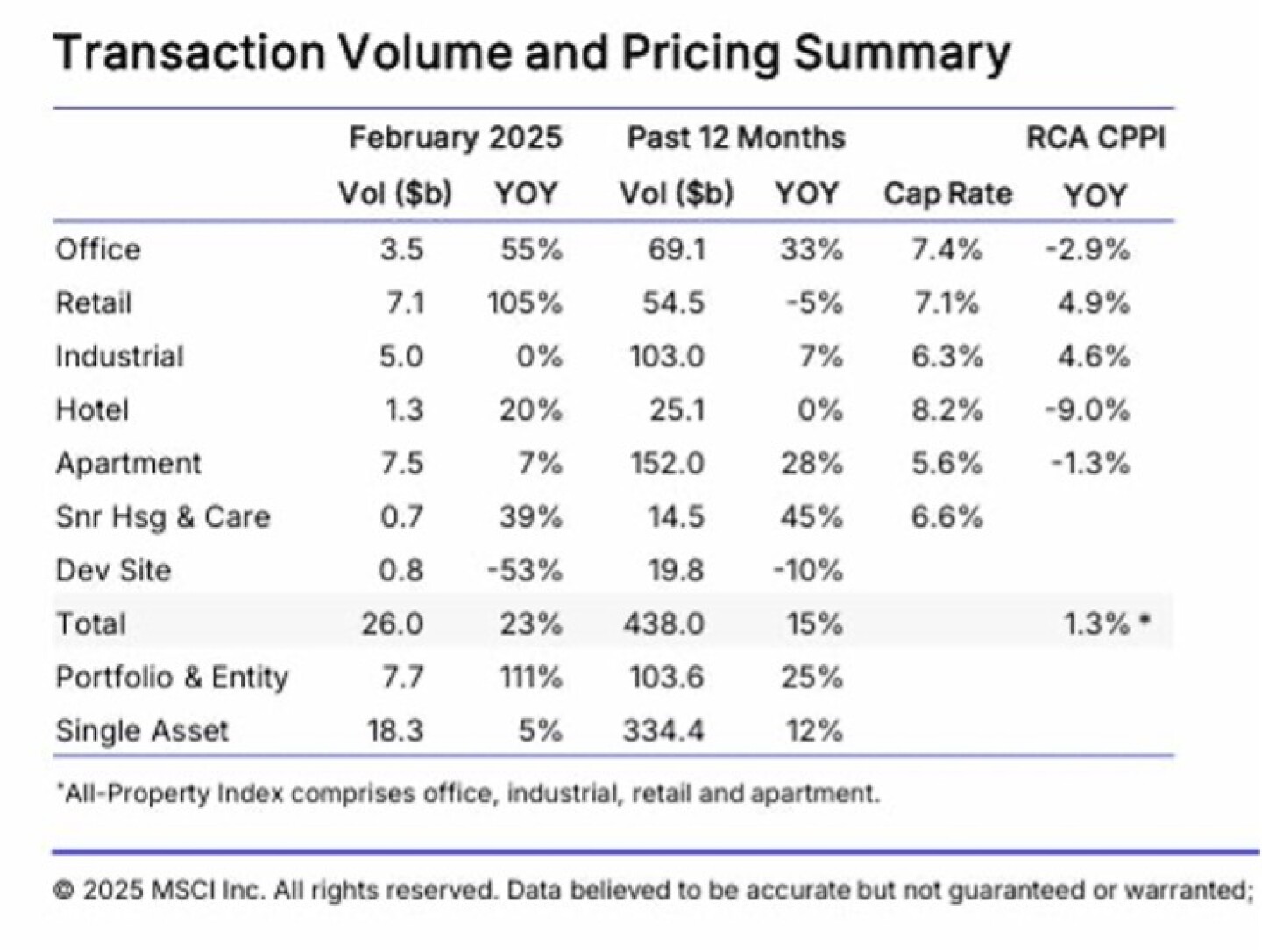

Deal-making has lately proved to be tough sledding for the commercial real estate industry. Although 2024 brought a welcome rise off the bottom in year-over-year sales, total sales still came in at the second-lowest level since 2013. The latest data from MSCI Real Assets shows $438 trillion in 12-month trailing sales volume through February, a 15 percent increase on a year-over-year basis.

Urban Land: Clearly, there are still a number of challenges standing in the way of regaining momentum in commercial real estate sales activity. Where do you see “green shoots” in the commercial real estate investment market in 2025, and why?

John Chang, senior vice president and national director of research services at Marcus & Millichap Real Estate Investment Services

The commercial real estate investment market will likely operate in a tumultuous macroeconomic and financial climate through much of 2025. The introduction of the highest tariffs in over 100 years put Wall Street into a tailspin and drove the 10-year Treasury below 4 percent. At the same time, the economic uncertainty index has increased to its highest level since the start of the pandemic, and the risk of rising inflation and an impending recession have escalated markedly. Against this backdrop, commercial real estate assets may become an increasingly appealing investment alternative.

The durability of commercial real estate cash flows, even during mild to moderate recession cycles, and the sector’s ability to pace inflation positions the asset class to outperform other investment options. Although lenders may increase their safety spreads over the underlying benchmark interest rate indexes, like the 10-year Treasury, the lower cost of debt capital may spur commercial real estate transaction activity. Traditionally, hard assets like commercial real estate have proven to be one of the favored “safe haven” investment options in times of economic and financial market volatility, and as Wall Street grapples with a broad revaluation in the wake of the introduction of tariffs, capital flows into commercial real estate could drive increased transactional velocity.

Nadia Evangelou, senior economist and director of real estate research at the National Association of REALTORS®

Multifamily housing remains one of the brightest spots. This sector is benefiting from a unique combination of strong, sustained rental demand and a slowdown in new construction. The construction boom of the past few years is tapering off, which will help to stabilize rents and strengthen fundamentals. Thus, I expect this sector to continue attracting investor interest throughout the year.

However, the improvement extends beyond multifamily housing. Even the office sector—which has faced the greatest challenges—is showing early signs of improvement. In fact, office, industrial, and retail space all saw increases in transaction volume over the past year. These gains suggest that investor confidence is gradually returning across more sectors.

Chad Littell, national director of U.S. capital markets analytics at CoStar Group

Identifying a turning point in the commercial real estate cycle can be challenging, particularly if one becomes overly fixated on individual metrics or swayed by conflicting narratives. A more insightful approach comes from economist Lakshman Achuthan, who, in his book Beating the Business Cycle, lays out three essential qualities to recognize cyclical turning points—what he calls “the three P’s”: pronounced, pervasive, and persistent. Let’s explore how these concepts apply to today’s commercial real estate transaction volume.

First, has the shift been pronounced? In other words, have we observed a substantial, meaningful increase in transaction activity—not merely a slight blip triggered by isolated large deals but a clear, market-wide uptick? Indeed, we have. Transaction volume in 2024 rose 16 percent above 2023 levels, despite early-year recession concerns slowing initial momentum. A more recent and compelling indicator—the year-over-year comparison of Q1 2025 to Q1 2024—reveals even stronger evidence. Across the five major property types, transaction volume surged nearly 40 percent. Office transactions spiked by 80 percent, hospitality jumped 52 percent, multifamily rose 46 percent, industrial increased 37 percent, and retail grew 18 percent. Clearly, this constitutes a pronounced change.

Second, is this uptick pervasive—is it broadly based, affecting multiple property sectors, geographic markets, and transaction sizes? Undoubtedly, yes. The recovery we’ve observed isn’t isolated; it’s extensive and multidimensional. Deal activity expanded across property types, dollar volumes, deal counts, markets, and nearly all price points. This widespread lift underscores the pervasive nature of the trend.

Finally, we evaluate persistence. Was this improvement limited to a single quarter, or have we consistently seen continued momentum building over time? Persistence has been clearly demonstrated since transaction volumes reached their low point in February 2024. Each subsequent quarter through the end of 2024 [brought] steady sequential improvements, culminating in a brisk Q4. Importantly, this strength carried forward strongly into Q1 2025, as outlined above, solidifying the notion of a sustained recovery rather than a fleeting head fake.

Applying Achuthan’s three P’s provides a clear and increasingly confident conclusion: the current uptrend in commercial real estate sales volume is unmistakably pronounced, pervasive, and persistent. While challenges undoubtedly remain on the horizon, history consistently teaches us that the market rarely provides an explicit “all clear” before embarking on its next move.

Adrienne Ortyl, director of research at AEW Capital Management

Real estate values appear to be at a cyclical bottom, giving buyers and sellers more confidence in pricing metrics, with sellers finally adjusting expectations to current market conditions and closing the bid/ask spread. Additionally, the broader U.S. economy remains in reasonably good shape, while property market fundamentals are expected to be positive, with the exception of office. Furthermore, debt markets appear to be opening up with credit demand picking up and credit conditions improving modestly. Spreads have narrowed slightly, [loan-to-value ratios] have expanded, and all in fixed rates are down roughly 50 [basis points] from a year earlier.

Meanwhile, construction financing is once again available, although limited to high quality deals and top tier sponsorship. Finally, lenders, which generally “kicked the can down the road” with respect to maturing loans in 2024, are moving to clear their books with short sales, deed-in-lieu, and workouts picking up. Against this backdrop, recent bidding processes for deals on the market have been active with multiple offers and strong competition for assets, particularly high-quality, well-located product. These factors should help unlock the transaction market and, hopefully, build greater deal momentum for 2025.

Kiran Raichura, chief commercial real estate economist at Capital Economics in London

Our expectation of only a slow recovery in investment volumes over the next year or so is underpinned by our forecasts for both risk-free and borrowing rates not approaching previous lows. But there are some parts of the market that are well-placed to outperform over the next few years.

After nearly a decade of struggles, and despite already seeing good relative performance in the last couple of years, retail remains our top sector pick over a five-year horizon across both the U.S. and U.K. Rents have rebased, asset owners have got to grips with the demands of the modern consumer and, importantly, the sector now offers attractive yields for well-leased, well-managed assets.

We also continue to project solid returns for multifamily assets across both the U.S. and U.K., although the sector stands out less positively in mainland Europe. The for-rent residential market continues to have a strong structural story, with demand outweighing supply, something that is being reinforced by the new higher level of interest rates, keeping renting much more attractive than home purchase in most markets.

On a market basis, we expect Iberia to continue to perform well within western Europe, driven by a decent economic backdrop. Meanwhile, in the U.S., we think Miami—and the wider South Florida area—has the best prospects amongst large office markets. Houston and Phoenix are the standouts in the multifamily sector and also offer decent prospects in offices.

Joe Biasi, head of research, commercial capital markets at Newmark

The last few years have been challenging for commercial real estate activity for a number of reasons, though the interest rate environment tops the list. There is never certainty about interest rates, but the market sees the probability of the Fed rate cuts [as being] much higher than the probability of hikes, and that is conducive to activity picking up as longer term rates move lower. The market already saw the impact of lower rates last fall, when both the 5-year and 10-year treasury rates were in the mid-3s, leading to total volume in the fourth quarter reaching a 2-year high.

We have heard for years that there is plenty of capital on the sideline waiting to be invested, and the number of bids has increased more recently. High demand would typically mean more aggressive pricing, but a higher-than-before interest rate environment puts a ceiling on how aggressive a buyer can reasonably be. Yields on performing assets have increased, but, outside of office, spreads to debt benchmarks like treasury yields remain tight, compared to history. While some buyers have been willing to take on negative leverage and underwrite strong fundamentals to make the asset cash flowing, most have not.

What has really gummed up the market is the release valve for transaction flow in an increasing rate environment. Distressed sales have been slowed by accommodating lenders who have been willing to extend loans and work with borrowers instead of forcing sales when the loan comes up for maturity. During the Great Recession, clearing out distress was an important step in getting markets moving again, as it pushed nonperforming assets to rework and revitalize its capital stack. Delaying forced sales not only means less deals on the market, but it also diminishes price discovery and adds to pricing uncertainty, exacerbating the already wide bid-ask spread seen in many commercial real estate markets. Ironically, there is an abundant supply of debt, particularly from private lenders and life insurance companies, who have been eager to fill the gap left by banks.

So far in 2025, there has been a concerted push from lenders to find a more permanent solution on troubled debt, and investors are looking to recycle capital on assets past their hold periods. Economic uncertainty remains a challenge, but it’s hard to remember when uncertainty wasn’t an issue, and [that] seems unlikely to change in the near future. In this environment, after two years of sluggish activity, comps will beget comps, and a convincing decline in interest rates, as markets have seen over the last few months, will help accelerate the process.

Related Resources: