Topics

Capital Markets and Finance

Thirty-eight states have passed legislation authorizing Commercial Property Assessed Clean Energy (C-PACE) financing to date. While C-PACE has been around for more than 20 years, the COVID-19 pandemic has accelerated its adoption.

Equity crowdfunding has emerged in recent years as a viable alternative to more traditional means of raising capital while also allowing members of the community to have a stake in the development. But it can also be used as a tool to generate wealth primarily for people from excluded and marginalized communities and groups, said panelists speaking at the 2022 ULI Spring Meeting.

While much of the focus on U.S. industrial is on large, single-tenant facilities, with big names like Amazon taking whole facilities. But multi-tenant industrial may offer diversification and risk reduction while helping small manufacturing firms grow over time. BKM Capital Partners spoke with Urban Land

Design & Planning

After another exciting FIFA World Cup, many people in Atlanta will be keeping a close eye on the festivities when the tournament comes to North America in 2026. A program called StationSoccer hopes to bring new training facilities to 10 transit nodes across the city by kickoff.

In the last year, the state’s government has taken robust legislative steps toward stemming the housing crisis.

Toronto’s deep-lake water cooling system stands as an example of the “third wave” of urban energy.

Development and Construction

Developers and buyers create new models for housing that hold the promise of a more environmentally friendly, connected, and multigenerational way of living.

A member of ULI Toronto describes the redevelopment of the Downsview Airport lands, representing an unprecedented opportunity: the chance to create a “city within a city,” a globally recognized, mixed-use urban community in the heart of one of the most vibrant and diverse metropolitan areas in North America.

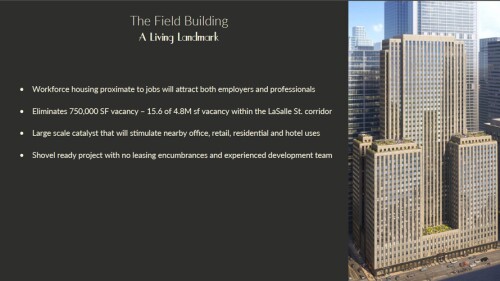

When the Field Building on Chicago’s LaSalle Street opened in 1932, it was a technological and architectural marvel, with high-speed elevators, drinking fountains, and even air-conditioning, a first for the city. Nearly a century later, the 1.3-million-square-foot (120,774 sq m) Art Deco landmark is a pioneer of a different sort.

Resilience and Sustainability

The implications of climate change are becoming hard to ignore. The frequency of natural disasters has increased significantly in recent years, with the United States experiencing an average cost of $18 billion–plus from climate disasters per year. As these kinds of events have grown more common, calculating climate risk has become a hugely important task for commercial property owners. The topic was the main theme during a panel discussion at the April 2024 Resilience Summit in New York City.

Eight years ago, the landmark Paris Agreement kicked off a worldwide campaign to reduce carbon emissions. The targets set were big: slash emissions by 45 percent by 2030 and be net zero by 2050. So far, the world is not making enough progress on those lofty goals, and the progress that has been made has been very unevenly distributed. Experts from major real estate firms, including Boston Properties, CBRE, and Community Preservation Corporation, drove home the net zero transition’s importance during a panel discussion at the 2024 ULI Spring Meeting in New York City. They talked about the costs of getting to net zero, what lenders and owners are doing to get there, and the risk of not addressing climate change.

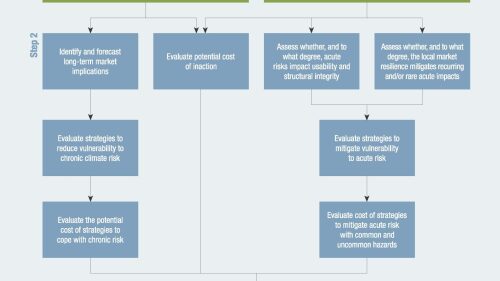

A new global report from ULI and LaSalle Investment Management (LaSalle), a leading real estate investment management firm, offers a new framework to help the real estate industry act on climate risk disclosure data. Across the real estate industry, practitioners understand physical climate risk to assets and portfolios poses a financial risk, but there are still many challenges to acting on the data being collected and disclosed.

Issues and Trends

Are sites like AirBNB.com to blame for higher rents in cities? Some analysis indicates that home sharing has the potential to make urban housing more affordable for more families.

According to multifamily industry leaders who spoke at the recent ULI Washington Real Estate Trends Conference, the multifamily housing market in Washington, D.C., and other top markets is so rich with investment opportunity that “there are no bad strategies right now.” Read what types of multifamily communities and developments the panel said are achieving market acceptance at present.