Across all international markets, building owners are increasing energy efficiency investments and deploying new technologies in order to save money, improve their public image, and capture government incentives, according to a new global survey of real estate decision makers conducted jointly by ULI and Johnson Controls. While interest in achieving energy savings targets is common to all markets, the survey respondents cite multiple barriers that remain in the path of a scaled-up building retrofit marketplace.

The 2011 Energy Efficiency Indicator (EEI) is the fifth annual survey of global executives and building owners responsible for energy management and investment decisions in commercial and public sector buildings. It tracks priorities, practices, investment plans, and financial evaluation criteria to understand the projects the owners and executives are implementing, the drivers of action, and the barriers they face. This year, the first of the ULI/Johnson Controls research partnership, the survey reached a record 4,000 respondents in 13 countries on six continents and was conducted in eight languages.

Energy Efficiency Drivers

In every market, the EEI survey shows an unmistakable growth in interest in energy efficiency. Seven in ten executives globally say energy management is extremely important or very important to their organizations.

Not surprisingly, energy cost savings remain the single biggest driver for energy efficiency initiatives around the world. Eight in ten respondents expect energy prices to increase over the next year, and the average expected increase is 11 percent.

Incentives such as government grants and utility company rebates are cited as the second most important driver of energy efficiency—up significantly in importance from 2010—for their role in helping fund efficiency projects. Named third is enhanced brand or public image. One leading symbol of branding and public image is the pursuit of certified green buildings, and interest in such buildings doubled from 2010.

Among other survey findings:

- Four in ten respondents indicate they have a certified green building in their portfolio—either a new or a retrofitted existing asset.

- Respondents report growing interest in green building certification and, for the first time, certification efforts are more prevalent for existing buildings than new ones.

- Other notable drivers of energy efficiency efforts include reduction of greenhouse gas emissions, domestic energy security, and other government policies.

Three-fourths of organizations surveyed have goals for reduction of carbon emissions or energy use, or both, and about one in four have made those goals public. For helping achieve carbon reductions, improved building energy efficiency again ranked as the top strategy, topping other renewable energy initiatives.

Expectations for new environmental policies remain constant around the world. Nearly 40 percent of North American respondents say new energy efficiency or climate policy at various levels of government is very likely in the next two years, while over 80 percent of Chinese respondents regard new policy as very likely.

Barriers to Energy Efficiency Investments

Although executives and decision makers recognize the broader importance of energy efficiency, many believe opportunities to achieve greater cost savings exist but report significant market barriers to pursuing further investment.

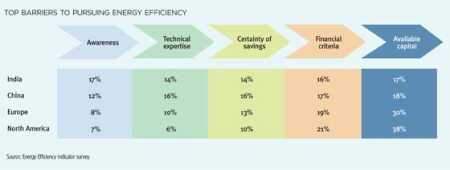

Barriers cited range from technical capacity to external financial considerations. The relative importance of different barriers varies across the type of real estate organization and across regional markets. The five key barriers to energy efficiency investments reported in the survey are:

- lack of awareness of opportunities for energy savings;

- lack of technical expertise to design and complete projects;

- lack of certainty that promised savings will be achieved;

- inability of projects to meet the organization’s financial payback criteria; and

- lack of available capital for investment in projects.

Awareness of opportunities and technical expertise are reported as the greatest barriers in India and China, with 31 percent and 28 percent of respondents citing these issues, respectively. Meeting return on investment criteria and a lack of capital ranked as the highest barriers in both North America, with 59 percent of respondents citing these issues, and Europe, with 49 percent. These findings suggest that the awareness of energy efficiency as an investment opportunity has substantially penetrated the U.S. real estate market, but the conditions necessary to invest in energy efficiency have not yet enabled real estate decision makers to capture the market value they know is there.

Technology Priorities

Despite these barriers, executives around the world report they have pursued an average of nine different energy efficiency measures in the past year. Common measures cited include switching to more efficient lamps and ballasts, installing occupancy sensors, tuning up control systems, and educating occupants.

Factors that make deployment of these technologies possible appear to include broad economies of scale and short payback periods: respondents with control over larger facilities report having implemented more energy projects than those with smaller facilities. However, scale is not the only relevant factor: several other attributes emerged upon examination of respondents reporting above-average rates of energy investments.

The survey results indicate that there is a wide variation in performance among otherwise comparable organizations when it comes to energy improvements adopted. Certain attributes are shared by those that implemented more energy efficiency projects versus those that completed fewer.

Analysis suggests that the real estate organizations most likely to pursue energy efficiency improvements share the following four key strategic practices:

- goals established for reduced energy use or carbon emissions;

- energy use data measured and analyzed at least monthly;

- added resources dedicated to improving energy efficiency through the hiring or retraining of staff, or the hiring of external service providers; and

- external financing sources used for projects.

Organizations pursuing these four practices were found to have implemented four times as many energy efficiency improvement measures as those that did not report those practices.