Over the last decade, real estate leaders have started to wrap the industry’s arms around what climate change—and the energy transition associated with it—means for the industry. Real estate companies with net zero commitments now account for nearly $1 trillion in market capitalization—well over half of the market cap of all publicly traded REITs. But setting targets is just the start. We’re learning a lot from those leaders moving beyond commitments to the hard work of transforming physical assets.

Those first movers are recognizing that real estate developers, owners, and operators are unable to decarbonize on their own; and that doesn’t mean just working with tenants. The bigger opportunity for collaboration sits upstream, with the energy supplier. Utility providers and real estate are often on opposite sides of the table; costs of service, timelines to get new sites powered, and access to low-carbon electricity represent increasing challenges. Despite their often-adversarial relationship, the two sides share an intimately intertwined future when it comes to decarbonization.

At Energy Impact Partners (EIP), an energy-transition investment firm that works closely with a set of corporate partners (including real estate and the utility industry) on research and innovation, we have firsthand experience in how both sides of the “utility meter” are engaging these opportunities. Clearly, collaboration can create a future that is greater than the sum of its parts—one with tremendous upside for participants in the real estate industry who are proactive in developing the right partnerships.

We’ve entered the “electric utility gauntlet”

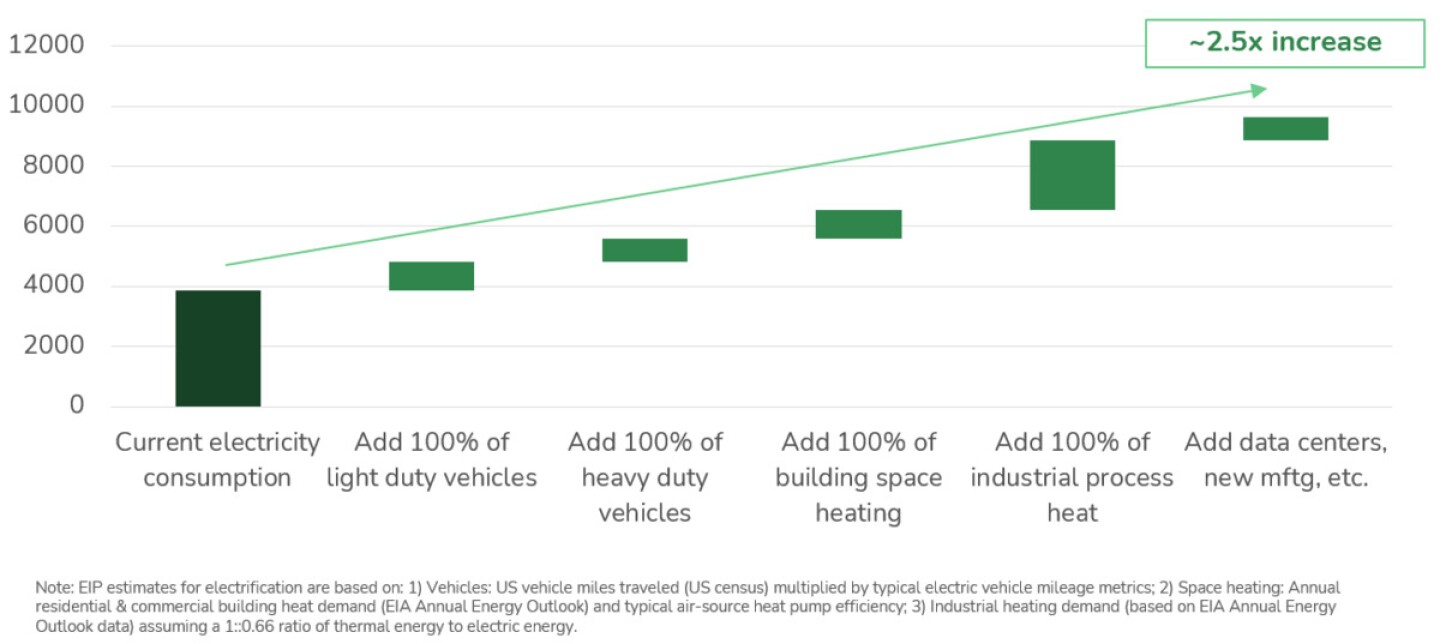

Decarbonization requires the utility industry to navigate two related, but distinct, pathways: they need to decarbonize their existing power plants and simultaneously prepare for a world where we consume a lot more energy via electricity (think electric cars, air source heat pumps, and even electric lawnmowers).

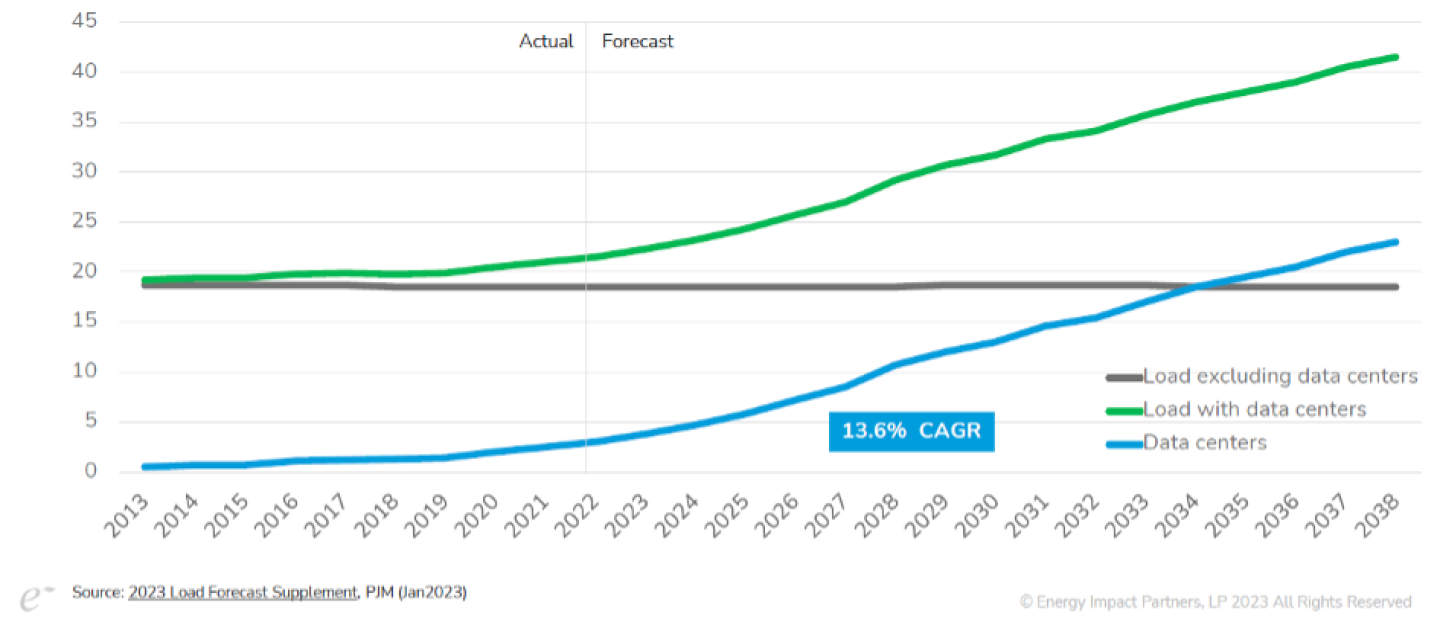

First: we’ve entered a new era of power demand growth after a 20-year respite in North America and Europe. It’s not due just to the electrification of vehicles and building systems, either. This period is shaping up to be defined by huge new sources of load. Data centers, industrial facilities, hydrogen production, and EV charging hubs will require the industry to double or triple the amount of power it provides today. As one example, Dominion Energy (the electric utility provider in parts of Virginia and North Carolina) expects the “peak” amount of electricity consumed by its customers to double over the next 15 years, all because of growth from the data center industry (see Figure 1).

Second: all of this new demand is arriving just as utilities are facing a capacity crunch. There is no obvious, immediate successor to the coal plants around which the grid was built, and most of which are slated to retire in the United States by 2030. Although natural gas power plants have been the industry’s de facto solution, policy pressure to decarbonize is making development of new gas power plants a much riskier proposition. Many promising alternatives are emerging (next-generation nuclear and enhanced geothermal are two we’re particularly bullish on), but none are quite ready to be deployed at the scale required. Meanwhile, bottlenecks to deploying new electric transmission and distribution capacity (the poles and wires that route electricity from power plants to buildings and industrial facilities) are also threatening to constrain the pace of load growth.

Over the last year, we’ve heard stories from all around the country about utilities having to turn away potential big customers for the next 3–5 years because they just can’t get enough power to serve them. This lack of capacity is most acute with large industrial customers, but we’ve heard anecdotes about new residential developments being delayed, and even commercial building owners having to wait for an electrical service upgrade to enable the electrification of their heating systems. Few utilities are currently prepared to interconnect hundreds of megawatts of new load in short order … let alone serve this load with firm, zero-carbon power, which some customers are now demanding.

This gauntlet is shaping up to be a generational opportunity for the whole electric power sector. If navigated correctly, utilities can deepen partnerships with their customers, help them decarbonize, and grow their business twofold or threefold (see Figure 2).

How do we clear this hurdle—and meet our net zero targets?

The utility industry is figuring out this challenge in real time, but one thing we know for sure is that the power sector will need to rely on the “grid-edge” to meet this opportunity. Real estate can be a hero in this story—and probably get paid for it in the process. The concept of grid-interactive efficient buildings (GEBs) has been around for a while, offering a set of solutions that integrate a mix of energy efficiency and “flexibility” (i.e., willingness to tweak building systems when needed to lower a building’s energy consumption). These aspects will constitute a key pillar of our strategy—but perhaps play second fiddle to sources of energy that can be called upon, no matter what, at a moment’s notice.

The time for microgrids might finally have arrived

For years, microgrid has been a buzzword across the power industry (see Figure 3). The idea of distributed hubs that could take themselves off of the centralized power grid during outages (also known as islanding) came into vogue during the first wave of rooftop solar projects. Although rooftop solar has its limitations (the National Renewable Energy Laboratory found that putting PV on every applicable rooftop could serve less than 20 percent of U.S. energy needs in a world with high electrification), the falling cost of lithium ion batteries has made the prospect of a paired “solar + storage” microgrid an exciting and novel goal. Power can be generated onsite—and saved for use when it’s most valuable.

Big energy users with acute needs for power supply—data centers, for example—are leading the charge for grid-connected, or even fully off-grid, systems capable of supplying power for extended periods. Initially, microgrids serving truly critical loads are running on natural gas, such as the ones built and operated by our portfolio company Enchanted Rock. These deployments can integrate solar/storage or include biogas procurement; see, for example, Enchanted Rock’s partnership with Microsoft. Unlike traditional diesel generators, these systems can run for an expanded set of hours. Thus, these systems can provide power back to the electric grid during hours of peak demand.

We’re watching a range of other technologies that could play a role in this space, including lithium-ion batteries, fuel cells, “linear generators,” and longer-duration energy storage systems. One such alternative is made by EIP portfolio company Moxion Power, which makes portable, electric generators that come on trailers and can be used for temporary power or emergency response applications. Another in our portfolio that is accelerating rapidly to commercial scale is Form Energy, a multiday storage solution which can supply 100 percent firm power when paired with the right mix of renewable resources.

Making microgrids pay

Utilities are increasingly finding value in accessing these microgrids to meet their overall electricity needs. We’ve seen at least 10 utilities launch programs to compensate customers for access to these resources. Although the models vary, they all have a common principle: enable a utility to use an asset that would otherwise be idle, while also helping to pay down the cost of that asset for the customer. A couple of specific examples:

- Entergy’s PowerThrough program is a resiliency solution for mission-critical businesses along the Gulf Coast. The utility covers roughly half of the cost of a behind-the-meter gas generator, with the customer paying the remainder via a monthly charge on their power bill. The customer gets full rights to use the system when the power goes out, and Entergy gets to use the asset like a small power plant during peak grid events. The PowerThrough program (of which Enchanted Rock is a delivery partner) was initially targeted at smaller customers looking for backup power, such as grocery stores. Now, it’s starting to draw interest from larger industrial customers looking to unlock a valuable resiliency asset at a lower cost than would otherwise be available.

- Emera’s BlockEnergy technology provides community-scale microgrids for new residential developments (see Figure 4). Its technology integrates solar, battery storage, and a gas generator to provide resilient, low-carbon power to households. BlockEnergy’s early projects have demonstrated that this integrated approach can produce a highly decarbonized energy system; one development was able to endure a multiday power outage with minimal (less than 10 percent) generator use. Most powerful is the impact this system can have on development timelines in power-starved communities. Where a utility has a long lead time to secure power, these community microgrids can get new communities up and running quickly while providing residents with resiliency.

Another compelling example of real estate leveraging its assets to accelerate the energy transition comes from EIP partner Public Storage. Public Storage is betting on rooftop solar as a key driver of its decarbonization strategy. The company has installed or contracted for rooftop solar across more than 650 properties. Most interesting is an effort it has launched in three states to leverage their rooftops as host sites for community solar projects. The company’s program, launched in partnership with a community solar developer (Solar Landscape) and an EIP portfolio company (Arcadia Power), will use rooftops on 130-plus Public Storage facilities to provide almost 90 megawatts of power to 10,000 households. Public Storage will be compensated by leasing the rooftops to the solar developer, and residents will save millions on their energy bills.

What does all this mean for real estate?

In addition to the emerging opportunity for microgrids are several other important implications of the coming “utility gauntlet” for real estate. There’s not enough space to highlight them all here, so I’ll leave you with a few key takeaways to ponder:

- Clean electrons are critical for decarbonization, but they’re almost certainly going to become more expensive.

- The utility sector might spend the next 30 years playing catch-up. But getting to zero carbon without the grid is a fantasy. Collaboration between utilities and big energy end users will be essential to keep long-term electrification plans on time and on budget.

- Owners and operators of large buildings can create and capture value through energy efficiency and grid flexibility, particularly as artificial intelligence capabilities get even better. HVAC and EV charging are the two biggest levers.

- Grid operators will want to tap into any resilience assets for more regular use, whether they take the form, for example, of an individual backup generator at a grocery store or a data center with dozens of battery energy storage systems onsite.

EIP is actively monitoring this space and is always eager to get feedback from industry practitioners. Please feel free to reach out if you have ideas or suggestions for solutions to help decarbonize the built environment.

Get Smart: The Business Case for Grid-Interactive, Efficient Buildings