Property Types

Hotels and Resorts

As long as lenders keep a tight grip on their wallets, the much-anticipated trend toward smaller houses probably won’t materialize, according to data presented at the NAHB’s recent annual convention.

Once the butt of jokes by late-night comedians, Newark now has building cranes dotting its skyline—proof that the Garden State’s largest city is experiencing something of a renaissance.

People are resuming travel. In some spots hotels are trading at prices that are above where they were in 2007. New York City just experienced record hotel occupancy rates this past May. As long as the market did not get overbuilt, hotels are coming back, says Greg Cory, principal of San Francisco–based Land Use Economics LLC and chairman of ULI’s Recreation Development Council. However, areas that got overbuilt are predicted to take longer to recover.

Industrial

As the number of U.S. factory jobs continues to shrink, cities increasingly find themselves with underused or abandoned industrial land. Where these sites border residential areas, the result is blight and increased crime. Read how the Oakland, California, housing authority took aging public housing on a blighted site and remade it to strengthen connections to nearby residences and community amenities.

As cities both large and small transition from manufacturing-based to service-oriented economies, municipal officials are forced to decide whether a site will be prepped for resale to another industrial user or if it should be remediated for residential development and commercial business. Read more to learn what a ULI panel told the city of Indianapolis to do with a well-sited vacant GM property.

It is the way that cities celebrate and showcase assets such as parks, culture and the arts, and safe neighborhoods that will determine the vibrancy of a community. Those communities that build partnerships to shape their response to these changes will be those that become successful 21st-century cities. Learn the three assumptions that successful cities will build on.

Mixed-Use

U.S. suburbs are changing in cities such as Denver, where new transit lines and placemaking efforts around walkable mixed-use neighborhoods are creating communities more similar to the urban core, said speakers at a ULI Colorado event.

International developer Hines turns an old factory site into transit-oriented urban housing near the terminus of Boston’s Red Line.

At a ULI North Texas event in Dallas, panelists said that the renewed optimism among small business owners, strong consumer confidence, and a robust U.S. job market suggest that the next recession may be further away than predicted just a year ago. The Dallas-Fort Worth area is well-positioned for further gains, as 16 competed or under construction projects near DART stations are forecast to produce $2 billion in economic development.

Multifamily

Eight years ago, the landmark Paris Agreement kicked off a worldwide campaign to reduce carbon emissions. The targets set were big: slash emissions by 45 percent by 2030 and be net zero by 2050. So far, the world is not making enough progress on those lofty goals, and the progress that has been made has been very unevenly distributed. Experts from major real estate firms, including Boston Properties, CBRE, and Community Preservation Corporation, drove home the net zero transition’s importance during a panel discussion at the 2024 ULI Spring Meeting in New York City. They talked about the costs of getting to net zero, what lenders and owners are doing to get there, and the risk of not addressing climate change.

It’s tough to view a strong economy as bad news. Yet a firmly positive economic projection in ULI’s Real Estate Economic Forecast does not bode well for commercial real estate participants who are hoping for relief in rate cuts from the U.S. Federal Reserve.

What does it take to secure debt in today’s challenging commercial real estate environment? It all boils down to experience, relationships, and a lot of creativity. That’s according to an expert panel speaking this morning at ULI’s spring meeting at the New York Hilton Midtown. The panel is the first in a series of three, which will include Raising Equity (10 a.m. Wednesday) and Borrowers’ Experiences—Recent Success Stories (10 a.m. Thursday).

Office

ULI MEMBER–ONLY CONTENT: Speaking at the 2021 ULI Fall Meeting, panelists discussed recent transactions in the office sector and which segments had performed the best.

The economic recovery in Washington, D.C., continued through the close of the third quarter of 2021. Office leasing activity is ongoing, though at a slower pace than years past, while asking rents are rising (up 2.1 percent from 2020 according to Newmark). The overall D.C. vacancy rate is just over 18 percent, according to CBRE.

This morning in Chicago’s South Loop, ULI members were treated to a tour of two historic and iconic buildings that have recently undergone major redevelopment and renovation: The Willis Tower and the Old Post Office.

Residental

The 50 top-selling U.S. master-planned communities (MPCs) during 2018 surpassed their sales totals for the previous year by an average of 5 percent, according to data from RCLCO Real Estate Advisors. The top two communities were both in Florida: the Villages, with 2,134 home sales, is once again the top-selling community in the country, followed by Sarasota, Florida’s Lakewood Ranch.

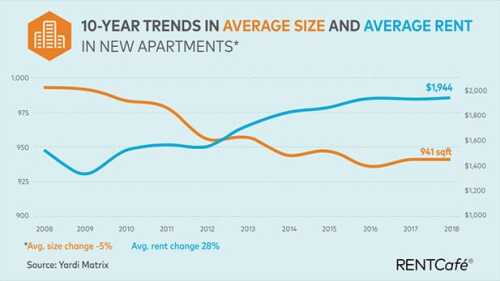

According to data from Yardi Matrix, the average size of a new U.S. apartment has shrunk 5 percent over the last 10 years, while the average price has risen 28 percent. The average floor plan of a new apartment measures 941 square feet (87.4 sq m), but that is still larger than the overall average of 882 square feet (82 sq m).

A novel condo development incorporates fully robotic parking and direct access to high-end units.

Retail

For decades, civic leaders have tried to revitalize Market Street, San Francisco’s central thoroughfare, only to see their efforts founder. “I sometimes call it the great white whale of San Francisco,” says Eric Tao, managing partner at L37 Development in San Francisco and co-chair of ULI San Francisco. “Every new mayor, every new planning director, every new economic development director has chased that white whale.” This year, however, an international competition of ideas hosted and run by ULI San Francisco, with support from the ULI Foundation, generated fresh momentum for reimagining the boulevard. The competition drew 173 submissions from nine countries and sparked new conversations about the future of downtown San Francisco.

The OAK project began in 2009, when a development firm set their sights on the corner of Northwest Expressway and North Pennsylvania Avenue, the state’s most important and busiest retail intersection. As the region’s only parcel capable of supporting a vertically integrated project of this scale and density, that land represented an opportunity to create something truly special.

As aging retail continue to evolve, one increasingly popular trend has been to redesign malls as town centers—recalling a time when such commercial districts were the heart and soul of a community. Mall–to–town center retrofits are emerging throughout the nation, especially in suburban communities, where pedestrian-friendly, mixed-use environments are highly attractive to millennials now raising families.