Industrial Warehouses

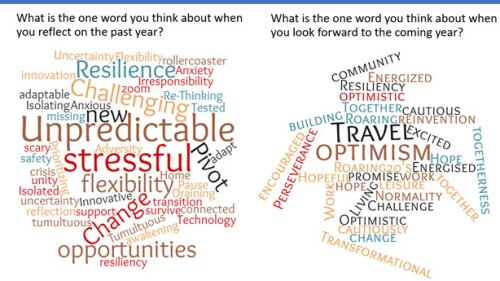

While many businesses in the United States have been coping with the impact of the COVID-19 pandemic for a year or longer, the broader availability of vaccines and a rebounding global economy are cause for more optimism than skepticism across the real estate industry, said industry leaders participating in a recent ULI webinar. Industrial, self-storage, and single-family rentals have been some of the sectors surging, while laggard sectors are still betting on a burgeoning recovery.

The U.S. industrial real estate market finished 2020 with a remarkably strong quarter, much of its resilience hinging on the acceleration of e-commerce, according to data from Cushman & Wakefield. The fourth quarter was the strongest for absorption ever, accounting for 89.8 million square feet (83.4 million sq m).

The persistent theme over the current economic cycle of “lower for longer” growth has contributed to a record expansion cycle that has surpassed 10 years. Results from ULI’s latest “Real Estate Economic Forecast” show that trend is likely to continue into 2021, said panelists speaking on a webinar discussing the survey results.

Retailers are focusing their physical presences on offering excellent customer service and curation of products, said panelists at a ULI Colorado event in Denver. The event itself was held at the Dairy Block, an example of new retail projects that are animating both commercial and public spaces with experimental and experiential places for people to shop, eat, drink, be entertained, and find community.

Important tax credits were preserved in the new federal tax law, but lower corporate rates shrink their value.

JLL’s head of research for Asia Pacific chats with the chairman of Global Logistic Properties—and outgoing ULI Asia Pacific chairman.

In the wake of Hurricane Harvey, development costs—not only up and down the Gulf Coast of Texas but also in areas that escaped the storm’s wrath—are poised to jump as builders grapple with a tighter labor market and higher material costs, according to speakers at a ULI Austin event in October.

Two small-scale developers detailed at ULI’s 2017 Fall Meeting in Los Angeles how the story arc of an imaginative building can be full of drama, setbacks, and plot twists.

With consumers increasingly expecting to tap their smartphones and find a product on their doorstep within hours, e-commerce is creating an ever more intense demand for industrial real estate near population centers that can used for last-mile logistics, according to panelists at ULI’s 2017 Fall Meeting in Los Angeles.

According to a new report from CBRE, investment in the U.S. data center sector reached record levels in the first half of 2017. First half of 2017 investment totaled $18.2 billion, more than double that for all of 2016 (inclusive of all single asset, portfolio and entity-level/M&A transactions). At this pace, investment in the data center sector is on track to surpass the total for the three previous years combined.