The strain of higher interest rates is creating sleepless nights for some commercial real estate owners and operators these days. On the flip side, there is significant capital eagerly lining up to take advantage of market dislocation.

Big-name managers such as Blackstone, Brookfield Asset Management, Ares, and Starwood are among those that have completed or are actively raising mega-funds targeting opportunistic strategies. For example, Brookfield is actively raising capital for its fifth vintage global opportunistic real estate fund, Brookfield Strategic Real Estate Partners V, which reportedly has a target raise of $15 billion. Office REIT SL Green Realty also is throwing its hat in the ring with a recent announcement that it planned to start fundraising for a $1 billion New York City-focused opportunity debt fund.

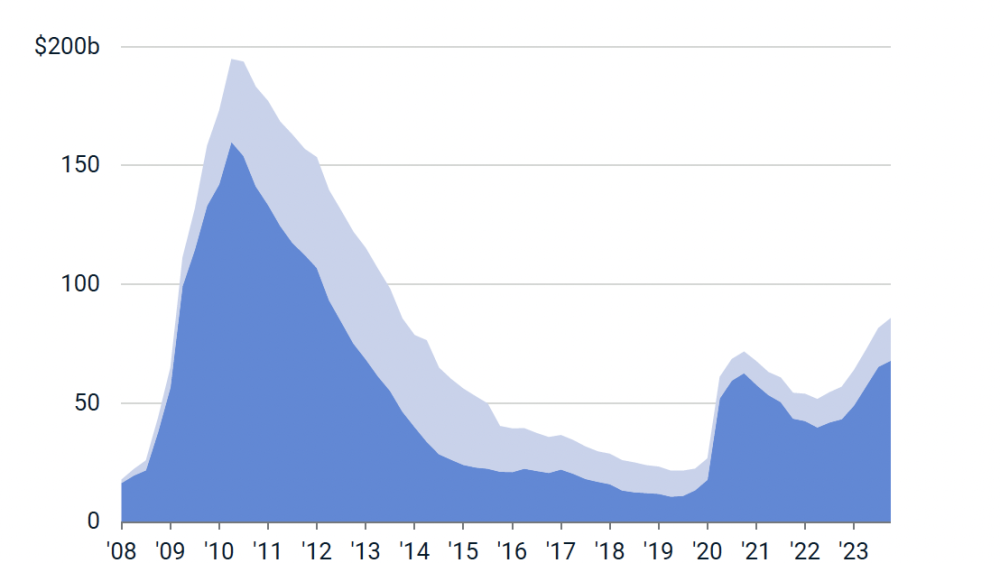

“Fundraising and the amount of capital sitting on the sidelines that’s ready to deploy is near record highs,” says Aaron Jodka, director of research | U.S. Capital Markets at Colliers. According to Preqin, there is roughly $260 billion in capital that is targeting North American real estate today. That level is down from the high-water mark of $283 billion in 2022, but still a sizable volume by historical standards. “At the end of the day, we’re still at tremendous amounts of investable capital, and the vast majority of this is focused on debt, value-add, and opportunistic strategies,” he says.

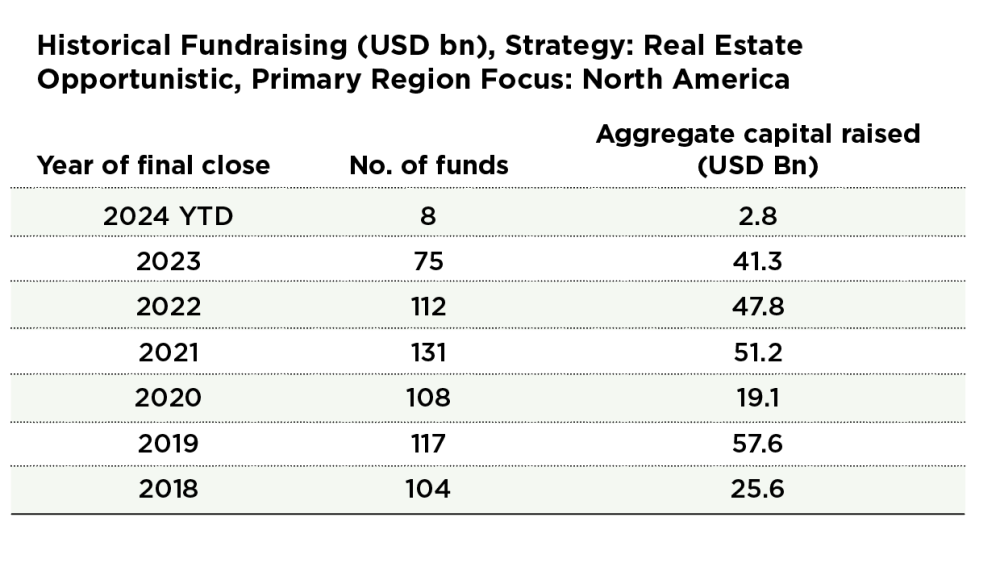

According to Preqin, roughly $109 billion of the capital raised is targeting opportunistic strategies, and when accounting for global strategies, the volume nearly doubles to $200 billion. “This isn’t the global financial crisis repeated or anything along those lines,” emphasizes Jodka. However, the opportunistic capital that has been raised for both debt and equity investments does provide a good backstop for some of the stressed and distressed real estate that exists, he adds.

Appetite for higher returns

Investors are hoping to capture attractive investment opportunities ahead that are being created largely by the higher rate environment. Investors also have an appetite for higher risk-adjusted returns with many core strategies delivering returns barely above the risk-free rate of treasuries. “There’s definitely a shift in appetite for higher return strategies with this expectation that there’s going to be distress and dislocation in the market. So there is more interest in value-add and opportunistic multi-sector focused funds,” says Douglas M. Weill, founder and co-managing partner of Hodes Weill & Associates.

Investors have been expressing a lot more interest in enhanced return strategies over the last 12 to 18 months, agrees Bernie McNamara, head of client solutions at CBRE Investment Management. According to CBRE’s 2024 Investor Intentions Survey, opportunistic is the preferred strategy for the third year in a row.

“Investors, understandably, want to be compensated with a decent spread versus base rates,” he says. In addition, many investors, both manager and LP clients, see the opportunity to take advantage of distress to buy high-quality assets at discounted prices, he says. Most of the interest has been directed in enhanced return, closed-end vehicles whereas open-ended vehicles have been wrestling with redemptions and net asset value (NAV) declines.

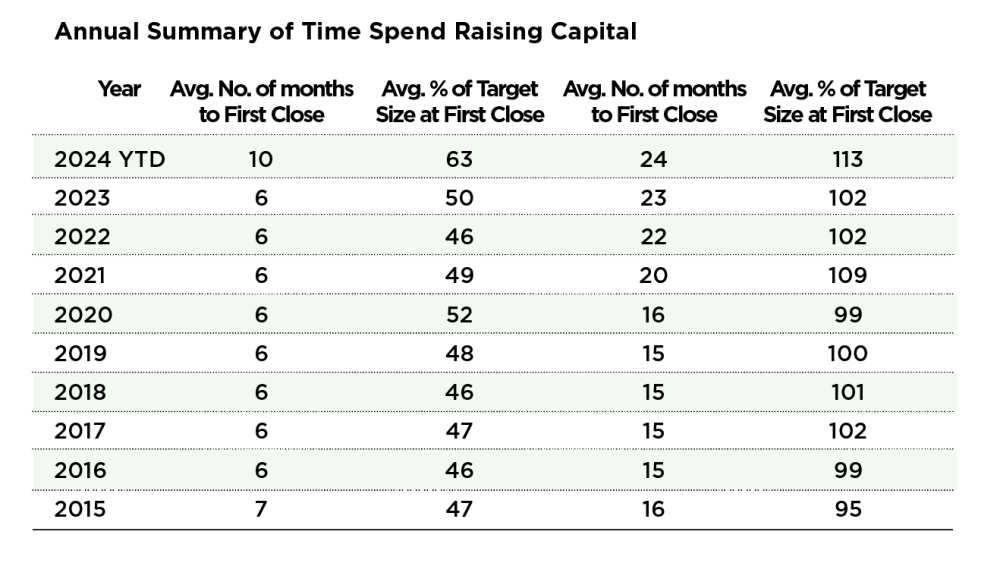

It’s also important to note that fundraising isn’t entirely smooth sailing. It’s a tougher fundraising environment for all types of real estate investment vehicles, including opportunistic and value-add funds. While investors are interested in opportunistic strategies, they also are hesitant to deploy capital, which is evident in longer lead times for funds to reach their fundraising goals. The average time it takes for a fund to get to its final close fundraising target is now hovering at 24 months compared to 16 months in 2020, according to Preqin.

“Last year was a tough year for fundraising generally, but the early part of this year has been characterized by a bit more optimism,” says McNamara. It may be a quieter first half of the year as investors wait for more clarity on the macro picture. However, investors do appear to be gearing up to “switch from defense to offense” with more interest in higher yielding opportunistic, value-add and core-plus strategies, he adds.

Maturing loans will demand capital

Given the expanse of opportunity funds in the market—more than 500 globally—there are a wide variety of strategies that range from global diversified funds to those that have a laser focus on a particular property sector and geography. Certainly, these funds are not focused only on distress. Some are pursuing other higher-returning strategies such as development in emerging markets.

However, distress is commanding a lot of attention with expectations that investing opportunities will arise from the estimated $1.5 trillion in commercial real estate loans maturing in a market where interest rates are higher, and lending is more conservative.

The capital markets are by no means frozen, and many borrowers and lenders will be able to work through those maturities. However, there inevitably will be situations of distress that will create investment opportunities for funds to come in with fresh equity and/or debt.

“The banks aren’t making a lot of new fresh loans until they get paid back on their maturing debt. So that source of capital is less than it has been historically, and we’re going to need to fill a pretty big gap with either debt or equity,” says John Berg, managing director of portfolio management for Principal Real Estate Investors. “So, there will be ample opportunity to deploy capital ahead.”

One high-profile example is the FDIC sale of the commercial real estate loan portfolio of Signature Bank, which was reportedly valued at more than $30 billion. However, such large-scale portfolio deals could be rare with funds taking more of a rifle-shot approach to place capital.

There are a lot of discussions going on between borrowers and lenders around loan modifications and extensions. However, the market seems to be in a higher-for-longer rate environment, even if the Fed makes good on its anticipated modest rate cuts in 2024.

“Until we see a Fed pivot, I believe the opportunities will continue to increase,” says Berg. For example, if an owner has a loan maturing that was done at 75 percent loan-to-value 10 years ago, the refinance of that loan may be at 60 percent today. “That’s creating an opportunity to solve in the capital stack with either debt to come in on top of the first mortgage or equity to come in as preferred equity.”

That being said, it is difficult at this point to gauge the scale of the opportunity ahead because it will depend on the cost and availability of debt, he adds.

Capital looks beyond office

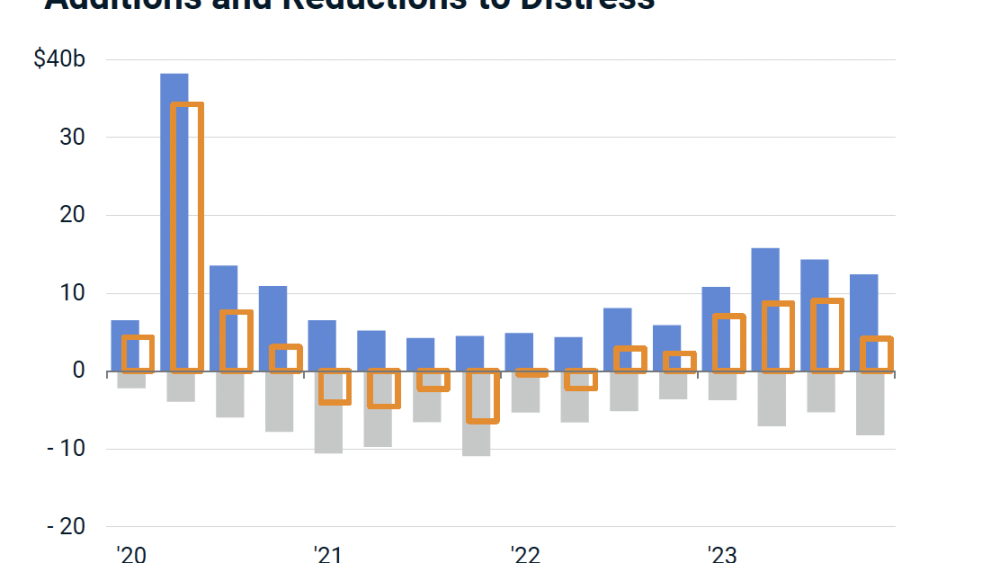

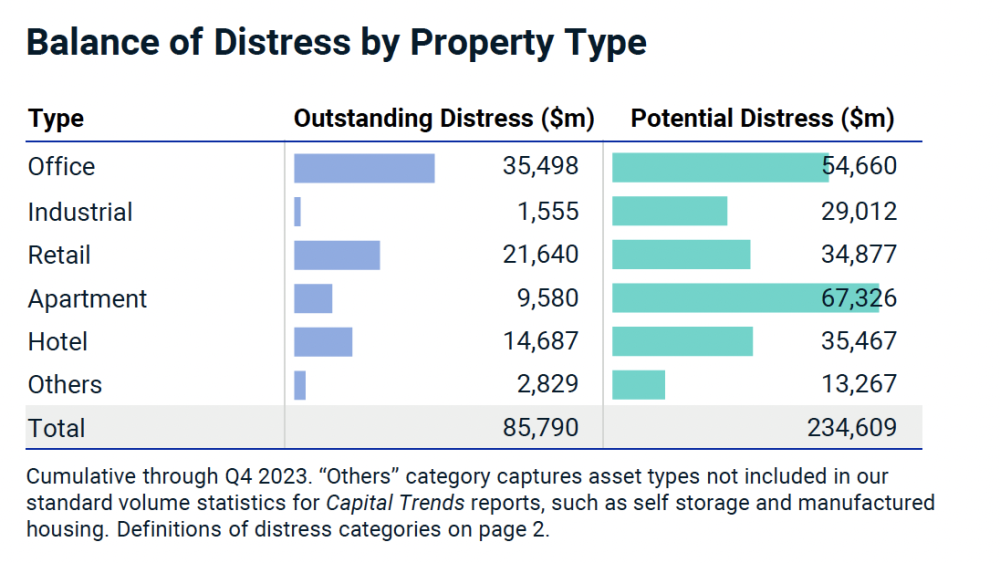

Although office dominates conversations around distress, there are opportunities across property sectors. According to MSCI Real Assets’ Distress Tracker, the estimated volume of distress in the U.S. commercial real estate market grew to $85.8 billion at the end of 2023.

Office accounted for the largest share at 41 percent, followed by retail at 25 percent, hotel at 17 percent and apartments at 11 percent. In addition, the value of assets classified as potentially troubled stood at $234.6 billion as of December, nearly three times that of the current distressed volume.

CMBS delinquency and special servicing data also shows the growing distress in office. According to Trepp, the percentage of CMBS office loans now in special servicing has jumped from 4 percent to nearly 10 percent in the past 12 months.

On the office side, in particular, it could be argued that where pricing has been reset, in some cases quite substantially, that these are generational buying opportunities, says Jodka.

Capital also is aimed at cracks emerging in the multifamily sector where loans were underwritten at historically low interest rates with an expectation for a short hold period. “At the end of the day, some of these deals were done with such a sharp pencil that they’re going to need help one way or another,” he says.

Another potential area of distress that is in the early stages of unfolding is logistics. Despite strong demand for logistics space, that market is now showing signs of real bifurcation and stratification of performance, notes McNamara. “Logistics, in some ways, parallels what has happened over the last decade-plus in office where there has been this separation between legacy and modern facilities that can cater to the leading occupiers today,” he says.

Modern logistics users such as Amazon, FedEx, and Walmart increasingly have building specs that are not compatible with legacy logistics buildings. For example, they need greater clear heights and roof load capacity that can support solar, floor slabs that can support robotics and automation equipment, as well as EV charging stations with battery storage.

Opportunistic funds are looking to buy well-located older properties and do a teardown to create a new modern facility. “So, it’s not just buying the dip, it’s about creating the next generation of logistics facilities,” McNamara says.

Too much capital to deploy?

The story of capital lining up to pounce on “generational buying opportunities” is not a new one. The amount of capital that has been raised begs the question of whether there is too much capital chasing too few deals.

“You can make that argument that there’s a lot of capital, but it’s a pretty deep market,” says Weill, who notes there’s roughly $400 billion of dry powder in closed end funds. Applying 2:1 leverage would push that buying power closer to $1.2 trillion.

In theory, that level of equity is enough to cover one year’s worth of global real estate transactions. “But what we tend to see in times of distress is that it’s not just asset sales. It’s recapitalizations; there’s distressed debt. So, there are a lot more opportunities to deploy capital than just investing in a property directly,” he adds.

“There is a lot of freedom to move across sectors and up and down the capital stack. By definition, that’s what they do. That’s how they generate alpha.”

Opportunity funds also have very broad mandates based on target risk and return, which gives them the flexibility to invest through cycles and pivot to where they see investment opportunities that align with their return targets.

“There is a lot of freedom to move across sectors and up and down the capital stack. By definition, that’s what they do. That’s how they generate alpha,” says Weill. For example, Ares is partnering with RXR to pool capital to invest in New York City office. Ares also has a logistics strategy that focuses on growth. “So, I think you’re going to see a mix of strategies going forward,” he says.

So far, many funds have been slow to deploy capital as there is still a bid-ask gap and managers are waiting for the bottom on pricing. “We anticipate a slower start to the first part of the year with more activity as the clouds start to clear and there’s more certainty,” says McNamara. Capital also may need to be patient as it often takes years for distress to work through the system.