As part of the proposed budget, President Obama is again saying that now is the time to invest in U.S. infrastructure, calling for $478 billion in spending on roads, bridges, ports, and other transportation nodes. Among other examples, the water main ruptures that flooded UCLA and Sunset Boulevard suggest that the state of infrastructure in America has significant room for improvement.

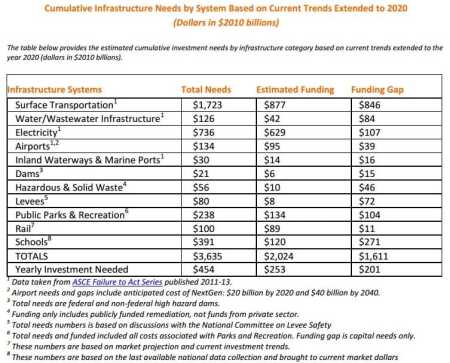

The American Society of Civil Engineers (ASCE), which gives a quadrennial assessment of the state of infrastructure in the United States, gave the nation a grade of D+ in 2013. The ASCE estimates that bringing dams, rail systems, schools, airports, etc., up to a state of good repair will cost about $3.6 trillion (in 2010 dollars) through 2020—for a total of $454 billion a year. Current allocations for infrastructure are about $201 billion a year. This creates a total shortfall of about $1.6 trillion, or nearly 10 percent of current GDP (GDP of $17.3 trillion, as of Q2 2014).

[Chart: American Society for Civil Engineers, “2013 Report Card for America’s Infrastructure.”]

Whether Congress chooses to act on the President’s budget, the development of alternative financing for such projects has recently gained some momentum in Washington. Last fall, the U.S. Departments of the Treasury and Transportation held a joint summit to discuss their recent report, “Expanding Our Nation’s Infrastructure through Innovative Financing.”

The summit touched on several strategies to bring such a comprehensive set of projects to materialization. First, the report estimates that the nation faces a $1 trillion funding gap for infrastructure projects between now and 2020 (somewhat less than the ASCE’s estimate of $1.6 trillion), but an innovative combination of public and private financing can be used to raise the capital. As former Pittsburgh mayor and current Urban Land Institute senior fellow Tom Murphy, who participated in the summit, said, “A lot of the financial people, from KKR, Goldman, Macquarie, CalSTRS—the people who would generate the money—were all present. They think there is opportunity to do more. In Miami and Texas, for example, there have been very effective PPPs [public/private partnerships].”

“There have been some bad deals in the past—the public sector doesn’t want to give away too much for too little, and the private sector doesn’t want to take on too many headaches,” says Murphy. “These projects will require more private investment and be less reliant on public funds, but people are enthused about this—they see it as a real opportunity.”

Any plan would aim to not only improve our national infrastructure, but also provide economic growth. Murphy said, “Improving labor markets is the reason local communities want these projects. It attracts private investment.”

Murphy says Treasury Secretary Anthony Foxx talked about different sources of funding—such as Union Station in Denver, which used federal rail money that had never been used before. This attracted $2 billion in additional investment. “Previously, there was an Amtrak [train] that only came twice a day,” says Murphy. “Now, Amtrak is there, but it is also the base of a 120-mile transit system. The project also helped build 3,500 units of housing, and hundreds of thousands of square feet of retail and office space.”

Allocating public money for these types of investments is often criticized in that it may crowd out private investment. But the Denver case shows the opposite effect—public money actually helped attract private investment, and attracted private capital that was otherwise sitting on the sidelines.

Like all large-scale programs, considerable uncertainty exists about whether or not this would be a worthy investment—if it would actually fulfill its intended purpose and be worth the cost. Economist Jay Morelock of FTN Financial thinks that while these types of major infrastructure projects do boost growth in the short term, their long-term value is unclear. Morelock says:

From an economic standpoint, the question becomes whether or not these investments are beneficial. The pros—that it boosts demand, accelerates growth, and decreases unemployment—are clear. But there are huge cons. Most of the time, massive government infrastructure projects run over cost. There are too many entrenched interests, and they don’t have the same incentive for efficiency as a private sector project.

One huge downside risk is that this type of program would result in the same type of ineffective “bridge to nowhere” projects that Japan experienced with its then-highly unusual monetary and fiscal policy experiments of the 1990s and 2000s.

What Japan did was put a facade on the country—many of these projects didn’t provide value and wasted resources. They did nothing to increase efficiency.

The American interstate system was a great example of an infrastructure project that provided a very high return on investment—it is something that is completely necessary for a developed economy. But improvements to Kennedy Airport may not provide the same return to society. If it doesn’t improve efficiency, and if the ROI isn’t positive, it is just a subsidy.

An infrastructure program might boost growth until 2020, but you’re also increasing debt to GDP. At best, these types of investments are a net wash, but usually it is a net negative in the long term.