Finance & Investment

The Dodge Momentum Index, a leading indicator for U.S. commercial real estate activity, increased 4 percent in February to 158.2, from the revised January reading of 151.9. In February, institutional planning rose 9 percent, and commercial planning moved 1 percent higher.

The next decade will be a critical period of change, with ongoing uncertainty amid the big evolution in technology, data, and laws. Commercial real estate market players may shift their strategies, affecting capital flows into and out of the asset class.

A new report by ULI and Heitman, a global real estate investment management firm, indicates that environmental change is prompting the migration of people and businesses, movements that may trigger significant shifts in demand for real estate. Just as investors are being forced to recognize and price the physical risks associated with climate change—wildfires, hurricanes, excessive heat—they need to integrate climate migration risk into their underwriting models.

Peter Ballon, global head of real estate for CPPIB Investments, kicked off the 2021 ULI Virtual Spring Meeting with a keynote panel of industry leaders from Europe, the Asia Pacific region, and the Americas discussing global capital flows.

As part of the 2021 ULI Virtual Europe Conference in February, high-level ULI members from across the global finance and investment sector gathered virtually to discuss capital flows, real estate market dynamics, and debt and equity markets. Among the trends discussed were an acceleration of deglobalization, shifting from “just in time” to “just in case” deliveries, and more interest in the hyperlocal, also characterized as “love thy neighborhood.”

A study by the U.S. Federal Reserve Bank of Philadelphia showed that tenants who lost jobs during the COVID-19 pandemic may have already amassed $11 billion in rental arrears. Procedures for evictions and foreclosures may be failing the most vulnerable tenants and landlords.

The climate plan outlined by U.S. President-elect Joe Biden’s administration is significant in that it reaffirms a commitment to addressing climate challenges, said panelists participating in a recent webinar hosted by the ULI Center for Sustainability and Economic Performance. The plan would also provide considerable resources to support and propel innovation throughout the real estate industry in key areas such as energy efficiency, carbon emission mitigation, and climate change resilience.

In a new survey conducted by ULI and EY, real estate professionals said that they overwhelmingly expect increased remote working, including more working from home (96 percent), more remote working away from the home (72 percent), and more use of satellite offices at the edge of cities (67 percent).

SPONSORED POST:See the latest trends in CRE and learn how slow payments in the construction industry generated domino effects costing an estimated $100 billion in 2020. Rabbet, a provider of cloud-based software for managing construction finances, surveyed real estate developers, lenders, subcontractors, and general contractors and packaged the results in its two latest reports.

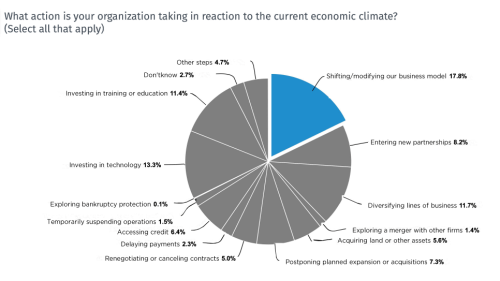

While the COVID-19 pandemic and ensuing recession have spurred ULI members to act quickly to adjust their business practices, a significant number of respondents to an Urban Landreader poll say they expect the real estate business to do better during this recession than during the Great Recession of 2007–2009. And a majority see opportunities for growth.