This article was prepared by KKR.

Commercial real estate finance participants navigated an unprecedented market environment in the early months of the COVID-19 crisis, with many traditional lenders and capital markets players temporarily sidelined. As we near the end of tumultuous year, many observers are beginning to see signs of cautious optimism. KKR’s head of Real Estate Credit, Matt Salem, answers a few questions about how this time is (or is not) different and his outlook on the road ahead.

KKR manages investments across multiple asset classes, including private equity, credit, real estate, infrastructure and energy, with strategic partners that manage hedge funds. KKR’s Real Estate Credit platform was established in 2015 and invests across transitional mortgages, mezzanine debt and CMBS securities through both public vehicles such as KREF and private funds. KKR Real Estate Credit is fully integrated within the broader global real estate group, which provides equity and debt capital across a variety of real estate sectors and strategies supported by a team of over 85 dedicated real estate investment professionals across eleven offices globally. As of June 30, 2020, KKR Real Estate has approximately $12+ billion of assets under management.

Before the pandemic, KREF’s loan origination strategy was mostly focused on originating senior loans on transitional properties in the U.S. How were you positioned at the start of the year and how has that evolved since then?

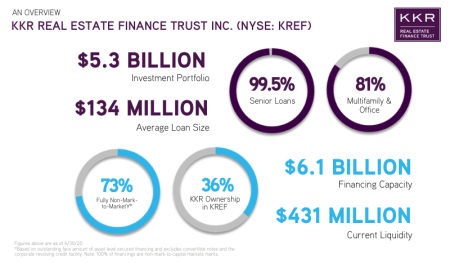

We’ve had a late cycle view for some time now so we were defensively positioned at the beginning of the year. Our strategy is to lend on institutional-quality real estate, owned and operated by large investors. Within that segment we have targeted lower beta property types and our biggest exposures are Class-A, multifamily and office properties. After an initial period of trying to understand the impact of COVID on the real estate markets and specifically our portfolio, we shifted to new lending opportunities. After an initial period of trying to understand the impact of COVID on the real estate markets and specifically our portfolio, we shifted to new lending opportunities. For the most part, we are sticking to what we like so I don’t see our portfolio composition changing materially.

Capitalizing on dislocation seems to be a common mindset for many investors as we head into year-end. How were you able to shift from triaging to underwriting efficiently?

We’ve got a great team with 24 people dedicated just to real estate credit, but it goes beyond that. We also access our equity team for sourcing and underwriting. Importantly, our existing portfolio had few COVID-sensitive property types so we shifted the team from asset management to new investments quickly. For KREF, our balance-sheet loan origination business, our integration within KKR and the firm’s broader Real Estate team has been critical – not just in the context of the pandemic, but also in how we are growing the Real Estate credit business.

KKR Real Estate Credit strategy is targeting a broad opportunity set. How do you decide the best way to approach an opportunity?

Resource allocation is one of the most important aspects of a credit business, which is more flow driven than equity investing. We’ve been good at identifying the themes we like, knowing our credit box, and targeting opportunities that fit squarely in that. At the same time, our team has strong relationships with brokers and owners in the market. It’s a relatively simple equation that allows us to be front-footed and targeted.

What makes KKR Real Estate Credit different from other platforms?

Our integration with the broader KKR platform is our biggest advantage. We’ve been able to drive differentiated outcomes through firm relationships and enhanced underwriting capabilities by incorporating the input of our various investing teams outside of real estate credit. As important, we’ve been able to leverage the firm’s extensive relationships to create bespoke/tailored financing for our portfolio as well which allows us to take less risk while still earning attractive risk-adjusted returns.

This post is not an offer to sell or a solicitation of an offer to purchase any securities of KREF or of any investment fund or vehicle sponsored by Kohlberg Kravis Roberts & Co. L.P. or its affiliates. General discussions contained within this presentation regarding the market or market conditions represent the view of either the source cited or KKR. Nothing contained herein is intended to predict the performance of any investment.

KKR Real Estate Finance Manager LLC (“KREF”) is a subsidiary of KKR & Co. Inc., a leading global investment firm with an over 40-year history of leadership, innovation and investment excellence. KKR manages multiple alternative asset classes, including private equity, credit, and real assets, with strategic partners that manage hedge funds. KREF is part of KKR’s global real estate group, KKR Real Estate, which provides equity and debt capital across a variety of real estate sectors and strategies supported by a team of 90 dedicated real estate investment professionals across seven offices globally. As of June 30, 2020, KKR Real Estate has approximately $12+ billion of assets under management.