Finance & Investment

While the COVID-19 pandemic and ensuing recession have spurred ULI members to act quickly to adjust their business practices, a significant number of respondents to an Urban Landreader poll say they expect the real estate business to do better during this recession than during the Great Recession of 2007–2009. And a majority see opportunities for growth.

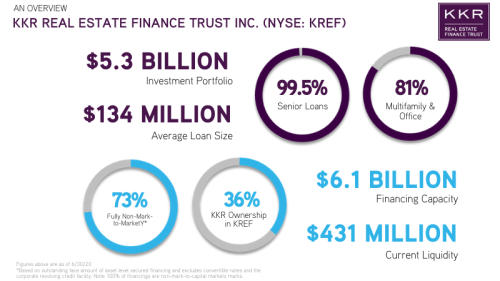

SPONSORED POST:Commercial real estate finance participants navigated an unprecedented market environment in the early months of COVID-19, with many traditional lenders and capital markets players temporarily sidelined. As we near the end of a tumultuous year, many observers are beginning to see signs of cautious optimism. KKR’s head of Real Estate Credit answers a few questions about how this time is (or is not) different and his outlook on the road ahead.

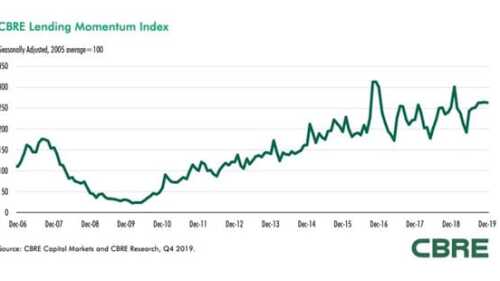

The U.S. Federal Reserve’s interest rate reductions, combined with continued economic growth, supported strong commercial real estate lending activity in the fourth quarter of 2019, according to the latest research from CBRE. The CBRE Lending Momentum Index, which tracks the pace of commercial loan closings in the United States, reached a value of 263 in December 2019—virtually unchanged from its third-quarter 2019 close and up 4.2 percent from a year earlier.

Despite the political uncertainty across Europe and around the world, European real estate remains a desirable asset for investors globally. That is the bottom line of the new Emerging Trends in Real Estate® Europe 2020report released by the Urban Land Institute with PwC in Brussels. The coming 2024 Olympic Games were cited as a big draw for Paris, but the Grand Paris project was also mentioned many times by panelists.

The persistent theme over the current economic cycle of “lower for longer” growth has contributed to a record expansion cycle that has surpassed 10 years. Results from ULI’s latest “Real Estate Economic Forecast” show that trend is likely to continue into 2021, said panelists speaking on a webinar discussing the survey results.

Tightening availability of tech talent in leading markets has spurred hiring momentum in smaller and upstart markets in the United States and Canada—such as Tucson, Arizona, and Waterloo, Ontario—as expanding tech employers seek additional labor pools, according to CBRE’s annual Scoring Tech Talentreport.

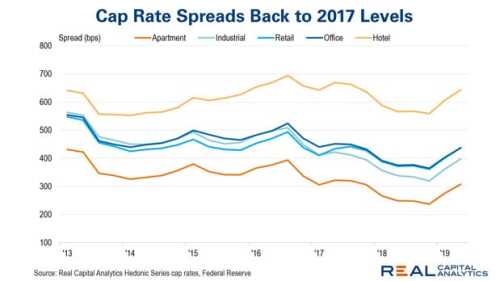

Interest rates have been on a roller-coaster ride over the last year, but cap rates are largely unchanged. The result of these moves is that cap rate spreads relative to the safe investments in the 10-year U.S. Treasury bonds have moved back to the levels seen in 2017. Given everything that has changed over the last year—as well as everything that has not—there may be room for cap rate spreads to move lower.

At the 2019 ULI U.K. National Conference, a panel on the practicalities of real estate investment reflected on the opportunities and challenges, not least in terms of the impact that Brexit is having on investor sentiment, as well as where we are in the market cycle. Multifamily continues to do well, while retail is struggling as in overbuilt markets.

Flush from Amazon’s selection of Arlington County, Virginia, for a new headquarters facility, three “titans” of the real estate scene in the Washington, D.C., metropolitan region took a moment to celebrate at the ULI Washington Trends Conference. To put all of this into perspective were John “Chip” Akridge III, founder and chairman of Akridge; Thomas “Tom” Bozzuto, chairman and cofounder of the Bozzuto Group; and Bryant Foulger, chairman of Foulger-Pratt.

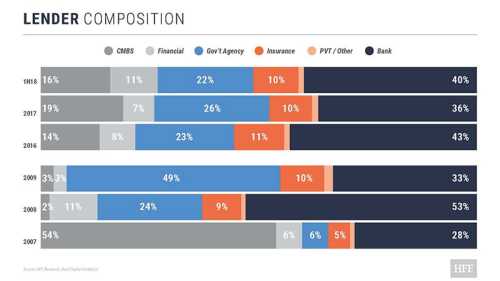

Alternative lenders increased their market share in the commercial real estate debt sector in 2018, panelists said at a ULI North Texas event in March. That trend is likely to continue this year as competition among all types of debt providers heats up capital markets.

A diverse group of experts presented a stark analysis of the rollout of federal Opportunity Zones during the recent ULI Housing Opportunity 2019 conference in Newport Beach, California. More than a year after the program was established, there is still confusion over regulations and implementation, they said.

Why CRE professionals of color should be included in opportunity zone plans.

Congress authorizes tax-free profits for investors in qualified opportunity funds.

A glut of liquidity in local capital markets is making life difficult for domestic and foreign investors alike.

The new ULI Real Estate Economic Forecast is taking a more bullish view on the U.S. economy—at least for the remainder of this year. As compared with the fall survey, key indicators such as gross domestic product (GDP) growth, jobs, and the Consumer Property Price Index (CPPI) all trended higher. But that boost may be short lived with growth tapering in 2019 and 2020.

While the latest Harvard University’s Joint Center for Housing Studies (JCHS) report on the state of rental housing in the United States. shows some positive signs for inventory, the overall trend persists that low- to moderate-income renters face significant cost burdens in most markets.

While the $1.5 trillion tax-cut bill passed by the U.S. House of Representatives is widely seen as beneficial for commercial real estate, one provision would eliminate a municipal financing tool that has been essential for housing, infrastructure, and industrial development investment for decades.

Commercial real estate lending markets remained on the upswing in Q3 2017 with rising equity prices, limited volatility, and tightening spreads, according to the latest research from CBRE.

According to a new report from CBRE, investment in the U.S. data center sector reached record levels in the first half of 2017. First half of 2017 investment totaled $18.2 billion, more than double that for all of 2016 (inclusive of all single asset, portfolio and entity-level/M&A transactions). At this pace, investment in the data center sector is on track to surpass the total for the three previous years combined.

Alternative, or nonbank, lenders are filling in gaps in the mortgage world where they find them, whether it be the result of increasing capital requirements for banks, consolidation in the banking sector, or a pullback by commercial mortgage–backed securities lenders. Last year alone, the five largest players in the sector collectively funded some $20 billion of interim loans. Plus, interest rate survey data from Trepp.

In a volatile year, the FTSE/NAREIT All REIT Index posted a modest total return of 9.3 percent in 2016, while the S&P 500 saw a total return of 12 percent. Real estate investment trusts (REITs) enjoyed a pleasant opening to the year, followed by a skittish second half as interest rate concerns applied downward pressure.

October share prices for REITS were lower month-over-month, and all sectors posted lower returns, except for infrastructure REITs which reported 18.3 percent in total returns for the year. Despite the decline in prices and performance, sector returns continue to surpass the S&P 500. Plus, interest rate survey data from Trepp.

A renowned global investor and the chairman of ULI Asia Pacific reflects on opportunity and risk in a low-interest-rate environment.

Encouraging economic news released in August heightened the potential that the Fed will increase interest rates. But this good news proved to be a bit too positive, as it may have contributed to a withdrawal in the real estate investment trust sector. Plus, interest rate survey data from Trepp.

Macy’s has announced plans to close 100 of its 675 traditional full-price locations and to increase investment in its online channel, which heightened concern about bricks-and-mortar retail versus e-commerce and led regional mall REITs lower. Plus, interest rate survey data from Trepp.

Transparency in the global real estate sector has improved markedly, according to a recent report produced by JLL and LaSalle Investment Management, with the ten most transparent countries taking 75 percent of global investment volumes.

Even as the broader equity markets fell, real estate investment trusts posted positive returns as economic uncertainty once again took center stage. The Federal Reserve Board’s decision not to raise interest rates this month was good news for REITs in terms of keeping their cost of capital low, but also reflected some weak economic news that could mean economic growth is faltering. Plus, interest rate survey data from Trepp.

AF Bornot Dye Works is a loft apartment and retail project in central Philadelphia that involved the adaptive use and restoration of three timber and concrete factory buildings. The capital stack assembled for this project was unusually complex, partly because of its unusual mix of uses, its location outside the Center City core, and the challenges posed by historic rehabilitation.

As financing for real estate development tightens, institutional equity investors are becoming more selective in their funding, and developers are exploring new market segments such as the over-70 sector, said panelists speaking at the 2016 ULI Spring Meeting.

As the broader stock market has tumbled further, the freestanding retail real estate investment trust (REIT) sector stayed in positive territory for the year. In contrast to the rest of the REIT industry, total REIT returns for this sector are up more than 10 percent so far in 2016. Also known as triple-net-lease REITs, this is one of the smaller REIT sectors by market cap. Plus, interest rate survey data from Trepp.