In an unusual shift, jobs in the Chicago area are moving where the talent is rather than the other way around: companies are relocating from the suburbs to downtown seeking to attract millennial workers and spurring the development of multifamily and office projects in the city.

In Detroit, construction is expected to begin this summer on the first new Class A office building to be built downtown in more than a decade. In Milwaukee, pent-up demand for space continues even after completion of a major office tower in 2016.

Cleveland—which benefited this year from a number of high-profile events, including baseball’s World Series, National Basketball Association championship games, and the Republican National Convention—is seeing increasing adaptive use of buildings, as well as new construction.

In Indianapolis, an expanding high-tech sector supports a robust economy with a growing job market and new real estate development. And Des Moines, Iowa, is experiencing multifamily and commercial relocation from the suburbs to downtown, similar to what Chicago is experiencing.

Real estate activity in America’s heartland is growing at a solid clip, driven by increases in employment, a recovering economy, and pent-up demand for new product.

“The Midwest region posted annual job growth of 1.7 percent between January 2011 and September 2016, which is broadly the recovery period from the Great Recession,” says Hans Nordby, managing director at Boston-based CoStar Portfolio Strategy, which provides commercial real estate analysis and portfolio strategy services. “Relative to the eastern U.S. [Pennsylvania through Massachusetts], which grew jobs at a 1.6 percent rate during the same period, the Midwest looks pretty successful.”

Thanks to the increasing movement of millennials—people born between 1980 and 1999, the largest component of the American workforce today—the central business districts of major cities in Illinois, Indiana, Ohio, Michigan, Wisconsin, and Iowa are expanding.

“The big-city downtowns of the Midwest are attracting young people to live because of technology scenes and other factors,” says Aaron M. Renn, senior fellow at the Manhattan Institute for Policy Research, a think tank focused on free-market philosophies.

“While these cities are improving economically, the working-class economy in traditional, smaller manufacturing communities is still struggling. Manufacturing got clobbered during the 2008 recession. It has come back a little, but with every economic cycle some areas are left further and further behind.”

Real estate demand growth should be solid across most property types in the Midwest this year. “Job growth year-to-date in almost the entire Midwest has been good, and new jobs translate into newly rented apartments and office leases,” says Nordby. “Most of the Midwest has little exposure to the energy markets, which have been hurting since energy prices began falling two years ago.”

Multifamily construction in urban Chicago and Indianapolis is solid, and apartment supply pipelines are expanding in Ohio as well. “Demand for multifamily assets has been very strong in the metros that have had solid job growth,” Nordby says.

“Homeownership rates are down and construction, until 2013, was pretty low all over the Midwest, so these are the salad days for apartment owners in the region.”

Illinois

Last June, global fast-food giant McDonald’s announced plans to move its corporate headquarters from the Chicago suburb of Oak Brook, Illinois, into the city by 2018—specifically to the former site of Oprah Winfrey’s Harpo Studios in Chicago’s Fulton Market District. McDonald’s executives say the move is being made in part to appeal to the younger, metropolitan workforce that prefers walkable neighborhoods, public transit, and a mix of recreational amenities. McDonald’s is following companies such as Kraft Heinz, ConAgra, and Motorola Solutions to more urban locations.

Because of sustained corporate migration from the suburbs and the limited availability of high-quality high-rise office space, Chicago’s central business district (CBD) remains a strong landlord’s market, with rents exceeding historic highs and minimal concessions being offered, says Robert Patterson, a research analyst in the Chicago office of Colliers International. The Chicago CBD vacancy rate in the third quarter was 10.9 percent, down from 12.5 percent during the same period in 2015, Patterson says; rents increased $1.34 to $37.50 per square foot ($14.42 to $403.65 per sq m).

“The seemingly never-ending exodus of corporate headquarters from the suburbs continues,” says Patterson. The largest lease transaction of the 2016 third quarter was Wilson Sporting Goods’ deal to move its global headquarters from near O’Hare International Airport into 80,000 square feet (7,400 sq m) of space at One Prudential Plaza downtown, he says.

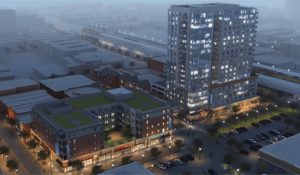

Elevate Oak Park, a multibuilding transit-oriented development in the Chicago suburb of Oak Park by Lennar Multifamily Communities and Chicago-based Clark Street Real Estate, will house 271 residential units and a 22,000-square-foot (2,000 sq m) Target store. The project is scheduled for completion this summer. (CLARK STREET REAL ESTATE AND LMC, A LENNAR COMPANY)

Such relocations are driving multifamily development. “Chicago’s economy is robust and jobs are being created,” says Joel D. Rubin, a partner in the local law firm of Seyfarth Shaw. “We’ve seen substantial multifamily construction in the last few years, and the West Loop area has become very hot for development. We’re seeing a lot of new multifamily buildings going up in Lincoln Park, too, as well as neighborhoods to the south.”

Strong demand for investment in projects and some 9,000 apartments set for delivery over the next two years indicate the sector is poised to remain busy. Local real estate development and investment firm Golub & Company opened five multifamily developments totaling some 2,000 units in the Windy City in 2016, including 1001 South State, a 40-story, 397-unit building; the 490-unit, 45-story Moment; and Sienna, with 50 rental units spread over five floors.

“Chicago is a transportation-rich global city that is benefiting from both larger demographic trends and its own unique attractiveness to renters,” says Lee Golub, the company’s executive vice president. “The city’s walkable neighborhoods are attractive to young people and ‘boomerang boomers’ alike. Those factors, coupled with many corporations moving all or part of their workforce from the suburbs to downtown, have pushed demand for luxury apartments to historic levels in the city.”

In addition, there is a new influx of investment in streetcar suburbs, including Oak Park, one of the most active Chicago areas for development over the past five years. Four downtown transit-oriented development projects are expected to deliver more than 1,000 residential rental units and 70,000 square feet (6,500 sq m) of commercial space in Oak Park by 2019, says Viktor Schrader, economic development manager at the Oak Park Economic Development Corporation. “In addition, there are two luxury for-sale condominium buildings in the works that are geared toward families that are downsizing,” he says. “While small—11 units and 28 units—these condo developments are some of the first in the western suburbs in ten years.”

The neighborhood has benefited from the rise of institutional capital’s interest in mixed-use rental development, says Schrader. “Oak Park land-banked key sites and lowered financial and administrative barriers to entry to ensure that this growth spurt continued,” he says. “These factors have aligned in recent years to create an ideal urban development opportunity.”

KA Inc. assisted with the master planning of the 400-acre (160 ha) East End Campus in Akron, Ohio, consisting of property previously owned by Goodyear Tire & Rubber. The firm performed a feasibility study and master planning for various tenant spaces and common areas of the existing headquarters structure, which includes 17 buildings. (KA INC. )

Ohio

Activity in downtown Cleveland, too, is ramping up quickly with large developments and master-planned communities to support growing interest in downtown living, shopping, and dining.

“The city’s health tech corridor is anchored by established, emerging, and startup medical research and technology companies, which is driving huge demand and extending the edges of downtown,” says Ron Tannenbaum of Cleveland’s Dorsky+Yue International architecture firm. “This district of innovation, and the visionary programs associated with it, is helping to solidify Cleveland’s future.”

Cleveland’s past is also playing an important role in the city’s future as developers embark on renovation and adaptive use. Midwestern cities like Cleveland have a rich industrial and cultural history that lends a sense of authenticity to buildings.

“The renovation of the Ritz-Carlton is one example of the revitalization occurring in Cleveland’s downtown,” says Rich Wilden, director of design at Cleveland-based design firm KA Architecture.

“KA is working with the Ritz owners and designers EDG and Jinnie Kim to modernize the rooms and the amenity spaces to better serve its high-end clientele and meld the Ritz-Carlton brand with local heritage. The renovation will include full-scale wall art of the city’s imagery, harmonized with glass, metal, and light to provide contemporary features juxtaposed with the richness of the original millwork throughout the property,” Wilden says.

Retail development remains strong throughout Ohio, as well. The recently completed Easton Gateway, the latest addition to Easton Town Center in Columbus, has added more than 500,000 square feet (47,000 sq m) of retail space on 54 acres (22 ha) in a format that blends large-format and medium-sized retail space and restaurants, says Kevin M. Zak, principal at Dorsky+Yue, which designed the addition. “It builds on the emotional connection that the town center has with its users by creating warehouse loft office space near the restaurants and shop storefronts,” he says.

American Structurepoint is leading the design of Riverview Health’s new $27 million, 112,000-square-foot (10,000 sq m) Outpatient Care Center (OCC) in Westfield, Indiana. Lean design strategies enabled planners to reduce the original program by 30 percent, creating more efficient, consolidated, and adaptable spaces. The OCC is expected to be completed this year. (AMERICAN STRUCTUREPOINT)

Indiana

Thanks to its growing science and technology sector, Indianapolis is experiencing a robust office market. Last year, San Francisco cloud-computing giant Salesforce leased about 230,000 square feet (21,000 sq m) of space in the 48-story Chase Tower downtown for its regional headquarters. Already one of the largest technology employers in California, Salesforce says the space in the since-renamed Salesforce Tower is part of the company’s expansion, which will create 800 new jobs in Indiana by 2021.

“As tech companies increase their head count—total tech employment in Indianapolis reached over 31,000 in 2015 and is poised to grow even more—they are also growing their footprint in occupying office space,” says Mike Cagna, senior research analyst at financial and real estate professional services firm JLL.

“With tech wages and rental rates among the lowest in the country, Indianapolis will continue to attract tech companies. While the city currently lacks a healthy supply of coworking and incubator space, making it challenging for tech startups to find space, building owners are starting to construct more unique and collaborative spaces.”

American Structurepoint designed the 42,000-square-foot (3,900 sq m) Michigan City, Indiana, Police Station to provide the best security possible while incorporating sustainability and community integration. Located in the Eastport neighborhood of Michigan City, the $12 million station was finished last July. (WILLIAMS)

Indiana is reporting growth in all segments of the real estate sector, from single-family residential to multifamily and mixed use to industrial and logistics, says Neil Myers, founder of Williams Creek, an ecological engineering firm specializing in integrated design. “We expect the level of private investment and public/private partnerships to continue in the months ahead in typical conservative midwestern fashion,” he adds.

Central Indiana is seeing growing demand for urban housing in and around central business districts and adjacent neighborhoods, which experienced disinvestment in the past. “This is all being driven by people’s desire to live in a connected and walkable urban setting,” Myers says. “Our firm is most active in creating urban conditions where connectivity and placemaking are key drivers.”

Multifamily absorption rates in the state are steady, says Jack Lashenik, vice president of American Structurepoint, a multidisciplinary firm in Indianapolis. “However, we are starting to see a slowdown in the design and rate of new land acquisition for multifamily in Indiana,” he says. “Rehabilitation of existing buildings in urban settings for hotel/hospitality is still moderate, depending on the availability of incentives for developers and tenants. The cost of capital is still low, and businesses are even more attracted to Indiana and many of its fast-growing communities because of their AAA credit ratings.”

Industrial built-to-suit for a specific tenant and spec construction are both hot in the region now, Lashenik says. “The increased economic activity near port communities such as Posey County has caught the interest of our state legislators, and Indiana is pursuing a new port facility in southeast Indiana near Cincinnati,” he adds.

Michigan

The expected redevelopment of the Paradise Valley Cultural and Entertainment District will celebrate Detroit’s rich legacy of African American culture with a mixture of retail, entertainment, hotel, office, and residential development. Five developers have committed $52 million to develop nine properties owned by the Detroit Downtown Development Authority. (DETROIT DOWNTOWN DEVELOPMENT AUTHORITY)

Like other cities in the Midwest, Michigan’s major metropolitan areas are being revived. This summer, work is expected to begin on the Little Caesars Global Resource Center, Detroit’s first newly constructed corporate headquarters building in more than a decade and only the seventh since 1950, says Andrew Batson, vice president and director of research in JLL’s Detroit office.

Construction of the nine-story, 234,000-square-foot (22,000 sq m) center—a development of Little Caesars and Olympia Development of Michigan—“will be another boost to Detroit’s impressive comeback story,” Batson says.

The Ilitch family, which started the Little Caesars pizza chain, is also building Little Caesars Arena, a $700 million stadium for the Red Wings National Hockey League team, in the District Detroit, a five-section community connecting midtown and downtown, he says. “The downtown market remains strong,” Batson says. “Since 2012, downtown vacancies have dropped 6 percentage points and rents have climbed 15.5 percent. As a result of these tight market conditions, we expect companies will choose to build their headquarters from the ground up to ensure their presence in the CBD is for the long term.”

The real estate market in Detroit’s downtown and surrounding areas continues to be solid, with a residential vacancy rate of 3.1 percent and numerous multifamily projects in the pipeline, says Moddie Turay, executive vice president for real estate at the Detroit Economic Growth Corporation (DEGC).

“Across the city there are 5,000 new multifamily units proposed or under construction,” says Turay. In parts of the city, apartment rental rates, which are near $2 per square foot ($21.53 per sq m), are rising and soon could reach $2.15 per square foot ($23.14 per sq m) in the downtown area, he says. Neighborhood redevelopment is also accelerating. In the next 12 months, launch of the QLINE street-car line, running through the heart of downtown, is expected, as is the opening of the Little Caesars Arena, he notes.

Plans are also proceeding to transform the area around a small downtown park with a mixture of developments that celebrate Detroit’s rich African American cultural history. The Paradise Valley Cultural and Entertainment District, now under construction, includes $52 million of new investments, including a boutique hotel and mixed-use residential, office, and retail space.

Neighborhood multifamily development in Detroit is accelerating thanks to the expected launch this year of the QLINE streetcar system, owned and operated by M-1 Rail, which will run from downtown through Midtown, New Center, and the North End. The QLINE is projected to generate $3 billion in development, including 10,000 new housing units and 5 million square feet (465,000 sq m) of new commercial space within ten years. To date, $1.3 billion in projects have been completed or are under construction. An additional $275 million in development is also underway. (DETROIT DOWNTOWN DEVELOPMENT AUTHORITY)

Other areas of Michigan are also being transformed, including areas hard hit by General Motors factory closings several years ago. RACER Trust, created in 2011 by the U.S. Bankruptcy Court to clean up and position for redevelopment properties owned by GM before its 2009 bankruptcy, is reporting a number of successes.

RACER sold a building in Flint to an automotive supply chain logistics company that is bringing 150 jobs to the area, says Bruce Rasher, RACER redevelopment manager. Also in Flint, RACER sold a portion of the vacant Buick City property to a firm that is supplying the pipe for a public water project, creating an additional 60 jobs.

In Pontiac, RACER sold land to M1 Concourse, which created an 87-acre (35 ha) facility for auto enthusiasts that includes 250 secured private garages and a state-of-the-art, 1.5-mile (2.4 km) performance track, Rasher says. Also, a buyer turned a former GM property in Moraine, Ohio, into multitenant space filled with numerous companies and sold off a portion to Chinese automotive glass manufacturer Fuyao Glass America for a new plant that is on track to create 2,000 new jobs for southwest Ohio, he says.

The Alexander Company is renovating Milwaukee’s iconic Fortress Building, a six-story, 193,000-square-foot (18,000 sq m) brick-masonry structure. Proposed plans include 132 market-rate, loft-style apartments and 25,000 square feet (2,300 sq m) of commercial space, with expected completion in spring 2018. (THE ALEXANDER COMPANY)

Wisconsin

The Alexander Company of Madison, Wisconsin, is project developer of the $40 million historic preservation of six buildings at Soldiers Home in Milwaukee, which will be operated by the Milwaukee Housing Authority. The development includes renovation of 100 housing units for veterans and their families who are homeless or at risk of becoming homeless. (The Alexander Company)

Financial services and information technology firms are supporting new urban development and increased density in Madison and Milwaukee. “The two cities are seeing revitalization, reinvestment, and new investment,” says Joe Alexander, president of the Alexander Company real estate development firm in Madison.

“We expect continued development of office and market-rate multifamily projects. There is also an increasingly pent-up market for condominiums and urban townhomes. Driven by the millennial generation’s desire to live/work/play in an urban setting, Madison has seen an explosion of new projects incorporating a mix of residential, retail, and office.”

The past year was one of the most active years for downtown Milwaukee in over a decade, says Kyle Koller, research analyst at JLL. In 2016, more than 350,000 square feet (34,000 sq m) of office space was delivered, three office towers traded hands in a $170 million deal, and over 190,000 net square feet (18,000 sq m) of Class A office product was absorbed, he says. “Such interest has left increasingly fewer blocks of Class A space in downtown, with multiple full floors claimed over the past three quarters,” he says.

Local developer Irgens last year completed Milwaukee’s newest office tower, the 18-story, 358,000-square-foot (33,000 sq m) 833 East Michigan. “Milwaukee is still a pace behind historical office tower development patterns,” Koller says. “Milwaukee could likely sustain another office tower of roughly 300,000 square feet [28,000 sq m]. A handful of developers have proposed multiple office towers and are waiting for a committed anchor tenant to break ground.”

The city’s hospitality sector remains robust. Milwaukee-based developer Jackson Street Holdings is proposing a major addition to the Wisconsin Center convention facility that would include three hotels, more than 100,000 square feet (9,000 sq m) of convention space, and 22,000 square feet (2,000 sq m) of food and beverage outlets on a two-acre (0.8 ha) site downtown, notes Thomas Miller, principal and housing and hospitality team leader at Milwaukee-based design firm Kahler Slater. The expansion would include 506 rooms in a trio of hotels atop a new station along Milwaukee’s planned streetcar line, all connected to Wisconsin Center by a skywalk.

“The city’s strong economy is driving conferences and conventions,” says Miller. “There is demand for additional meeting space and a need for more hotels. The city is analyzing Jackson Street’s proposal, and the three hotel flags haven’t yet been finalized.”

Milwaukee is also seeing revitalization of historic structures, including one of the city’s most recognizable edifices—the Fortress Building, a six-story, 193,000-square-foot (18,000 sq m) brick-masonry structure. The proposal for the building, slated for completion of construction in spring 2018, includes a mixed-use component of 132 market-rate, loft-style apartments and 25,000 square feet (2,000 sq m) of commercial space, says Alexander.

Eagle View Partners has developed the second new mixed-use building, MU1, for downtown Cedar Falls, Iowa, as part of the River Place Development. The first building was completed in 2015. Designed by Slingshot Architecture, the second building includes 30 residential units and 20,000 square feet (1,900 sq m) of retail, restaurant, and office space. Slingshot is now working on a mixed-use building to the north centered on a large gathering plaza that binds the development together. (Slingshot Architecture)

Iowa

With values increasing at a moderate rate, the state is experiencing a healthy residential real estate market. Iowa’s two major cities—Des Moines and Cedar Rapids—are reporting solid activity, says Kirk Hiland, managing broker at NAI Iowa Realty Commercial in Cedar Rapids.

“Real estate in Iowa is typically stable, without large swings in value,” he says. “Growth should be steady but not spectacular in the near future, primarily influenced by demand with a minimal speculation market.”

Driven by the insurance and financial industries, along with state government, growth throughout the Des Moines metro area has been impressive. Recently, seven tower cranes dotted the city skyline and numerous streets were closed for construction, says David Voss, principal at Des Moines–based Slingshot Architecture.

“The city has been very involved in planning initiatives over the last 15 years, and the current economy is really driving forward that hard work,” he says. “Multifamily projects are typically leased prior to completion, and developers are still moving forward with future projects, including multifamily with ground-level commercial and new office, including renovations.”

Among the projects under construction in Des Moines are the 120unit Eagle View Lofts by Johnston, Iowa–based Hansen Real Estate Services; Hansen’s 23-unit Eagle View Townhomes; Hubbell Realty Company’s 5Fifty5 townhouse development with 47 units; and Hubbell’s five-story 65-unit Dwell Apartments—all scheduled for completion this year.

In Cedar Rapids, the central business district continues to be redeveloped after the devastating 2008 flood that enveloped much of the downtown, says Hiland. “New housing, new and rehabbed office space, and a rebuilt hotel convention complex have highlighted the reconstruction of downtown Cedar Rapids,” he says. “The expansion of major employer aerospace and defense giant Rockwell Collins continues a realignment of office space.”

Thanks to job expansion, the desire of millennials to live downtown, and a strong push for refurbishment, development in the Midwest continues. The real estate sector in this part of the country did not soar to unsustainable heights during the good times and did not fall into the depths during the bad times. Real estate entrepreneurs in the region believe slow and steady always wins the race.

Mike Sheridan is a freelance writer based in Richmond, Virginia.