Many office property owners are heading for the exits amid weaker demand and looming debt maturities, while opportunistic private equity groups are leaning in to capture what could be once-in-a-generation buying opportunities.

“This is a moment in time where there is a lot of distress and more distress coming. But that distress is going to create opportunities for capital to step [in], make some bets, and get really good risk-adjusted returns,” says Mike McDonald, a senior managing director in the Dallas office of JLL Capital Markets, Americas. The house view from JLL is that there will be opportunities to generate alpha returns in the office sector over the next five years.

The caveat is that it is a “stock picker’s” market, meaning that investors need to be very cautious and selective in choosing deals that have the potential to deliver outsized returns. “It’s not like it was coming out of the RTC [Resolution Trust Corporation], where you could have literally bought anything and made money,” says McDonald.

Investors tend to be cautious about buying assets in the right location and with qualities that not only meet the demands of today’s tenants but also the demands of capital from a liquidity standpoint. Buyers also are paying close attention to such basics as current cash flow, creditworthiness of tenants, and weighted average lease term. And the basis, or purchase price, is more important than ever.

One of the frustrations in the office market is the difficulty of finding good sale comps, because pricing ranges across the board, from deep discounts to sales that are generating records in their respective markets. “The story is a little bit of a mixed bag,” says Victor Gutierrez, vice president at Ten-X Commercial. In terms of what buyers are willing to bid on office properties, Ten-X is testing the market every two weeks, and results vary widely. “I usually pride myself in being able to predict what’s going to happen at auction, and I am so wildly off today [that] it’s not funny,” he says.

The final pricing and the number of interested bidders is very asset- and market-specific. Gateway markets still seem to be experiencing plenty of demand. For example, Ten-X has seen success for those office property sales located just outside New York City in suburban New Jersey, downtown D.C., and suburban Virginia. “When you go into secondary or tertiary markets, or even suburban office buildings, it’s very tough right now,” Gutierrez says.

Sharp drop in deal flow

Commercial real estate transaction activity is down across the board, and office sales are taking a bigger hit. At the end of the third quarter, office sales so far this year totaled $36.6 billion, which represents a 62 percent drop in activity compared to last year and a bigger step back than the 55 percent decline in total transaction volume. The $10.6 billion in office sales that occurred in the third quarter marked the weakest volume since the first quarter of 2010, according to MSCI Real Assets.

Despite the focus on distress, properties are coming to the market for various reasons. “There are definitely some ‘must sell’ situations involving distressed assets or those looking to beat maturing loans. However, there are also plenty of want-to-sell motivations,” says Russell Ingrum, vice chairman, capital markets at CBRE. Some owners are looking to get ahead of potentially bigger pricing declines or are facing pressure from a loan maturity, tenant turnover, or major cap-ex event. Some funds are reaching end dates, and some owners want to sell solid office assets to raise capital or rebalance portfolios.

According to McDonald, the early part of 2023 brought more sales activity driven by institutions that were selling higher-quality, tier-one office assets to balance portfolios, reduce their weight in office, and remove from risk their balance sheets. Since then, the market has evolved to include owners who were selling because they faced distressed situations and loan maturities. “Right now where we are is early stages in terms of where we’re going. It’s like the third inning of a baseball game, but the game is a day-night doubleheader,” he says.

Finding a bottom on pricing

Most office buyers are private equity groups, family offices, and ultra-high–net worth individuals who bring cash to the table or can negotiate seller financing. Private equity groups see a real opportunity because of the dislocation in the market. Although some exceptions exist, institutions have largely moved to the sidelines for now and could remain there until early to mid-2025.

Across the board, a tough market endures due to higher interest rates, uncertainty on pricing, and tighter liquidity for commercial real estate. Some listed or auction properties are struggling to meet reserve prices in a market that is shifting quickly. “The debt market is inefficient, and the outcomes are variable,” Ingrum says. “You can have a willing seller and a willing buyer, but if you don’t have a lender, the deal doesn’t get done.”

Ten-X quantifies transaction activity on its platform by its trade rate, with a typical goal of achieving a 60 percent trade rate. That trade has drifted lower for office, from 66 percent in 2021, to 52 percent in 2022, and now to 45 percent, year-to-date, in 2023. Effectively, that means sellers are not hitting their desired price target or reserve price. A disconnect exists between the price a seller wants to achieve and what buyers are willing to pay. The view that office prices will move lower over the next 12 months, as loans mature and the volume of distress in the sector rises, exacerbates that gap.

Although buyers and sellers are trying to get a better read on pricing, there is a broad range in sales comps across the country. According to MSCI, the average price per square foot on office sales occurring during the third quarter dropped 11.1 percent to an average of $220 per square foot ($2,315.35 per sq m). The top three markets that experienced the biggest declines in pricing on a percentage basis are:

- San Francisco, which dropped 39.8 percent to average $448 per square foot

- Manhattan, where prices declined 24.4 percent to average $549 square foot

- Orange County, California, where prices fell 17.2 percent to $298 per square foot

Meanwhile, some markets are reporting office sale prices that are holding steady or even inching higher on a year-over-year basis. The top three markets that reported the biggest gains in sale prices during the third quarter are:

- Houston, where office property prices increased 7.7 percent to average $194 per square foot

- Cincinnati, which had prices climb 4.7 percent to $130 per square foot

- Nashville, where office properties rose 4.1 percent to $328 per square foot

More distress ahead

The expectation is that distress and loan maturities will continue to drive more transaction activity in the coming year. According to MSCI, office is now the leading sector in the amount of current and potential distress ahead. At the end of the third quarter, there was $32.5 billion in distressed office assets, including both financially troubled and bank-owned assets. MSCI estimates potential distress in office to be an additional $50.3 billion. The research firm quantifies that potential distress as having—if not reconciled—the potential to become full-blown financial trouble.

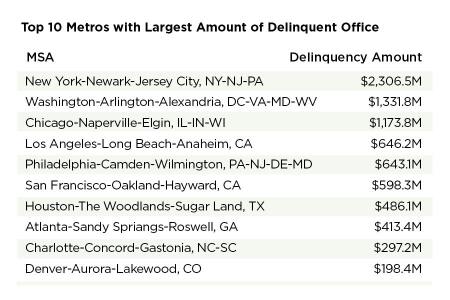

The latest data from Trepp shows that office stress is continuing to rise. In September, the volume of delinquent CMBS office loans increased to 5.58 percent, and the volume of office loans now with special servicers jumped to 8.34 percent. The MSA with the largest amount of delinquent office space is New York-Newark-Jersey City, with $2.3 billion in office delinquencies, followed by the Washington, D.C., MSA at $1.3 billion.

Although there are different ways to track distress and impending distress, actual distressed trades are still quite low, notes Abby Corbett, senior economist and head of investor insights at Cushman & Wakefield. Over the last 12 months, distressed sales have accounted for about 1.6 percent of total transaction activity, with distressed office at a slightly higher level, 2.6 percent of total office transactions. “Ultimately, this speaks to the fact that we are still very early along in the price discovery period,” she says. It’s also worth noting that distressed trading activity unfolded over the course of seven years following the Global Financial Crisis, and we expect this distress cycle to unfold in a similar manner, she adds.

On the buy side, many different strategies are in play. Some investors are hoping to pick up quality office assets at bargain prices, while other buyers may have a repositioning, redevelopment, or conversion plan for a property. Income-focused buyers want strong tenants and are trying to avoid near-term repositioning risk, given the current market challenges related to elevated vacancies.

“There are still investors out there that like the office product and are willing to take a chance or make a contrarian bet on office,” says Gutierrez. Buyers with an opportunistic view believe they can buy a distressed office property at a lower basis and drop their rents to attract tenants and stabilize the asset. Their goal is to generate positive cash flow and, ideally, also raise the value of the asset over the hold period. “I think the office market definitely has its challenges, but I also think environments like this [one] create a lot of opportunities to buy nice, well-located buildings that will have an office demand and an office use in the future,” he says. “If you can find those deals as an investor and you’re willing to take a chance, I think now it’s actually a really good time to buy.”