Commercial real estate lending in the United States continued to grow in the second quarter, led by a surge in commercial mortgage–backed securities (CMBS) mortgages, according to the latest research from CBRE.

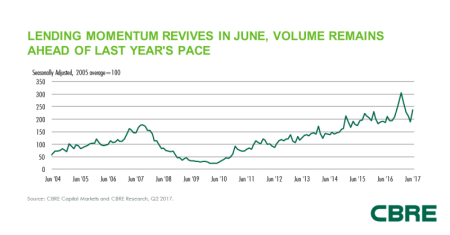

Despite an increase in short-term interest rates by the Federal Reserve in June, capital markets remained favorable in the second quarter, with rising equity prices, tight spreads, and limited volatility. The CBRE Lending Momentum Index shows that U.S. commercial loan closings edged higher between March and June and are 27 percent above their year-earlier level. Volume improved across all major lending groups, with CMBS conduits leading all other lenders in terms of market share.

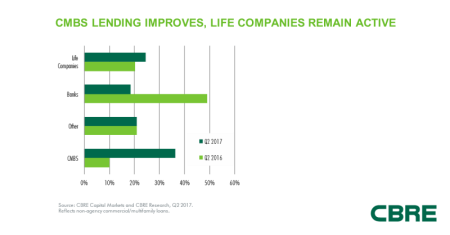

Reflecting the favorable capital market environment, CMBS issuance revived in the quarter, lifting year-to-date issuance to $38.8 billion, well ahead of 2016’s pace of $30.7 billion. CMBS conduits accounted for 36 percent of nonagency origination activity in the second quarter, well above the 16 percent market share in the first quarter and 10 percent market share a year earlier. While the increase included a large Manhattan office loan in the second quarter, it generally reflects stronger industrywide CMBS origination volumes.

“The overall lending environment is well supplied with debt capital from all sources,” said Brian Stoffers, global president, debt and structured finance, for CBRE Capital Markets. “CMBS, life companies, banks, and alternative lenders are all actively issuing bridge and permanent financing quotes. The recent surge in CMBS mortgages demonstrated that these lenders are becoming increasingly comfortable with risk-retention rules that kicked in at the end of last year.”

Life companies also continued to post strong origination activity, accounting for over 24 percent of nonagency commercial loan closings. That level was down from their 38 percent market share in the first quarter, but above their 20 percent share a year ago. Banks accounted for 18 percent of loan volume, down from 26 percent in the first quarter and almost 50 percent a year ago.

“We remain cautiously optimistic regarding commercial real estate debt availability for the second half of 2017.” Stoffers said. “Debt is still attractive in terms of rates and spreads, while the yield curve has tightened significantly in the past six months. Lending terms remain reserved, with LTVs [loan-to-value ratios] and DCRs [debt coverage ratios] in relatively conservative ranges compared with aggressive periods preceding significant downturns. Meanwhile, the supply/demand equilibrium is largely in check, with no massive overbuilding apparent in any sector.”