Over the last 18 months, commercial real estate loans have been maturing at a torrid rate, in a rapidly evolving marketplace. Although economic growth remains resilient, commercial real estate oversupply, growth in operating expenses, higher leverage, and the cost of debt are creating headwinds for commercial real estate asset values. Moreover, roughly $2 trillion in commercial real estate loans will mature by the end of 2026.

Lenders and commercial real estate industry participants already struggle with higher interest rates, oversupply, and financing issues. All these factors have put added pressure on the most important aspects of commercial real estate: value and cash flow. With rising foreclosures and the looming level of loan maturities on the horizon, how are lenders addressing the issue of loan refinancings? Before we answer the question, lets level-set the current environment.

The U.S. economy is healthy, but growth has moderated

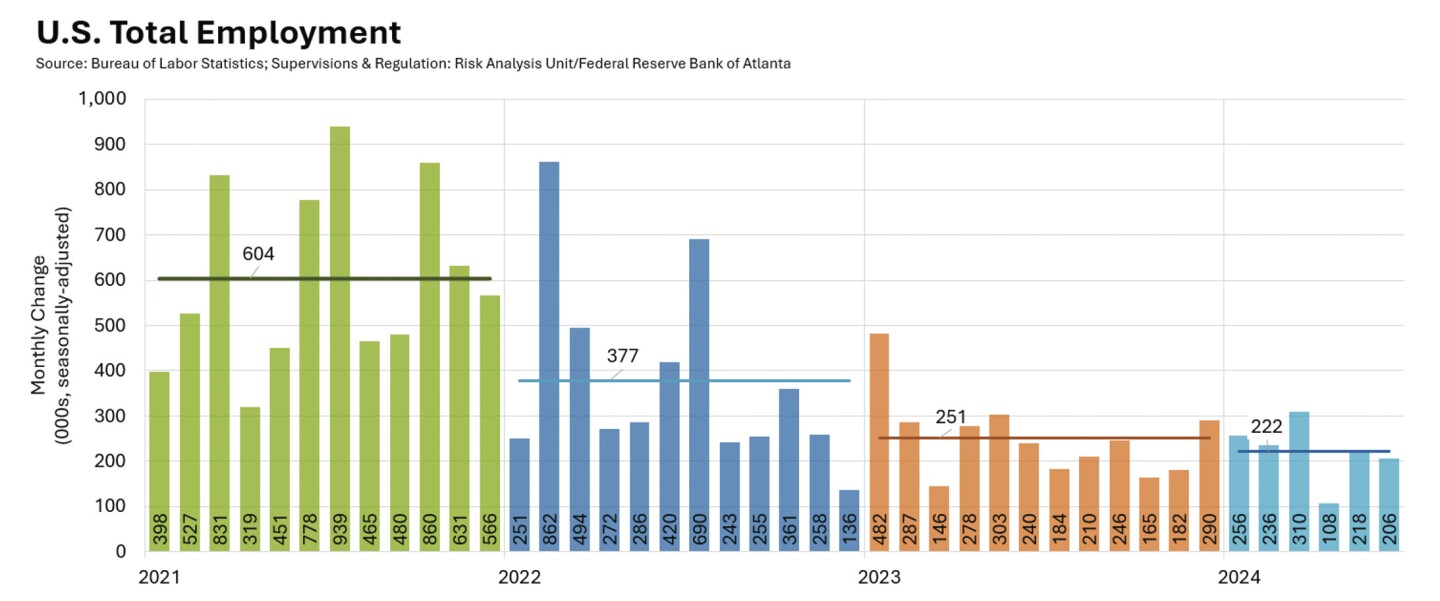

Challenges facing commercial real estate need to be viewed in the context of broader economic performance. Although continuing to expand during the first half of 2024, the nation’s economic growth has moderated versus the latter half of 2023. Real gross domestic product (GDP) increased by 4.9 percent and 3.4 percent in the third and fourth quarters of 2023, respectively. Growth cooled to 1.4 percent in the first quarter of 2024, followed by 2.8 percent (an advance estimate) in the second quarter. According to the Atlanta Fed’s GDPNow, real GDP growth was tracking at 2.1 percent in the third quarter, as of September 4, 2024. GDPNow’s results are indicating that some slowing in the economy is occurring. This moderation is supported by the slowing job growth results for the months of July and August.

Similarly, consumer spending remains resilient and continues to drive economic growth; however, economists and retailers are noting that some lower-income cohort finances have experienced more stress due to inflation. Concurrently, consumers appear to be seeking cost savings via discounts and, in some cases, trading down from one product to a cheaper substitute.

The stress caused by changing consumer purchase decisions is affecting retail commercial real estate, as retailers continue to announce store closings. Such retailers as Big Lots, Walgreens, Family Dollar, Rue 21, and 99 Cents Only all announced store closures in 2024. Still, downward pressure on inflation and real wage growth, which should allow discretionary income to continue to grow, are positives for the commercial real estate industry.

Commercial real estate conditions make for a mixed bag

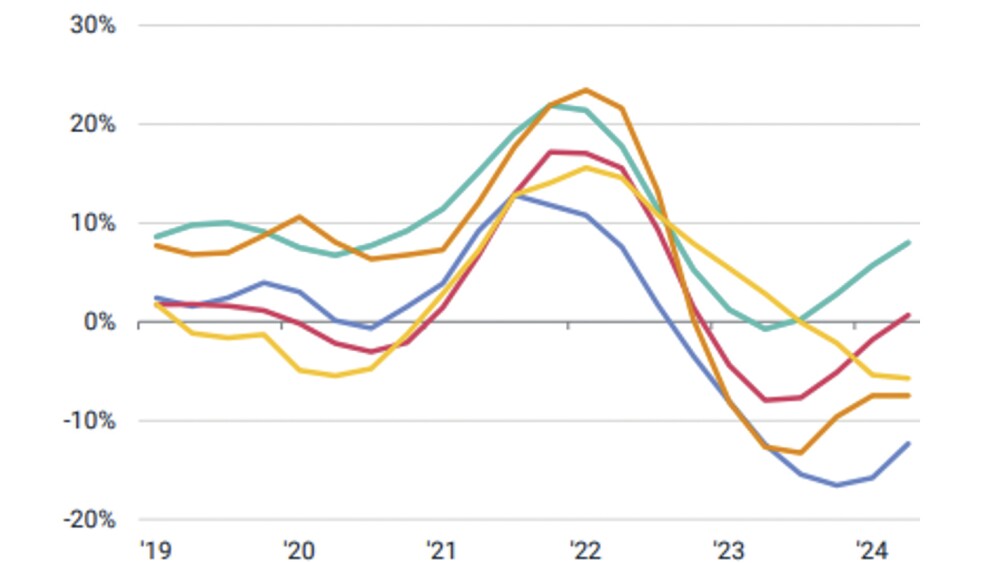

Mixed commercial real estate conditions and downward pressure on property net operating income are affecting the ability to refinance the wall of maturities. On a global scale, expenses have been rising at atypical rates and, in some cases, faster than rents have. In 2022 and 2023, depending on the location and type of property, several expense items—property taxes, insurance, and labor and utility costs—grew at double-digit rates. In 2024, expense growth has begun to moderate.

Generally, the office and multifamily sectors are still encountering weakness, as vacancy rates continue to rise and rent growth is flat to negative. Multifamily vacancy rates have risen significantly over the past year. In such markets as Atlanta, Austin, Dallas, and Nashville, multifamily vacancies have reached levels not encountered since 2009. A large share of these vacancies is occurring in luxury and high-end units, which translates into declines in rent, net operating income, and property value, which in turn is leading to refinancing issues.

Thren again, retail commercial real estate remains healthy, with suburban properties outperforming their central business district counterparts. Some recent softness occurred in industrial commercial real estate, particularly as more warehouse/distribution space enters the market. However, industrial vacancies are coming off all-time lows in several markets, so some added vacancy is causing rent growth to moderate versus the double-digit levels experienced in 2023. For added analytics and insights into commercial real estate, the Atlanta Fed’s Commercial Real Estate Market Index assists the public in tracking and understanding those conditions in more than 350 markets.

Uncertain commercial real estate asset values

Asset values have been influenced by a combination of higher interest rates, growing expenses, and declining revenues. This mix led to reduced transaction volume, which can have implications for accuracy in valuations.

Asset values, in general, have been in a state of flux since the start of the decade. The onset of the pandemic put pressure on retail and hotel property values. Then, with pandemic support payments underpinning economic growth, price growth accelerated. Beginning with the office sector in late 2021, asset pricing started to weaken and eventually declined in 2022. As of mid-2024, asset pricing trends appear to be reversing, as the rate of decline is lessening.

Note that the trends discussed here are general in nature. Value is location- and property-specific. Circumstances exist wherein a significant deterioration in value has occurred. In some cases, value is off by 50 percent or more.

Also, gauging value is challenging. In one instance, three large brokerage companies valued the same office building for a lender over a span of three weeks. Their opinions of value ranged from $8 million to $32 million. Owners and lenders make decisions amid such a wide range of value only with great difficulty.

The highest and best use of some office properties—as driven, in part, by changing use in the office sector—is to raze the sites and turn them into vacant land. Asset values are also being affected by changes in the availability of finance.

Financing

Financing is among the most challenging areas of commercial real estate today. Issues driven by higher debt costs and declining values continue to have profound implications for the sector. With the Great Financial Crisis in the rear-view mirror, commercial real estate lenders have been generally more conservative with their underwriting and loan risk profiles. This caution has put them in a better position to deal with industry volatility and uncertainty linked to changing economic conditions. Compared to their footing in the Great Financial Crisis, lenders are better capitalized now and have improved their capabilities in commercial real estate.

However, the wide disparity among declines in value have put many lenders in the unusual position of having to deal with loans that carry an atypical higher amount of risk. This risk materialized not only from the current, more normalized rate environment but also stems from higher operating expenses, less affordable multifamily rents, and greater space efficiency in the office sector.

Lenders must navigate a myriad of situations in today’s changing environment—whether the loan is current or new; and whether the borrower is in good standing, among others. These factors, alongside many others, will influence the refinancing of the sizable number of commercial real estate loan maturities.

Lenders’ responses to the downturn in value and to added loan risk have varied widely. Part of their response has been dictated by the borrower’s standing. If the borrower is fulfilling obligations, lenders are working with them. A primary strategy is to adjust the loan maturity in return for additional equity, the pledge of collateral, or both.

Strengthening loan covenants is another tactic some lenders are using. Doing so creates greater transparency, lender control, and safeguards on the funds from the property. In cases where a property is not cash-flowing and the borrower is not supporting the loan, investor-related firms are foreclosing or selling the note. In the case of regulated lenders, some are resorting to note sales.

In the case of new loans, lenders have tightened underwriting standards and retrenched with their most qualified borrowers. At the same time, lenders admit to strong competition for the small segment of available loans. In some instances, robust competition means that some lenders have reported easing back on covenants and pricing.

To be or not to be concerned

With more foreclosures occurring and greater amounts of maturities on the way, should there be concern regarding the vast wall of commercial real estate loan maturities? Although the market continues to navigate the challenges, several reasons for elevated concern linger. First and foremost is the inability to accurately gauge value. The lack of surety around accurate values creates added uncertainty, which in turn can delay transactions, generate greater underwriting risk, and lead to a host of other substantive issues. Additionally, early this year, debt costs exceeded equity. As debt became more costly than equity, many projects were unable to refinance. Recently, rates on debt appear to be receding, which may allow for more projects to be financed.

The vast amount of loans that are being prolonged for modest durations creates more unknown factors for both lenders and borrowers. A resilient economic climate has provided strength during a period of mixed commercial real estate conditions. If the slowing becomes more pronounced, though, then there could be added pressure on demand factors such as increased vacancy and declining rents, which could contribute to slow refinancings and transactions.

(These thoughts are solely the author’s and not those of the Federal Reserve System or the Federal Reserve Bank of Atlanta. Article data is as of September 6, 2024.)

Further reading:

August ’24 Economist Snapshot: Commercial Real Estate’s Impending Wall of Debt Maturities

The Countdown to the End of Extend and Pretend

Cracks Appearing in U.S. Office Sector Lending; More Pain Ahead?

![brian_bailey-pic[1].jpg](https://cdn-ul.uli.org/dims4/default/fcdc1a3/2147483647/strip/true/crop/500x705+0+0/resize/450x635!/quality/90/?url=https%3A%2F%2Fk2-prod-uli.s3.us-east-1.amazonaws.com%2Fbrightspot%2Fb3%2F3f%2F90b26f3f4bbb951530d007c825a2%2Fbrian-bailey-pic1.jpg)