Asia Pacific

Insights, trends, and innovation shaping real estate and urban development across the Asia Pacific region’s dynamic markets and cities.

Members of ULI’s Asia Pacific Tech Council discuss the potential long-term impact of the coronavirus pandemic on the real estate industry.

A new industry-led initiative by Tishman Speyer China, mindful MATERIALS, and GIGA is pushing for accelerated action on improving the transparency of building materials data, starting with embodied carbon.

ULI MEMBER–ONLY CONTENT: Real estate investors gathered for a panel at the ULI China Real Estate Investment Summit said they are optimistic about continued opportunities in China across a broadening group of sectors and product types, a position echoed by a second panel featuring Chinese developers. The summit was held in December with both virtual and in-person participants, as well as tours in Shanghai.

ULI MEMBER–ONLY CONTENT: With recovery from the global pandemic well underway, China has areas of stability and opportunity it can capitalize on as it enters the new year, panelists said at the ULI China Real Estate Investment Summit in December. China is expected to be the only G20 economy to have seen economic growth in 2020.

While the success of Asia Pacific governments in containing the spread of COVID-19 has helped limit its impact on local real estate markets, concerns are growing that a correction may be in the cards next year, according to the Emerging Trends in Real Estate ® Asia Pacific 2021report. Singapore, Tokyo, and Sydney continue to rank as the top three markets for investment and development prospects in the region.

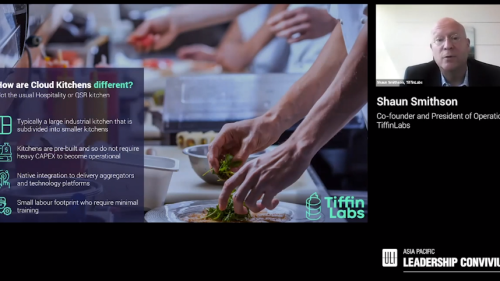

Well-prepared food of practically any cuisine you can imagine, delivered to you with the help of busy drones and robots. In the not-too-distant future, this could be an everyday reality for people in cities all over the world, said a speaker at the the ULI Asia Pacific Leadership Convivium.

Office workers across the Asia Pacific region are returning to the office at varying paces, taking into consideration government directives and company policies. Though the permanent impact of remote working remains to be seen, landlords will need to innovate and adapt to a changed environment, said participants in ULI Asia Pacific’s latest FutuRE of Cities and Communities webinar.

ULI MEMBER-ONLY CONTENT: The tendency to isolate yourself from the outside world by sheltering at home could be an enduring effect of the coronavirus pandemic, Miki Tsusaka, managing director and senior partner in the Tokyo office of Boston Consulting Group, said in early September at ULI Asia Pacific’s REImagine conference.

Global growth in e-commerce spurred by the coronavirus pandemic is boosting investor interest in a “new economy” asset class dominated by data centers and logistics facilities, speakers said in early September at a session during the ULI Asia Pacific REImagine conference.

ULI MEMBER–ONLY CONTENT: Every major global economy except Mainland China will see a decline in growth this year due to the coronavirus pandemic, said Janet Henry, chief global economist at HSBC, as part of ULI’s REImagine event.

Singapore

Known as a multicultural melting pot, Singapore is one of the world’s most forward-thinking cities on embracing density, sustainability, and livability as guiding principles for urban design and development in a resource-constrained environment.

Dr. Cheong Koon Hean, a widely acclaimed architect and urban planner credited with shaping much of Singapore’s urban landscape, has been named the 2016 recipient of the ULI J.C. Nichols Prize for Visionaries in Urban Development. Dr. Cheong, the 17th Nichols laureate and the first from Asia, was honored during the 2016 ULI Fall Meeting in Dallas.

Singapore’s Urban Redevelopment Authority has transformed Marina Bay into mixed-use urban neighborhood. public open space, and source of drinking water for the country’s 5.4 million residents.

Hong Kong

Hong Kong is famous for its hospitality industry, but the sector has been under fire for the past three years. Even so, the hotel and food and beverage (F&B) industries have shown resilience and adaptability said panelists during a ULI Hong Kong conference in September.

The Hong Kong government’s recent decision to embrace a new tendering process for the sale of a prime parcel of waterfront land adjoining the Central business district marks a welcome departure from longstanding policy. In the past, such tenders were invariably awarded to the highest bidder without regard to the quality of the proposed development. Now, however, use of a “two-envelope” approach to sell the plot, known as Site 3, means that design also becomes part of the equation.

Communities around the world are racing to control the spread of the novel coronavirus and the disease that it causes, COVID-19. Increasingly, that means implementing aggressive social distancing measures, which can inhibit the spread of the virus and flatten the transmission curve. Given what is known about the virus so far, using building strategies to help slow the spread of the disease makes sense to help protect those who must work in an office or commercial setting and in multifamily settings.