While the success of Asia Pacific governments in containing the spread of COVID-19 has helped limit its impact on local real estate markets, concerns are growing that a correction may be in the cards next year, according to the Emerging Trends in Real Estate ® Asia Pacific 2021report. The 15th edition of the regional real estate forecast report is jointly published ULI and PwC.

The report, which is available on ULI Knowledge Finder, names three markets where stress seems likely to surface. Firstly China, where a liquidity squeeze is creating bank financing challenges for smaller developers. Secondly India, where the implosion of local nonbank finance companies has created opportunities for foreign private-equity funds. And lastly Australia, where the economic impact has been most acute and greater market transparency is likely to open up more buying prospects.

Singapore, Tokyo, and Sydney continue to rank as the top three markets for investment and development prospects in the region. These markets are each promising a sense of safe harbor in an increasingly hostile global environment, both in terms geopolitical and economical risks. Seoul rose steeply in this year’s investment prospects rankings as South Korea enjoys the benefit of a deep domestic economy that allows assets to be brought or built with a view to serving domestic demand rather than outwardly facing geopolitical risk. Ho Chi Minh City once again is seen as the sole emerging-market city with the best prospects for growth, boosted by its successful containment of the pandemic and a rapidly growing economy spurred by the escalating China/U.S. trade tensions.

David Faulkner, president of ULI Asia Pacific, said: “The Asia Pacific region has been remarkably resilient to the challenges faced by coronavirus, particularly compared to Western markets, but we expect to see some market correction. Despite the common rhetoric that the pandemic has ignited many changes to our society, what we have seen so far in the real estate sector is an acceleration of trends already underway before the arrival of COVID-19. ESG themes are one example of this, as is a movement by developers towards designing general-purpose structures that can be adapted to serve multi purposes over their lifetimes.”

“2020 has certainly been a challenging year for Asia Pacific real estate, witnessing a steep decline in transaction volumes,” said K.K. So, Asia Pacific real estate tax leader, PwC. “However, investors in the region remain nimble and are already grasping opportunities emerging from the crisis. While remaining focused on mainstream asset classes, they are also looking at other sources of reliable income streams in a down-trending market.”

The report highlights that logistics will probably be the asset class that emerges from the pandemic strongest since it continues to witness sustained demand, driven by a number of cyclical and structural drivers, in particular the robust growth in e-commerce. Meanwhile, residential sectors in the Asia Pacific region have remained surprisingly resilient to the impact of COVID-19, despite threats of economic downturns. In an environment of uncertainty, this upbeat consumer sentiment, together with an equally reliable long-term mortgage and rent payment track record, earmarks the residential sector as a defensive asset class that investors in the region are now targeting.

Other trends of note cited in the report include the following:

- Asian companies are divesting real estate corporate assets in the form of sale-and-leaseback transactions;

- Positive signs are pointing to growing demand for green debt in the Asia Pacific region;

- Respondents in the Asia Pacific region tend to be less in favor of a long-term work-from-home trend;

- Travel bans have affected markets with more international investors, such as Australia;

- There is a standoff between buyers and sellers over asset pricing; and,

- Hot desking may soon be a thing of the past.

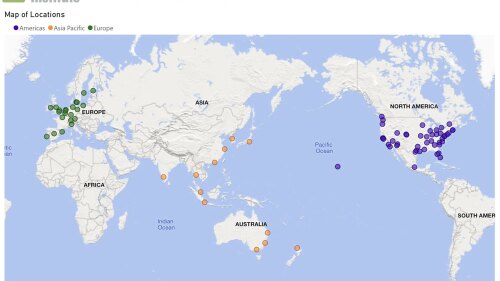

The Emerging Trends Asia Pacific report is based on a survey of 391 real estate professionals, as well as 134 interviews, including investors, developers, property company representatives, lenders, brokers, and consultants.

Access this report and others on demand in Knowledge Finder.