Demand for industrial space has pushed vacancies to historically low levels. But the high tide may no longer be lifting all boats. A surge in new supply along with a growing appetite for more modern facilities is putting more pressure on the sector’s aging building stock. Legacy buildings are having a tougher time keeping up with the changing demands of today’s space users.

“Advancements in technology and the functionality of new buildings, material handling systems, and the overall supply chain have been continuously improving and evolving,” says Jack R. Cline Jr., president of Lee & Associates in Los Angeles. Legacy logistics companies in particular are utilizing more advanced logistics systems that emphasize efficient movement of freight. Among the key features that logistics tenants require is adequate space for container/truck staging, ceiling heights of 36 to 40 feet, high door-to-square footage ratios, and more substantial power service.

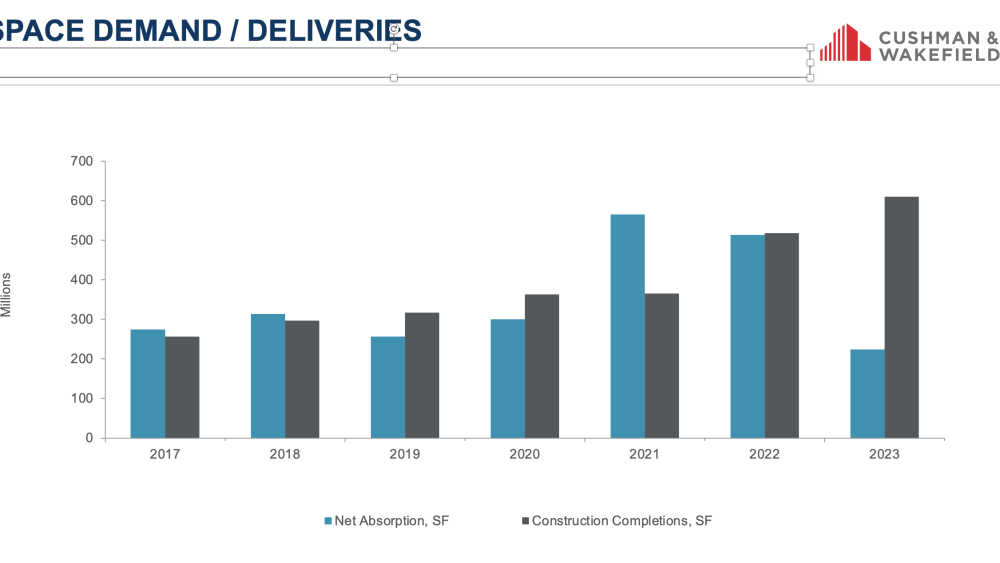

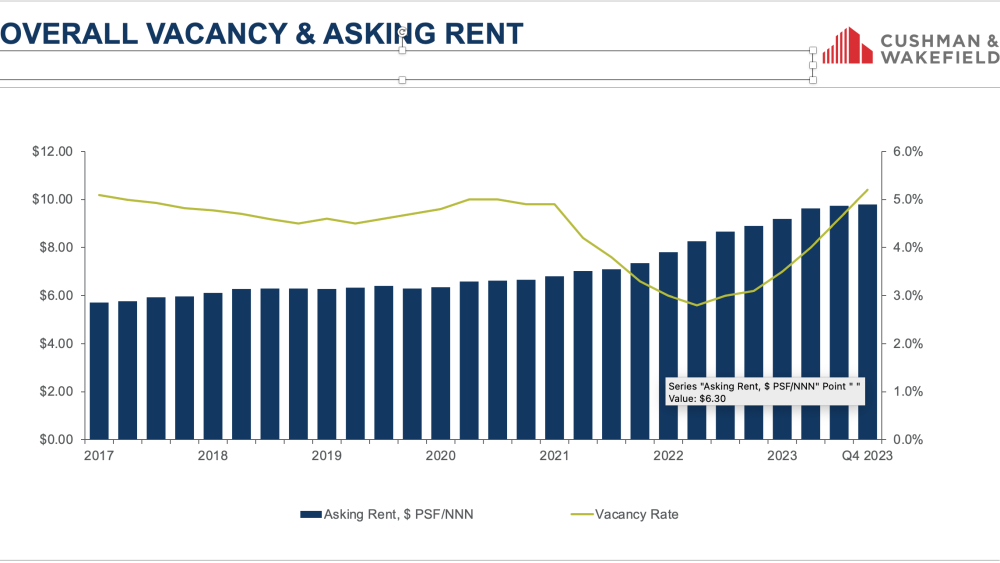

At the same time, the influx of new supply has increased competitionfurther widening the gap between old and new assets. Continued expansion of e-commerce during COVID-19 fueled a blistering pace of industrial development with 518.4 million square feet in completions in 2022 followed by a record high level of 609.6 million square feet last year, according to Cushman & Wakefield. Overall net absorption totaled roughly 224.3 million square feet for the year, with almost all of the positive absorption concentrated in newly delivered, pre-leased industrial facilities.

“There is a significant number of logistics buildings that are functionally obsolete,” says Jim Carpenter, vice chair and co-head of the National Industrial Advisory Group at Cushman & Wakefield. “The primary determinant is simply age because user requirements have evolved over time.” Vacancies inched higher in the fourth quarter to 5.2 percent due to the new supply, which amounts to roughly 900 million square feet, with vacant space that is more skewed toward older, less functional properties. According to Cushman & Wakefield, 59 percent of available logistics space on the market was built before 2000, and nearly half, 48 percent, with clear ceiling heights below 28 feet.

Despite strong demand for logistics space, the industrial market is now showing signs of real bifurcation and stratification of performance, says Bernie McNamara, head of client solutions at CBRE Investment Management. What is now in the early stages of unfolding in logistics is similar in some ways to what has happened in the office market over the last decade-plus. “That same parallel is now starting to play out in logistics where there is a real separation between modern logistics facilities that can cater to the unique needs of the leading occupiers today,” he says.

In its recent white paper, The Case for Modern Logistics Facilities, CBRE Investment Management highlighted some of the top requirements for users that also include greater roof load, reinforced floor slabs, deeper truck bays, energy efficiency and amenities that can help attract labor.

Unlocking the value of aging industrial

The appetite for close-in, just-in-time industrial locations has helped sustain demand for even less-than-ideal facilities. However, investors are also seizing on opportunistic and value-add strategies to repurpose or redevelop aging industrial properties into better functioning, higher value assets.

According to Cline, over 85 percent of the industrial stock in Downtown Central Los Angeles is considered economically obsolete. “This means that the underlying land value for alternative uses or development purposes exceeds the value of maintaining the old buildings. Many of these obsolete buildings can potentially be repurposed or selectively demolished and rehabilitated to meet users’ needs,” he says.

The investment strategy varies depending on the location and characteristics of the existing structure and site. Industrial real estate is the “Swiss army knife” of real estate asset classes, says Cline. In other words, investment strategies for legacy industrial assets run the gamut from total or partial demolition to renovation of existing structures to modernize and make them more marketable. As an example, Lee & Associates is working on one project in L.A. where the roof is being raised from 16 feet to 30 feet. “Where you find elements of a property that do work for modern logistics and can enhance and or correct other elements, you make those improvements,” he says.

In addition, there is significant capital being raised for opportunistic and value-add strategies targeting industrial and logistics real estate. For example, BKM Capital Partners is currently raising its third industrial real estate fund with a target of $500 million. The company specializes in the acquisition and improvement of value-add, light industrial, multi-tenant properties in metro areas across the Western U.S., with a focus on acquiring small-bay industrial in particular.

“Our strategy is taking this older product and transforming it into that new modern style from both an aesthetic and functionality perspective,” says Brett Turner, senior managing director, acquisitions and dispositions at BKM Capital Partners.

Because industrial tenants are using more technology, they also need people who know how to use that technology. For some firms, that means attracting a higher level of talent. “How do you get someone with a master’s degree to go in an industrial park?” says Turner. “You have to make it cool. You have to make it creative, and you have to make it close to amenities and in-fill.” So, in addition to functionality there is an aesthetic component that real estate needs to help attract labor, he adds.

Future-proofing assets

Aging building stock is forcing owners to address the need to “future-proof” assets for value preservation. The surge in institutional capital targeting the sector in recent years is also bringing more attention to the business case for ESG. For example, industrial assets now represent roughly one-third of holdings within the NCREIF Fund Index— Open End Diversified Core Equity.

Real estate owners and managers of all property types, industrial included, are seeing more pressure across the globe from investors and regulators to both measure and advance ESG goals. In addition, firms such as Prologis have emerged as leaders that are raising the bar on best practices for sustainable development in logistics facilities.

“Although industrial has seemed to lag other property sectors, it does seem to be at an inflection point where there is growing momentum behind it,” says August Williams-Eynon, a manager with ULI’s Randall Lewis Center for Sustainability in Real Estate. Industrial owners are facing the same pressures that the rest of the commercial real estate industry is facing. “Buildings that are not performing to a certain level will, if not now, then in the next few years start to be subject to discounts in pricing and other hits to value,” he says. Investor demand and the changing regulatory environment, particularly in Europe, creates a strong business case in and of itself for owners to pursue sustainability. That is complemented by increasing tenant demand for high-performing spaces, he adds.

To help advance those efforts, ULI’s Lewis Center for Sustainability in Real Estate is in the process of creating a new research report on the business case for ESG in industrial, and the sustainability strategies leading companies are using to build value, that is scheduled to be released later this summer. The report aims to give industry participants the tools and a better understanding of the opportunities and benefits of creating more sustainable industrial assets.

“Within ESG, the ‘E’ environmental has really been the primary focus for many years, but we’re now seeing a trend where the ‘S’ social is becoming a focal point as well,” says Beth Nilsson, a director with ULI’s Building Healthy Places. There is more consideration of how industrial buildings are creating community engagement; how buildings can help to provide healthy places for employees; and how they can be more resilient in the face of more extreme climate-related weather events, she adds.