Property Types

Hotels and Resorts

How do you guide the resort and real estate businesses through an erratic economy—and the fickle whims of Mother Nature?

As providers seek to bring care closer to the community, health care campuses may come to include hotels, retail, research facilities, and more.

Natural assets, combined with inventive design, help transform a global gateway.

Industrial

Medical clusters—health and life sciences clusters that include hospitals, universities, research institutions, and life science companies—can be a boon for communities, such as Lake Nona in Florida.

At ULI’s 2011 Fall Meeting in Los Angeles late last month, a panel of experts shared their thoughts on emerging real estate trends, leadership in a global real estate marketplace, and what they see for the future of the real estate industry. Read more to learn why global business strategies and an ever-changing real estate and business marketplace demand a new breed of real estate leaders.

The enormous volume of traffic at Los Angeles’s two major ports has made the city America’s trade capital. Over the past few decades, the ports of Los Angeles and Long Beach have propelled southern California’s rise as a regional trade giant. Learn what is fundamentally changing the landscape regarding industrial property, as well as the region’s position as an import-based economy.

Mixed-Use

James Rouse’s visionary development is 50 years old. The process of urbanizing its town center may create a model for other suburban developments.

With roughly 58,000 people moving to the city of Tampa in 2016 alone, the region stands out as an example of accelerating U.S. growth. Water Street Tampa will give an urban facelift to Tampa’s skyline and double the downtown area in size.

At a recent ULI Cincinnati event, panelists agreed that a midsize market like Cincinnati needs cooperation between the public and private sectors to move things forward.

Multifamily

Spanning 80 acres (32.4 ha) and 1 million square feet (93,000 sq m) of industrial space, The Works is located off Chattahoochee Avenue, a once-quiet industrial corridor on the west side of Atlanta. This pocket of the city—now known as the Upper Westside with a new CID to prove it—has seen explosive growth since plans for The Works were announced in 2017.

A one-two punch is hitting condo owners and associations in Florida, forcing some to sell to cash buyers at massive discounts or risk foreclosure. The setback could have national implications.

St. Louis, long known as the Gateway to the West, is rapidly becoming the gateway to the region’s future. Diverse communities have begun working together to make the city a major hub for cutting-edge innovations in aerospace, agriculture, finance, transportation, biosciences, entertainment, and much more. The St. Louis Economic Development Partnership is dedicated to finding economic development partners who can help companies thrive in greater St. Louis, regardless of their size, and at the same time help those companies to deliver new opportunities into under resourced neighborhoods.

Office

The strain of higher interest rates is creating sleepless nights for some commercial real estate owners and operators these days. On the flip side, there is significant capital eagerly lining up to take advantage of market dislocation.

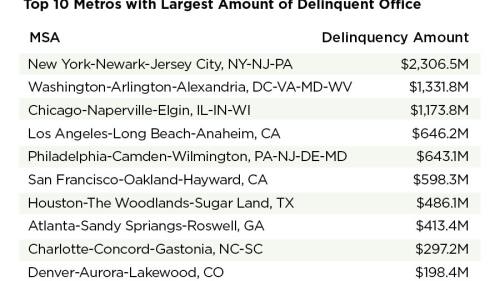

Many office property owners are heading for the exits amid weaker demand and looming debt maturities, while opportunistic private equity groups are leaning in to capture what could be once-in-a-generation buying opportunities.

Hollywood and the film industry has changed dramatically over the last several decades, especially in recent years with the rise of streaming networks.

Residental

ULI Los Angeles, together with the Los Angeles County Metropolitan Transportation Authority (LA Metro), engaged the UCLA Lewis Center for Regional Policy Studies and the Los Angeles Planning and Land Use Society to study seven half-mile (0.8 km) transit station areas in Los Angeles County in order to determine the positive effects that more development near transit might have on transit ridership, as well as on sustainability, economic development, health, and quality of life in Los Angeles.

Panelists at the recent ULI Housing Opportunity 2019 conference said that while the data paint a bleak picture of America’s housing affordability, the spending priorities of California’s new governor may be a sign of positive policy changes at a more local level.

Recent moves by companies like tech giant Microsoft and health care provider Kaiser Permanente to invest in housing initiatives represent a form of “enlightened self-interest,” said panelists during the recent ULI Housing Opportunity 2019 conference in Newport Beach, California.

Retail

For decades, civic leaders have tried to revitalize Market Street, San Francisco’s central thoroughfare, only to see their efforts founder. “I sometimes call it the great white whale of San Francisco,” says Eric Tao, managing partner at L37 Development in San Francisco and co-chair of ULI San Francisco. “Every new mayor, every new planning director, every new economic development director has chased that white whale.” This year, however, an international competition of ideas hosted and run by ULI San Francisco, with support from the ULI Foundation, generated fresh momentum for reimagining the boulevard. The competition drew 173 submissions from nine countries and sparked new conversations about the future of downtown San Francisco.

The OAK project began in 2009, when a development firm set their sights on the corner of Northwest Expressway and North Pennsylvania Avenue, the state’s most important and busiest retail intersection. As the region’s only parcel capable of supporting a vertically integrated project of this scale and density, that land represented an opportunity to create something truly special.

As aging retail continue to evolve, one increasingly popular trend has been to redesign malls as town centers—recalling a time when such commercial districts were the heart and soul of a community. Mall–to–town center retrofits are emerging throughout the nation, especially in suburban communities, where pedestrian-friendly, mixed-use environments are highly attractive to millennials now raising families.