Office

Commercial real estate services firm Grubb & Ellis forecasts the U.S. office market to have a “half-speed recovery” this year, according to the company’s 2011 Real Estate Forecast, released in January. Vacancy rates will drop from 2010’s 17.8% to 17%, net absorption will increase by 35 million square feet and Class A rents will rise by 0.4%. How do these improvements compare to the pace of typical economic recovery or growth cycles?

Thanks to their diversified economy, Minnesota’s Twin Cities’ real estate activity is picking up. Minneapolis-based firms such as 3M, Target, Cargill and Carlson Companies as well as government and healthcare are starting to drive job growth. Read what Michael Lander, president of Minneapolis-based Lander Group, and a member of the ULI Advisory Council, and others have to say about the Twin Cities’ economy and real estate activity.

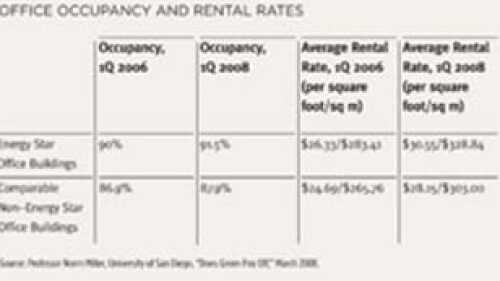

The problem: The value of the 629,000-square-foot, 34-story Phoenix Tower in Houston was declining. Energy costs were rising alarmingly. The solution: Extensive retrofits that increased the value of the property. Read about the savings and the results that were achieved through a retrofit approach by Franklin Street Properties Corp. and Hines that can be a blueprint for owners, developers and asset managers.

Initial signs of a turnaround are beginning to appear in the U.S. office market. The national office vacancy rate dropped during 2010’s third quarter for the first time since 2007. The upshot for ULI members is that the overall recovery in the U.S. office market is expected to be slow and long. Here are lists of major metros with the best year-to-date net absorption in downtown and suburban Class A office space.

Several hundred real estate professionals recently gathered at a Sustainability Summit in Washington, D.C., to hear Washington-area experts discuss the current and future status of sustainable development. Read what the experts had to say about where we’ve come, where the future is with USGBC’s Leadership in Energy and Environmental Design (LEED) rating system and the current rollout of LEED 2012 for its first public comment process.

Many holders of commercial property loans made from 2000 through 2007 will not be able to pay on time when their loans come due in the next few years. Borrowers will simply be unable to raise enough additional equity capital to make such payments. Learn about the five potential sources of equity for commercial loans coming due and which is most likely to fill the equity gap.

America’s obsession with social networking on sites such as Facebook and its fascination with new technology are spurring one of the hottest trends in the real estate industry today: construction of data centers. Increased demand has also been noted by Doug Hollidge, CEO of Charlotte, North Carolina–based Five 9s Digital. Read about where this development is happening and read advice for those considering development of data centers.

A freestanding Smart & Final warehouse grocery store in Modesto, California, was sold to a private investor for $1.9 million—and at an 8.56 percent cap rate. A nearly 9 percent cap rate in today’s market? It was a triple-net-lease property in a tertiary market. Philip D. Voorhees, senior vice president in the Newport Beach, California, office of CB Richard Ellis Inc. and an expert on triple-net leases offers advice for developers.

What are the latest trends in commercial property values and prices in the U.S, and what is the trajectory for values/prices going forward? A review of four U.S. property price/value indices reveals that investment grade commercial property values and prices were either down 3.3 percent, flat, up 1.61 percent, or up 5.48 percent in the most recent reporting periods. What is the prevailing trend?

Thousands of examples exist of successful energy efficiency renovations of hospitals, schools, and other public buildings. And companies are willing to secure the capital for the renovation and guarantee the energy savings, virtually eliminating the owner’s risk. With all these opportunities and benefits, why are energy efficiency retrofits not happening faster?