Markets

Urban Land Magazine covers all of the major commercial real estate markets and property types. Some of the largest include Dallas-Fort Worth, Los Angeles, San Francisco, Chicago, and New York City. ULI also hosts two meetings per year for its membership in many of these cities, with upcoming meetings in Nashville and Miami in 2026.

Chicago

Six finalists have been selected for ULI’s Urban Open Space Award, the first year in which the competition was open to projects outside the United States and Canada. An international jury will select one winner, which will be announced at the Fall Meeting.

Five finalists have been announced for this year’s award, which recognizes outstanding examples of successful large- and small-scale public spaces.

Detroit complete with new development, a focus on density and walkability, and a growing, diverse population.

Dallas

In 2025, the country’s industrial market is experiencing a rebalancing in the wake of surging demand and record new supply that marked the early pandemic years. New opportunities in fast-growing markets are emerging, and demand drivers are shifting. New space demand will grow the most, especially for small-bay industrial assets, according to a Q3 2025 report from the business advisory and accounting firm Plante Moran.

Around the turn of the 21st century, downtown Kansas City, Missouri, faced challenges familiar to many American cities: abandoned buildings and surface parking lots filled 10 core blocks despite multiple redevelopment attempts dating to the 1960s. The downtown residential population was sparse, and some 60,000 downtown office workers made haste for the suburbs at 5 o’clock each weekday.

Drawing on insights from more than 1,700 leading real estate investors, developers, lenders and advisors across the U.S. and Canada, the report identifies key opportunities, risks and market shifts that will shape the industry in the coming year.

Los Angeles

The ULI Foundation has announced that Alex J. Rose, executive vice president for Continental Development Corporation, has donated $1 million to support ULI’s Advisory Services program, which offers expertise and technical assistance to communities facing complex land use challenges. This gift is a contribution to the ULI Foundation’s first capital campaign, Our Cities, Our Future, which aims to raise $100 million in support of the Institute’s global mission.

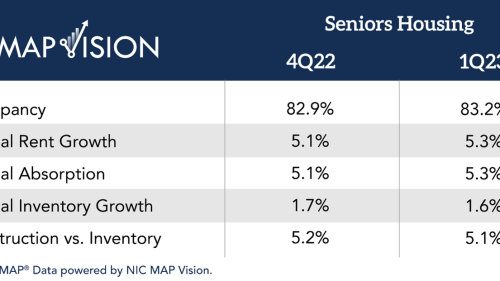

The senior housing occupancy rate increased 0.3 percentage points from 82.9 percent in the fourth quarter of 2022 to 83.2 percent in the first quarter of 2023, according to data from NIC MAP Vision released by the National Investment Center for Seniors Housing & Care. The occupancy rate has increased 5.4 percentage points overall from a pandemic low of 77.8 percent in the second quarter of 2021 but remained 4.0 percentage points below the pre-pandemic high of 87.2 percent in the first quarter of 2020.

Americans are voraciously consuming digital content. The Consumer Technology Association estimates that consumers will spend $151 billion on technology services (the category for video, gaming, audio, and apps) in 2023, marking five consecutive years of growth. Entertainment companies are hurriedly working to meet this demand by ramping up television and film production.

New York City

Eight years ago, the landmark Paris Agreement kicked off a worldwide campaign to reduce carbon emissions. The targets set were big: slash emissions by 45 percent by 2030 and be net zero by 2050. So far, the world is not making enough progress on those lofty goals, and the progress that has been made has been very unevenly distributed. Experts from major real estate firms, including Boston Properties, CBRE, and Community Preservation Corporation, drove home the net zero transition’s importance during a panel discussion at the 2024 ULI Spring Meeting in New York City. They talked about the costs of getting to net zero, what lenders and owners are doing to get there, and the risk of not addressing climate change.

Women in leadership roles was the theme of a discussion during the 2024 ULI Spring Meeting in New York City. Kelly Nagel, who was recently named Head of Residential at EDENS, an owner and operator of mixed-use properties nationwide, hosted a fireside chat with Nancy Lashine, founder and managing partner at Park Madison Partners, a New York-based boutique advisory and capital-raising firm.

Real estate developers across the United States and around the world are under pressure to cut the amount of carbon their activities put into the atmosphere.

San Francisco

These 10 hotels embody environmental sensitivity plus energy and water efficiency.

BREEAM, the sustainability assessment method developed by BRE Global (‘BRE’), has announced that Mountain Technology Center—MetLife Investment Management’s development featuring five state-of-the-art manufacturing warehouses in Tracy, California—is the first U.S. development to earn BREEAM International New Construction (‘INC’) certification.

Three San Francisco developers discuss focusing on “what would work” in order to create the city’s Mission Bay mixed-use development, during the WLI session at the 2020 ULI Virtual Fall Meeting

Toronto

Infrastructure Ontario’s Provincial Affordable Housing Lands Program aims to create a mix of market-rate housing and permanent, sustainable, affordable housing on surplus land in greater Toronto. For its first effort, the agency chose Dream Asset Management, Kilmer Group, and Tricon Residential to develop a mixed-use community with 2,500 apartments on a former brownfield industrial site.

Across North America, cities are confronting a housing crisis that demands urgent, innovative responses. In Toronto, the launch of the Rapid Housing Initiative (RHI) in April 2020 marked a pivotal moment—an accelerated effort at the height of the pandemic to deliver safe, stable housing. Since then, unprecedented investments have been made in communities across Ontario to address housing insecurity, reshaping the province’s residential landscape.

Canada’s real estate market is in the midst of a pivotal shift as the Bank of Canada (BoC) rolls back what has been “higher for longer” interest rates. Yet despite welcome relief on financing costs, real estate leaders are still moving somewhat cautiously amid uncertainty and fluid market dynamics.

London

Ten built environment projects from eight countries across the EMEA region have been announced as the finalists in the sixth annual ULI Europe Awards for Excellence, which recognize exemplary projects and programs in the private, public, and non-profit sectors. This year’s finalists comprise cutting edge refurbishment, restoration and new build projects, and include residential, healthcare, mixed use, education, community, laboratory, and office projects from Italy, Germany, the UK, Belgium, Sweden, Denmark, France, and Spain.

Following a masterplan adopted by British Land, the AustralianSuper pension fund, and the Southwark Council, developers are now seven years into a 15-year project to transform a 53-acre (21.44 hectares) parcel of industrial land and a former quay into a community that will include as many as 3,000 new homes, office, retail, leisure, and entertainment space.

In the heart of London’s Covent Garden neighborhood, a complex of five Victorian-era structures—previously home to a seed merchant company, a brass and iron foundry, and a Nonconformist chapel, among other uses—have been restored and adapted into a single, cohesive office building with ground-floor retail and dining space. The three-year restoration preserved the property’s industrial heritage, yet it provides enough flexibility to meet the needs of today’s workforce.

Paris

With society and the real estate industry significantly behind on achieving the targets set in the Paris Agreement, and worsening affordability in Europe’s housing, ULI Europe’s C Change for Housing program has launched a landmark interactive systems map and companion report to help the real estate industry identify, co-create, and scale the solutions needed to decarbonize existing and future affordable housing.

Although ready to commence a new real estate cycle, real estate leaders globally are braced for another challenging year of uncertainty, with lingering inflation, largely driven by factors including geopolitical instability, and persistently higher interest rates in some regions, potentially delaying a hoped-for recovery in capital markets and occupancy metrics. This is according to the Emerging Trends in Real Estate® Global Outlook 2025 from PwC and ULI, which provides an important gauge of global sentiment for investment and development prospects, amalgamating and updating three regional reports which canvassed thousands of real estate leaders across Europe, the United States and Asia Pacific.

The outlook for the European real estate market is cautiously optimistic despite growing geopolitical uncertainty and concerns about economic growth, with London, Madrid, and Paris emerging as the standout performers, according to a new report by PwC and the Institute.

Hong Kong

On China’s southern coast, the integration of the Greater Pearl River Delta links nine cities, plus the special administrative zones of Hong Kong and Macau, to create an urban area of 21,100 square miles (55,000 sq km) and a population of up to 80 million.

Singapore

The 2026 Emerging Trends in Real Estate® Asia Pacific report, published jointly by ULI and PwC found a mood of cautious optimism among real estate professionals; however, respondents described considerable disparities in markets and sectors across the region. Tokyo was ranked as the top city for investment in the Emerging Trends survey, top of the table for the third consecutive year, followed by Singapore, Sydney, Osaka, and Seoul.

A seminar organized by the ULI Singapore NEXT Committee presented attendees with the little-known concept of real estate “tokenization,” or fractional investing/trading, as a potential bridge between private investors and direct ownership. Although not new, tokenization in real estate is a niche market, particularly in Asia Pacific, with Singapore hosting a small number of the specialized digital platforms.

Once the site of an abandoned quarry, Singapore’s Rifle Range Nature Park now serves as a buffer zone protecting one of the island nation’s last primary rainforests, Bukit Timah Nature Reserve, from encroaching development and human activity. Located to the reserve’s south, Rifle Range is Singapore’s first net-positive energy nature park, harvesting more energy than its annual operational requirements.