Market Trends

Housing Industry Finds Unexpected Strength in Certain Products in the Face of COVID-19 and Recession

Despite COVID-19 and the recession, the housing industry is seeing unexpected resilience in certain segments of the market, speakers said at the Housing Trends and Outlook session at the ULI Virtual Fall Meeting.

A recent webinar organized by ULI Japan helped envision this “new normal,” looking at the current state of the global economy to make predictions about the “post-pandemic world.” The online forum was moderated by Jon Tanaka, managing director and cohead of Japan Real Estate, Angelo Gordon, who was joined by Izumi Devalier, chief Japan economist, Bank of America Merrill Lynch.

The latest “Real Estate Economic Forecast,” produced by the ULI Center for Capital Markets and Real Estate, points to a U.S. economy that has likely already hit bottom, with growth resuming in the second half of the year that will soften some of the blow. Panelists on a ULI webinar said that this outlook comes with crossed fingers due to uncertainty related to the path of COVID-19 and the time it takes to develop an effective vaccine.

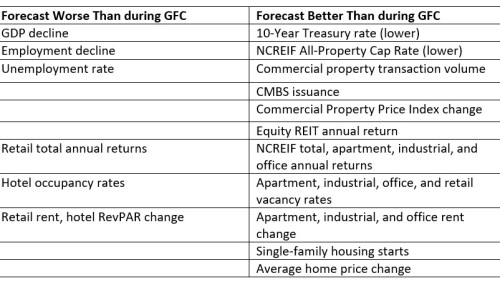

According to survey data from the latest ULI Real Estate Economic Forecast, the current economic recession will be short-lived in the United States, with above-average gross domestic product growth returning in 2021 and 2022. Second, the impact on real estate market conditions and values will be relatively modest and much less severe than the impact experienced during the global financial crisis, with some exceptions by sector.

Talk of a true urban “transformation” tends to carry more weight when it comes from a former police chief-turned-mayor speaking at a reinvented former trolley warehouse. The mayor of Tampa, Florida, Jane Castor, greeted attendees at a recent ULI Tampa Bay conference at the brick-walled Armature Works project.

The Dodge Momentum Index moved 4.1 percent higher in September to 143.6 from the revised August reading of 137.9. The gain in September was due entirely to an 8.9 percent increase in the commercial component, while the institutional component fell 4.8 percent.

A new report from the ULI Greenprint Center for Building Performance shows that the real estate industry has made significant progress over the past 10 years in reducing carbon emissions and energy consumption while increasing asset value. Volume 10 of the Greenprint Performance Report™, which measures and tracks the performance of 8,916 properties owned by Greenprint’s members, demonstrates a 10-year improvement of 17 percent in energy use intensity, which is the annual energy consumption divided by gross floor area. The report also finds that Greenprint members are still on track to reduce carbon emissions by 50 percent by 2030.

A CBRE analysis of U.S. consumer spending and demographic patterns suggests significant changes for food-and-beverage operators and the real estate they occupy, including a greater push for convenient, prepared foods; a growing millennial influence; and the emergence of inner-ring suburbs as the industry’s hottest market.

A series of presentations at the ULI China Mainland Winter Meeting, held in Shanghai in December, demonstrated how the growth of the sharing economy, combined with the desire for social connectivity, is affecting the development and management of office, residential, and hotel properties.

As part of a wide-ranging panel on adapting development to new technologies, held at the ULI Japan Fall Conference in Tokyo in November, industry leaders discussed using e-commerce data to drive development decisions, adapting Japan’s traditional banking sector for the future, and creating a more innovative startup culture.