Summary

Lows as well as highs were energized this month: unemployment dropped to an almost four-year low; cap rates stayed near four-year lows, but moved enough to suggest a broadening buyer appetite for secondary markets; CMBS issuance vaulted to an almost five-year high; new home prices shot past their pre-recession peak; mortgage rates continued their decline to new all-time lows; and multifamily permits were near four-year highs.

Significantly, 85 percent of the key indicators in the Barometer are better than a year ago. At this time last year (October 10, 2011), only 52 percent of the key indicators were better than the year before.

Note: More commentary and data can be found throughout the tabs and in the accompanying tables.

The top ten trends in this month’s Barometer:

- Employment growth was above 100,000 for the third-straight month. The unemployment rate, 7.8 percent, is below 8 percent for the first time since January 2009, as part-time employment made big gains.

- The monthly increase in the Consumer Price Index, a measure of inflation, was the largest in more than three years. This was due primarily to a jump in gasoline prices. This price increase was also the primary influence on the substantial rise in retail sales.

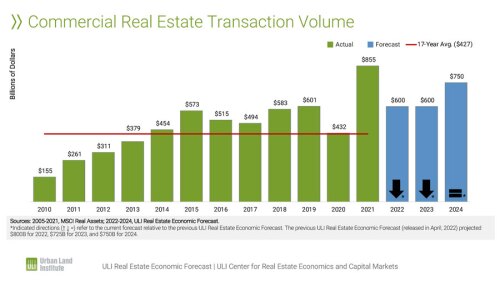

- Commercial property transaction volumes shot up, most substantially in the apartment sector; property prices were slightly off or improved slightly, depending on the data source, but they remain at or near three-and-a-half-year highs.

- Total REIT returns were off, but one-year returns were considerable.

- Monthly cap rates inched up from their lowest level since mid-2008 as pricing remains aggressive in primary markets but buyer appetite for secondary markets improves.

- CMBS issuance vaulted to a five-year high; delinquency rates continued to drop after reaching an all-time peak in July.

- Multifamily permits moved down just slightly from a four-year high. Starts were up after a three-month retreat.

- Following a growth spurt in the spring and into June, in July the rebound in prices for existing homes slowed considerably or prices dipped, depending on the data source, and prices were flat in August. Sales jumped.

- Prices of new single-family homes shot past their pre-recession peak. Sales barely changed. The inventory of new single-family homes remains at historic lows, but permits and starts rose to two-year highs.

- In response to the Federal Reserve’s first monthly purchase of $40 billion of mortgage-backed securities on September 13, mortgage rates fell to astonishing lows. The monthly average for the 30-year mortgage was 3.50 percent, but lows of 3.29 percent were reached in the second half of the month. The extent of the impact on sales will not be reflected for another month or so.

(For annual projections of key Barometer indicators, see the new ULI Real Estate Consensus Forecast).

Economy

The decline in the unemployment rate is a very positive indicator. Even though it is due to an increase in the number of part-time workers who would rather work full-time, the figure represents a step away from layoffs and toward staff maintenance and expansion. The manufacturing sector expanded, reversing a three-month slide towards contraction; monthly S&P returns were positive and year-over-year returns stellar; and consumer confidence rose to its highest level in seven months. The downward revision to the second-quarter GDP is not expected to be a harbinger of third-quarter GDP growth.

Net job growth

in September of 114,000 jobs was made up of 104,000 private sector jobs and 10,000 in public sector jobs. Net growth for July and August was revised upward to 181,000 and 142,000, respectively. The country has 4.5 million fewer jobs than it did almost five years ago. At September’s growth rate, it would take more than three years to regain just those 4.5 million jobs. The greatest private sector job gains in September by far were in health care, followed by transportation and warehousing, food services, education at the state level, and professional and business services. The overall unemployment rate in September fell to 7.8 percent from 8.1 percent in August, the first time it has been below 8.0 percent since the beginning of 2009. The key to the decline this month is the substantial increase in persons employed part time for economic reasons, also referred to as involuntary part-time workers.The third estimate of second-quarter GDP growth is 1.3 percent, down from 2.0 percent for the first quarter and down nearly two-thirds from 4.1 percent for the fourth quarter of 2011. The deceleration in the second quarter primarily reflects slower growth in personal consumption expenditures, residential fixed investment, and nonresidential fixed investment. These were partly offset by smaller decreases in federal, state, and local government spending and acceleration in exports.

The Consumer Confidence Index improved 9 points in September to 70.3, the largest gain and highest level in seven months. The index is 17 points below percent below the pre-recession level (in January 2008) of 87.3. Total retail sales in August were up 0.9 percent, although when gasoline sales are excluded, sales were up only 0.3 percent, below the monthly historic average increase. Sales rose for motor vehicles, building materials, food services, and health care, but fell for electronics, general merchandise, and clothing. Grocery store sales were flat. Retail sales of $406.7 billion are 4.7 percent higher than those of a year ago but exceed the pre-recession peak of $378.4 billion (in November 2007) by only 7.5 percent.

The value of private construction put in place softened slightly in August, down 0.5 percent from July; the figure is now 6.5 percent higher than a year ago. Public construction put in place declined 0.8 percent. August’s total construction value of $837.1 billion is down 31 percent from the pre-recession high in March 2006, with private construction down 42 percent.

Inflation, as measured by the Consumer Price Index, rose 0.6 percent, the largest monthly increase since June 2009. About 80 percent of the increase was due to a 9.0 percent increase in the gasoline index, with the balance due to smaller increases in shelter, medical care, personal care, new vehicles, and recreation. For the past 12 months, the CPI has risen 1.7 percent.

Monthly S&P 500 returns rose 2.6 percent in September—above the long-term monthly average increase of 0.9 percent. Year-over-year returns were stellar at 30.2 percent.

The Purchasing Managers’ Index improved in September, moving to 51.5 from 49.6 percent in August, according to the Institute for Supply Management. September’s level indicates that the manufacturing economy is generally expanding, whereas June, July, and August’s levels had indicated contraction.

Real Estate Capital Markets

Capital markets came back from last month’s lethargy with solid—and in some cases, even impressive—activity. CMBS issuance vaulted to a five-year high; total commercial transaction volume rebounded substantially from last month’s dip, most strongly in the apartment sector; sales prices slipped slightly or improved slightly, depending on the data source, but remain at or near three-and-a-half-year highs; and cap rates inched up, suggesting buyer appetite for secondary markets is improving. Although total REIT returns were off for the month, one-year total returns were strong, with the industrial, lodging/resorts, and retail sectors even stronger.

Capitalization rates, as reported by Real Capital Analytics (RCA), rose to 6.91 percent in August; July’s cap rate of 6.82 percent was the lowest level since October 2008 and only 29 basis points above its lowest level recorded (since 2001), reached in mid-2007. As reported by NCREIF in last month’s Barometer, the capitalization rate slipped from 5.97 percent in the first quarter of 2012 to 5.96 percent in the second quarter, 59 basis points above its lowest level (since 1978), reached in the first quarter of 2008.

Commercial property sales volumes

(excluding land and hotels) rose 21 percent to $16.7 billion in August, according to RCA, close to the long-term average (since 2001). Transactions increased most substantially in the apartment sector (by 84 percent), whereas the office sector declined slightly.

The ten most active sales markets in the past 12 months accounted for 42 percent of all transactions—down from the 43 percent share last month. The markets were, in descending order, Manhattan, Los Angeles, Chicago, San Francisco, Dallas, Houston, Boston, Atlanta, Seattle, and the Virginia suburbs of Washington, D.C., according to RCA. Over $5.7 billion in transactions have been recorded in each of these cities since August 1, 2011.

The Moody’s/RCA Commercial Property Price Index slipped 1.23 percent in July from June, when the index reached its highest level since January 2009. (This is a same-property index based on all U.S. transactions over $2.5 million.) Values are now down 22.5 percent from the peak value in December 2007 and are just 7.1 percent higher than a year ago.

The new value-weighted composite CoStar Commercial Repeat-Sale Index rose 1.1 percent in July, up 11.3 percent from a year ago. July’s index was the highest since the beginning of 2009. (This index is based on a repeat-sales methodology that tracks transactions over $100,000 and includes land sales.) Values are down 18.5 percent from the peak value in January 2008.

Green Street Advisors (GSA) Commercial Property Price Index, based on estimates of private market values for REIT portfolios, moved up 1.0 percent in September. Over the past 12 months, the GSA Price Index has increased just 6.2 percent, although it is down just 3.3 percent from its peak value in August 2007.

As reported in last month’s Barometer, the NCREIF Property Index turned in a positive second quarter with total returns of 2.7 percent, sustaining the consistently positive returns of the past two and a half years. The capital appreciation component was 1.2 percent for the quarter. Total 12-month returns are now 12.0 percent. Returns for the quarter by property sector range from 2.1 percent for the lodging/resorts sector to 3.0 percent for retail.

Total equity REIT returns were down at –1.78 percent in September. Returns for individual core sectors ranged from 3.0 percent in both the industrial and lodging/resorts sectors to –3.8 percent for apartments. One-year total returns as of September stood at 32.6 percent, with one-year returns in the industrial, lodging/resorts, and retail sectors reaching 49 percent, 45.5 percent, and 43.2, respectively. Apartments had the lowest returns at 18.9 percent.

CMBS issuance

vaulted to the highest monthly volume since 2007, reaching $5.9 billion, after a dip in August broke a four-month run of monthly volumes between $4.2 billion and $4.8 billion, according to Commercial Mortgage Alert. According to Trepp LLC, CMBS delinquency rates dropped to 9.99 percent in September, under 10 percent for the first time since April, when the five-year loans securitized in 2007 were reaching their maturity date. After peaking at an all-time high of 10.34 percent in July, delinquency rates have reversed that climb for two straight months; the bulk of the five-year loans have passed their maturity date, and loan resolutions and loan cures continue to put downward pressure on the delinquency rate.

Bank real estate loan delinquency rates continued to fall in the second quarter. Commercial and multifamily mortgage delinquency rates are now 3.34 percent and 2.03 percent, respectively. Construction and development loans have the highest delinquency rate at 10.81 percent, substantially above the quarterly historical average (since 1991) of 5.3 percent.

Housing

In July, the rise in prices for existing homes slowed considerably or prices dipped, depending on the data source, and in August, prices were flat, but sales jumped. For new single-family homes, prices shot up while sales barely changed. Mortgage rates slid to previously unimaginable lows in response to the first installment of QE3.The extent of the impact of the lower interest rates on sales, not just refinancing, of all types of homes will not be reflected for another month or two. The inventory of new single-family homes remains at historic lows, but permits and starts rose to two-year highs. Multifamily permits slipped slightly from a four-year high, and starts rose.

Existing single-family home prices rose for the fourth-straight month, according to the S&P/Case-Shiller Index (which tracks repeat sales in 20 cities), with a 1.6 percent increase in July. While the growth rate slowed from the previous two months—when rates were the highest since mid-2004—prices are now up 1.2 percent from a year ago. Still, prices remain 30 percent below their peak in July 2006. The Federal Housing Finance Agency House Price Index (HPI) for existing single-family home prices (tracking repeat sales in the entire country) barely changed, but showed growth for the sixth-straight month—0.1 percent in July; it is now up 3.8 percent from a year ago. The monthly increases in March, April, and May were the largest in 21 years, whereas June’s slightly lower increase was the largest in seven years. The index remains 15 percent lower than its peak in June 2007.

National Association of Realtors

(NAR) data (monitoring individual, unpaired transactions for the entire country) for existing single-family home prices barely changed in August, rising 0.1 percent after a slight dip in July. The results of the past two months are in marked contrast with the substantial increases in March through June, which accounted for the longest sustained period of strong price growth in over 40 years—totaling a whopping 21 percent. Median prices for existing single-family homes stood at $188,700 in August, 10 percent higher than one year ago. Still, prices are 15 percent below the peak in 2006.New single-family home prices

jumped by 11.2 percent to $256,900 in August and are up 17 percent from August 2011. Most significant, prices are 3.6 percent above the 2007 peak.Single-family building permits were up 1.6 percent in August (an annual rate based on a three-month moving average) to 505,000. The number of permits has increased each of the past 16 months and is at its highest level since spring 2010; still, August’s permit numbers are 71 percent below the pre-recession high in November 2005. Single-family housing starts increased 1 percent in August (on a three-month moving average) to 524,000 after an essentially flat July and are now at their highest level since early spring 2010; starts are 71 percent below the pre-recession high in November 2005.

Sales of new single-family homes

barely changed, sliding 0.3 percent in August. Monthly sales volumes are 73 percent below the pre-recession high in July 2005, and over the last 28 months volume has been among the lowest seen since record keeping began in 1963. However, it is important to note that sales are a strong 28 percent higher than a year earlier. Inventory remained unchanged in August, staying at the lowest monthly figure since record keeping began.

Sales of existing single-family homes (seasonally adjusted) jumped 8 percent in August to 4.3 million, 10 percent higher than those of a year earlier and the highest monthly level since early summer 2010. August’s monthly sales were 32 percent below the pre-recession high in September 2005. Even with just a 6 percent increase in inventory, supply fell slightly to 6.2 months, lower than the historical average. The forward-looking NAR Index of Pending Sales (of existing single-family homes, condos, and co-ops) fell 2.6 percent in August, continuing the monthly zigzagging seen since the beginning of 2012. July’s index level was the highest since the first-time homebuyer credit ended in April 2010.

Multifamily building permits decreased 1 percent to 261,000 in August, after July’s 6 percent jump to 264,000 permits. July’s level had been the highest in almost four years (based on a three-month moving average), but August’s level is close and is the second-highest over the same time frame. Multifamily housing starts were up 5 percent in August to 212,000 after three months of retreat from the three-and-a-half-year high of 230,000 reached in April.

As reported in last month’s Barometer, the rent index for apartments, reported quarterly by CBRE, was up 1.1 percent in the second quarter of 2012 to $1,293, which is 5.0 percent higher than a year earlier. Apartment vacancy rates, reported quarterly by CBRE, edged down to 4.8 percent in the second quarter of 2012, continuing a fairly consistent two-and-a-half-year slide.

Existing condo sales increased in August by 6 percent to 520,000, just 4 percent higher than in August 2011, and inventory decreased substantially, so supply fell from 7.8 months to 6.0 months.

New foreclosure filings—default notices, scheduled auctions, and bank repossessions—edged up in August from a month earlier to 193,508, according to RealtyTrac, but are down 15 percent from a year earlier. RealtyTrac noted that previously deferred activity in several judicial states (states in which courts oversee the foreclosure process) is rebounding, with Florida and Illinois now leading in foreclosure rates. Notes RealtyTrac, “Previous to August, the nation’s top two state foreclosure rates have been from one of four non-judicial states [Arizona, California, Georgia, and Nevada] every month since December 2010.”

Home mortgage rates (30-year fixed) fell slightly from 3.60 percent in August to 3.50 percent in September. September’s rate was the lowest monthly rate since record keeping began in 1971.

Commercial/Multifamily

Apartment rents continue to climb past their pre-recession highs, and hotel RevPAR is now back at its pre-recession high; rents in the industrial and office sectors are slowly inching up, but retail rents are still declining. Office vacancy rates moved down closer to their long-term average, retail and industrial availability rates remain high but are inching down, and apartment vacancies are low and moving lower. Second-quarter hotel occupancy improved from a year earlier. Net absorption doubled in the apartment sector and was strong in the office and industrial sectors; retail absorption remained improved but remained weak by historical standards. Completions in all sectors are extremely low by historical standards, with the exception of the apartment sector, which is at about four-fifths of the long-term average.

Office vacancy rates

edged down to 15.7 percent in the second quarter of 2012 from 16.0 percent in the first quarter, according to CBRE. This was the first time in three years that vacancy rates have been below 16 percent. Rents crept up 1.3 percent, the sixth-straight quarter of rent growth, and are up 2.8 percent from a year earlier. Net absorption was 12.7 million square feet, the largest quarterly gain in five years, while completions remain low at 12 percent of the long-term average (since 1985).Retail availability rates

barely changed, notching down from 13.1 percent in the first quarter to 13.0 percent in the second quarter, according to CBRE. Availability rates have fluctuated between 13.0 percent and 13.2 percent for over two years. Rents continued their four-and-a-half-year slide in the second quarter and are off 1.8 percent from a year earlier. Net absorption was up from the first quarter and positive for the fourth-straight month at 4.1 million square feet; completions were up slightly and stood at 11 percent of the long-term average (since 1980)Industrial availability rates

stood at 13.2 percent in the second quarter of 2012, continuing their slow but consistent eight-quarter decline; rates are now down 80 basis points from the same quarter a year earlier. Rents edged up for the second-straight quarter but are still barely above the 14-year low reached in the last quarter of 2011. Net absorption was strong at 26.5 million square feet, although down from the previous quarter; completions were down slightly and stood at only 11 percent of the long-term average (since 1980).Apartment vacancy rates

edged down to 4.8 percent in the second quarter of 2012, continuing a fairly consistent two-and-a-half-year slide. Rents were up 1.1 percent in the second quarter and are 5.0 percent higher than a year earlier. Completions in the first quarter of 2012 were up a whopping 135 percent to 34,784 units. This is the highest quarterly level in three years and it is now at 83 percent of the long-term average (since 1994).Hotel occupancy rates stood at 65.1 percent in the second quarter of 2012, up from 63.2 percent in the same quarter a year earlier, according to Smith Travel Research, while the RevPAR Index was up 7.9 percent from a year earlier.

(Note: The commentary and data outlined below and in the accompanying table are the same as those presented last month because all the information is taken from quarterly data).