The latest forecastfrom the Urban Land Institute and EY shows that expectations across the real estate capital markets are moderating after several years of strong growth. A survey of 43 economists and analysts from 32 leading real estate organizations shows that real estate capital markets are expected to continue strengthening, though at a slower pace compared with that witnessed in recent years. The survey, conducted September 8–26, 2014, asked respondents to give forecasts for a series of 26 economic and real estate indicators.

Related: Download the full presentation | Hear more about the forecast at the ULI Fall Meeting | Register for the Fall Meeting

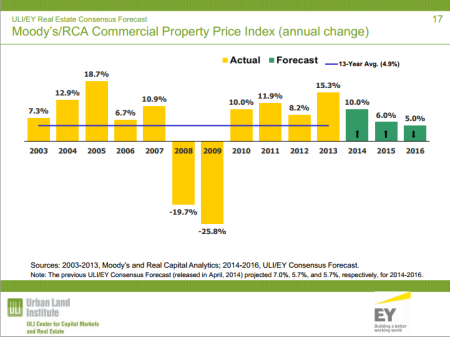

For the commercial real estate sector, the results were slightly more optimistic than those in the April 2014 forecast. Commercial real estate market prices increased by 15.3 percent in 2013, according to the Moody’s/RCA Commercial Property Price Index, but the economists surveyed expect that growth rate to fall to 10 percent in 2014, and then to 6.0 percent in 2015 and 5.0 percent in 2016. This compares to the April readings of 7.0 percent in 2014, 5.7 percent in 2015, and 5.7 percent in 2016.

Martha Peyton, head of global real estate strategy and research at TIAA-CREF, thinks that this trend reflects more confidence among real estate investors. She says, “You are still seeing investors picky [about] where they are willing to go and what they’re willing to buy. However, over the first three quarters of this year, that kind of pickiness has been easing up a little bit.”

Commercial property transaction volume also is expected to continue to grow, though also at a slower pace than in recent years. Volumes have remained well above historical averages, and the 2016 estimate of $445 billion would be the highest volume ever, save for the inflated pre–financial crisis peak of $576 billion in 2007.

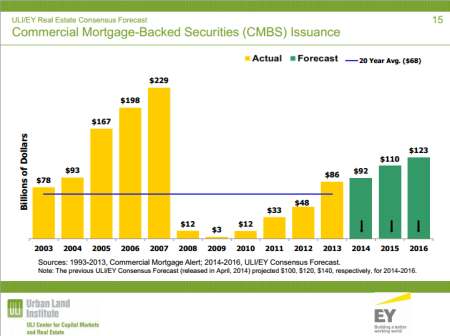

The enthusiasm in the commercial real estate markets may be directly tied to a rebound in the commercial mortgage–backed security (CMBS) markets. After collapsing to only $3 billion worth of CMBS issued following the Financial Crisis in 2009, this securitized debt market has shown renewed strength in recent years, with a 2014 issuance estimate of $92 billion, and continuing growth to $110 billion in 2015 and $123 billion in 2016.

Other markets are expected to follow similar positive, though moderated, growth trends over the next three years:

- Retail: The economists surveyed expect rental rates in the retail segment to rise in 2014, after six straight years of decline. Rental rates are expected to grow by 2.0 percent in 2014, followed by growth of 3.0 percent in 2015 and 2016. Retail availability rates are expected to fall to 11.6 percent in 2014, followed by a decline to 11.2 percent and 10.9 percent in 2015 and 2016, respectively. This is below the peak of 13.0 percent in 2011, but still above the historical average of 9.8 percent.

- Industrial: Over the past few years, industrial and warehouse vacancies have decreased sharply from the 2010 peak of 14.3 percent. The economists surveyed expect this decrease in vacancy rate to slow in the next three years, however, from 11.2 percent in 2013 to 10.1 percent by 2016. Increased demand is expected to push up rental rates, from 3.6 percent growth in 2013, to 4.0 percent in 2014 and 2015, before falling back to 3.0 percent in 2016.

- Office: Office vacancy rates have fallen for three straight years—a trend that is expected to continue through 2016, when office vacancy rates are expected to reach 13.4 percent. This would be the first time vacancy rates are below the long-term average of 13.6 percent since 2007. Office rental rate growth is expected to increase, from 2.6 percent in 2013, to 3.0 percent in 2014, and 4.0 percent in 2015 and 2016.

- Hotel: Hotel occupancy rates are expected to increase from an estimated 63.2 percent in 2014 to 64.1 percent in 2016, continuing to push above the long-term average of 61.5 percent.

- Apartment: Apartment vacancy rates have fallen since the peak of 7.4 percent in 2009, to a 2014 estimate of 4.9 percent. This is the only sector where vacancy rates are expected to rise, with estimates of 5.0 percent in 2015 and 5.1 percent in 2016.

- Housing: Single-family housing starts continue to improve from the 50-year low of 430,600 in 2011, with an estimated 650,000 in 2014, 800,000 in 2015, and 912,000 in 2016. However, despite this strong growth, the number of single-family homes built is significantly below the historic average of 1.073 million per year. Josh Scoville, senior vice president for research at Hines, thinks that this market will self-correct in the coming years. He says, “Two years ago, the number of new homes for sale was incredibly low—two standard deviations below the long-term average. Does it get back to levels from the mid-2000s? No, but we have the benefit in this country of decent population growth, which should lead to an increase in single-family housing growth.”

Steady as She Goes

Overall, macroeconomic conditions are just healthy enough that most analysts think that we will continue to see positive—though relatively slow—growth moving forward. The economists surveyed estimate 2014 real gross domestic product (GDP) growth of 2.0 percent, followed by a jump to 3.0 percent in 2015 and 2016. With interest rates expected to remain low, and inflation expected to remain just at the Federal Reserve target of 2.0 percent, the slow-and-steady pace of economic expansion seems to mirror the expected conditions of most real estate market segments. These diffident macroeconomic conditions are reflected in the real estate capitalization rate for institutional-quality investments, which is expected to rise slightly from a 2013 level of 5.7 percent to a steady 6.0 percent until 2016.

Scoville thinks that investors should be happy with the positive trends in the American real estate markets, but should be cautious moving forward. He says, “We are at a point in the cycle where things feel very good. We can’t get too complacent, because things that are good get bad quickly. There are price growth and rent increases left, but we have to be aware of the risks, because things will change.”