U.S. real estate economists predict generally improved economic and property market news for the rest of 2020, as well as for the following two years, compared with their forecasts of six months ago, according to the fall ULI Real Estate Economic Forecast. The current recession will be somewhat short-lived, they predict, with above-average gross domestic product (GDP) and job growth in 2021 and 2022 contributing to recovery. Also, real estate market conditions and values are forecast to hold up much better than predicted six months earlier, with industrial real estate and single-family housing expected to perform best.

ULI members can access the forecast on demand on Knowledge Finder.

The Real Estate Economic Forecast, produced by the ULI Center for Capital Markets and Real Estate, is based on a survey conducted in October 2020 of 43 economists and analysts at 37 leading real estate organizations. It should be noted that the forecast is based on the median responses gathered in the survey, which reflected a wide range of views both better and worse.

Noteworthy in the forecast is that many of the most pessimistic forecasts for 2020 from the spring survey have been revised upward. Among the 2020 metrics that look better compared with six months ago are GDP, the unemployment rate, real estate transaction volumes, commercial mortgage–backed securities (CMBS) issuance, private and public real estate returns, vacancy/availability rates, and single-family housing starts.

Key Findings for Commercial Real Estate

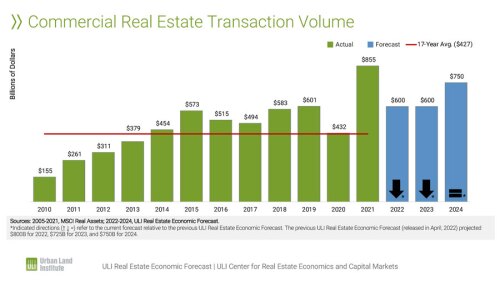

U.S. real estate transaction volumes are predicted to decline to $300 billion in 2020, well below the 2019 level of $588 billion but a $25 billion upward revision from the spring forecast. Transaction volumes are expected to rise to $400 billion in 2021 and $500 billion in 2022, both higher than the long-term annual average of $343 million. Debt financing is expected to be generally available, as indicated by the projected issuance of $50 billion of CMBS in 2020, although this is about half the total issuance in 2019. CMBS issuance is predicted to rise to $83 billion in 2022, above the long-term average.

Commercial real estate prices as measured by the Real Capital Analytics (RCA) Commercial Property Price Index are projected to decline by 2 percent in 2020, a marked improvement from the 7 percent decline forecast in the spring survey.

Total returns from unleveraged core real estate are estimated to decline 1.7 percent for full-year 2020, a marked improvement from the 5.0 percent decline forecast last spring. Total returns are predicted to rebound to 3.0 percent in 2021 and 5.6 percent in 2022, slightly lower than projected in the earlier survey. The returns are expected to vary widely across property types: the industrial sector will post a 4.5 percent return in 2020, whereas returns in the retail sector (all formats) are forecast to be –9.9 percent this year. Returns for equity real estate investment trusts (REITs) will average –12 percent in 2020 (better than the previous forecast of –18 percent) but are predicted to rise to 6.5 percent in 2021 and 8.0 percent in 2022.

Wide differences are forecast for market fundamentals according to property type. Hotels are forecast to suffer the most, with the average occupancy rate plummeting to 49.1 percent in 2020 from 66.1 percent in 2019. The retail availability rate for neighborhood and community centers is forecast to rise 200 basis points to 10.6 percent in 2020, and to 11.3 percent in 2021 and 2022. Industrial/warehouse availability will suffer little impact from the COVID-19 recession, with availability rising 50 basis points to 7.7 percent from 2019 to 2020, before declining to 7.3 percent in 2022, close to the low over the past 19 years of 7.0 percent. Apartment and office vacancy rates will see modest deterioration in 2020, rising 100 and 200 basis points, respectively, from 2019 vacancy rates. Both sectors will see falling vacancy rates by 2022, according to the forecast.

Industrial will lead all property types in rent growth over the 2020–2022 time frame, averaging 2.1 percent per year. Apartment rent growth will fall 2.5 percent in 2020, but its three-year average will be positive 0.03 percent. The other major property types will average rent declines over the next three years, with hotels down 3.3 percent, as measured by revenue per available room (RevPAR); retail rents down 2.3 percent; and office rents down 0.5 percent.

Single-family housing is one of the bright spots in the economy. About 871,250 houses are predicted be started in 2020, very close to last year’s level and a large upward revision from six months ago. And housing starts are expected to continue to rise, reaching 975,000 in 2022, the highest level since 2006. Home price growth is forecast to average 5.0 percent in 2020, compared with the spring forecast of 1.1 percent and the long-term average of 3.9 percent.

Key Findings for Major Economic Indicators

The U.S. GDP is forecast to fall by 5 percent this year, slightly better than the 6 percent decline predicted in the spring forecast. A bounce-back is expected in 2021 and 2022, with forecast GDP growth of 3.6 percent and 3.2 percent, respectively, both well above the long-term average of 2.1 percent.

The economy is expected to lose a net 9 million jobs during 2020, compared with a forecast of 10 million jobs lost in the spring survey. The job recovery is forecast to continue at a strong pace in ensuing years, with a net increase of 3.5 million jobs in 2021 and 3.0 million in 2022, compared with a long-term average of 1.1 million.

Despite expected growth, total employment is not expected to return to the previous peak until 2023 or later. The forecast calls for the U.S. unemployment rate to end 2020 at 8.0 percent, up slightly from the September rate of 7.9 percent, and fall to 5.5 percent by the end of 2022, below the long-term average of 5.9 percent.

Yields on the 10-year U.S. Treasury note are expected to stay at historically low levels for the entire forecast period. The year-end 2020 yield is predicted to be 0.8 percent, close to the current yield, and climb to 1.5 percent in 2022, well below the long-term average of 3.3 percent.

The fall survey provides generally good news about the U.S. economy and real estate markets, particularly compared with the spring survey. The worst fears of earlier this year have mostly eased. Several survey respondents pointed out the inherent difficulty of forecasting given the many unknowns related to the novel coronavirus. Others pointed to further uncertainty due to the upcoming national election, with big differences in tax policies likely dependent on the outcome. But as of now, leading real estate economists are signaling that resilience and underlying strength will likely win out over uncertainty and risk.

WILLIAM MAHER is director, strategy and research, RCLCO.