Transparency in the global real estate sector has improved markedly in the last two years, and will come under even greater scrutiny in light of high-profile scandals such as the Panama Papers leak, according to a recent report.

Global real estate transparency is led by the “Anglophone” quartet of the United Kingdom, Australia, the United States, and Canada, according to the biennial Global Real Estate Transparency Index, produced by JLL and LaSalle Investment Management.

In a world where an ever-greater amount of capital is being allocated to real estate, this gives these markets a significant advantage, with the ten most transparent countries representing 75 percent of global investment volumes, the report found.

In terms of where transparency is heading, JLL and LaSalle found that the four most transparent markets are heading toward a point of “hyper-transparency,” where real estate can begin to compete with other asset classes such as equities and bonds in terms of the quality of information available to investors.

Technology also is a major driving factor in the rise of transparency, and in some cases is allowing countries further down the index to undertake dramatic increases in their levels of transparency, achieving quickly what other countries took decades to achieve. This is being driven by both the public and private sectors.

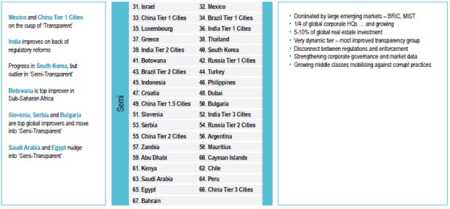

The top four most transparent markets remained unchanged, with the United Kingdom, Australia, the United States, and Canada taking the top spots. Europe was strongly represented among the ten markets that JLL and LaSalle deemed “highly transparent,” with Germany achieving this status for the first time. France, Ireland, the Netherlands, and Finland are other European countries that achieve this status, with the top ten markets completed by New Zealand.

JLL and LaSalle said that Poland also is on track to achieve highly transparent status soon. Also in the second “transparent” tier, there has been strong improvements from “high-income Asian markets.” Japan jumped seven places to 19th on the back of improved market fundamentals data, and Taiwan rose to 23rd as occupier services and market tracking improved.

Singapore also is just off the highly transparent category in 11th place, and China’s tier 1 cities are close to rising from the “semi-transparent” category to “transparent.”

Libya was the least transparent of the 109 countries measured by JLL and LaSalle.

Overall transparency improved by 2.4 percent between 2014 and 2016—slower than the 3.4 percent growth in the preceding two years, but higher than the 0.6 percent growth seen from 2008 to 2010, when the financial crisis meant transparency was put on the back burner.

The report’s main author, Jeremy Kelly, JLL’s director of global research programs, told Urban Land that with the amount of capital allocated to real estate increasing, there now is no ceiling on the benefits that improved transparency can bring to a real estate market.

“We previously harbored a hypothesis that once transparency reached a certain level, the benefit of boosting it further was only marginal,” he said. “We’ve changed our view. With so much capital allocated to real estate, the sector is competing with other asset classes. There is an expectation that even in highly transparent markets, there will be a level of transparency that matches those other asset classes. There is a requirement from investors and clients for more transparency, more granularity, greater frequency of data.

“This is pushing the top tier of markets towards another category which we are thinking of instituting, that of ‘hyper-transparency.’ None of those markets would yet achieve this; it requires more transaction data from smaller submarkets and alternative sectors, in particular.”

He said that the United Kingdom would continue to benefit as a result of being the world’s most transparent real estate market in spite of the recent “Brexit” vote.

“It’s too early to call what the effect on the real estate market will be, but the U.K. and London will certainly need to work ever harder to be competitive, and the fact that there is a highly transparent real estate market, whether it is in or out of the E.U., will be an important factor in that.”

The report found that there was a greater focus on transparency this year as a result of scandals such as the Panama Papers, the leaking of information about off-shore tax havens and the wealthy individuals and institutions that use them.

This has led to countries such as the United Kingdom putting in place plans to create a registry of the beneficial owners of companies, including those that own real estate. Highly transparent countries are being watched and are expected to take a lead on this, Kelly says, and international cooperation is vital in fighting corruption.

“The Panama Papers have highlighted that areas like beneficial ownership and anti-money-laundering regulation need to be tightened up,” he said. “The early soundings are very positive in that area, but it is vital that there is international cooperation, and that is the way it’s likely to go.”

He added that in less transparent countries, the emerging middle class was demanding greater accountability from businesses and governments, which was also driving transparency.

“We are seeing this particularly in places like Latin America—Brazil is a good example—where the call for greater transparency is being mobilized. You are seeing a lot of scandals being uncovered, which can make it seem like in fact transparency is going backwards, but the fact that these things are being revealed is part of the process.”

In less transparent countries, technology and digitization also are playing a crucial role in bringing about major advancements. In the public sector, the report points to the examples of Kenya and Ecuador, 61st and 84th respectively, where digital land registries have been created. And Ghana, in 85th place, is trailing an innovative system to record the ownership of title deeds using block chain technology.

In the private sector, Kelly points a startup in China that “scrapes” the internet to find information about the location of retailers, geocodes it, and uses it to create data on retail penetration and density in the world’s largest country.

Jacques Gordon, LaSalle Investment Management’s global head of research and strategy, pointed out that there is still more to be done in terms of improving transparency, and reiterated the benefits this would bring for societies and investors.

“Our index shows steady advances, which are a result of both industry and government efforts,” he said. “That said, there are too many examples of opaque and corrupt practices, poor corporate governance, and failures in regulatory enforcement that are resulting in serious consequences for society, business activity, and investment. Investors and tenants will bypass countries unable to address these shortcomings, and will gravitate instead to more transparent markets.”